Global| Oct 29 2010

Global| Oct 29 2010U.S. GDP Growth Stable At 2.0%

by:Tom Moeller

|in:Economy in Brief

Summary

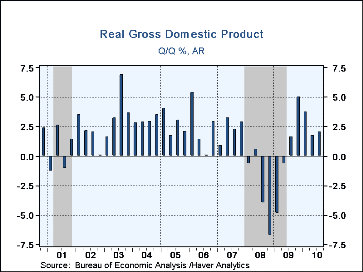

Real GDP increased 2.0% (SAAR) last quarter. The increase roughly matched Q2 as well as expectations for a 2.1% rise according to the Bloomberg survey. So far since the last recession GDP growth has averaged 2.8%, a figure that is [...]

Real GDP increased 2.0% (SAAR) last quarter. The increase roughly matched Q2 as well as expectations for a 2.1% rise according to the Bloomberg survey. So far since the last recession GDP growth has averaged 2.8%, a figure that is less than half the average following other, severe, postwar recessions.

Propping up growth last quarter was an increase in the contribution from inventory accumulation to 1.4 percentage points, nearly double the Q2 effect. Moreover, there was less of a subtraction from foreign trade deficit deterioration. Its 2.0 percentage point subtraction from growth was due to a 5.0% (12.2% y/y) gain in exports which was outpaced by a 17.4% rise in imports (16.3% y/y).

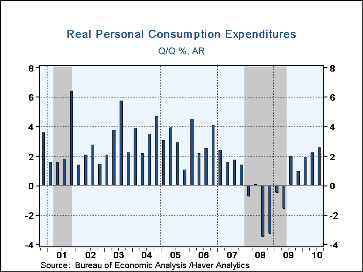

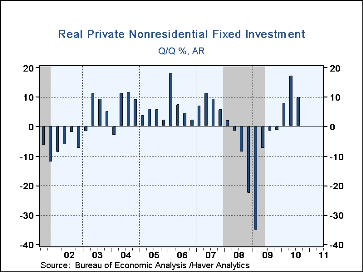

Growth in domestic final demand decelerated sharply from 2Q to 2.5% from 4.3%. Residential investment more-than-reversed all of its 2Q gain falling to a level nearly two-thirds below its 2005 peak Growth in business fixed investment nearly halved to 9.8% though that still was the third consecutive quarter of robust increase. Last quarter's gain was led by a 12.0% y/y rise (17.9% y/y) in equipment spending paced by transportation equipment. That was accompanied by a 3.8% rise (-1.9% y/y) in structures. Growth in government spending also slackened helped by another decline in state & local government spending (-1.4% y/y). Finally, consumer spending had a stabilizing influence with 2.6% growth that was led by a 6.1% advance (5.1% y/y) in durable goods spending. The gain mostly reflected strength in recreational goods & vehicles (12.5% y/y).

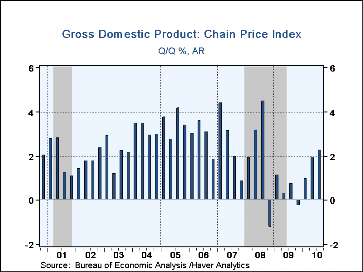

Price inflation as measured by the chained GDP price index ticked up to 2.3% though the 1.2% yearly advance was near the lows of the early-1960s. The personal consumption chain price index rose 1.0% (1.4% y/y). The price index for fixed business investment increased a bit by .09% q/q (-1.0% y/y) and the residential investment price index fell marginally (0.3% y/y).

| Chained 2005 $, % AR | Q3 2010 | Q2 2010 | Q1 2010 | Q3 Y/Y | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| GDP | 2.0 | 1.7 | 3.7 | 3.1 | -2.6 | -0.0 | 1.9 |

| Inventory Effect | 1.4 | 0.8 | 2.6 | 2.0 | -0.5 | -0.5 | -0.3 |

| Final Sales | 0.6 | 0.9 | 1.1 | 1.1 | -2.1 | 0.5 | 2.2 |

| Foreign Trade Effect | -2.0 | -3.5 | -0.3 | -1.0 | 1.0 | -1.1 | 0.7 |

| Domestic Final Demand | 2.5 | 4.3 | 1.3 | 2.1 | -3.1 | -0.6 | 1.5 |

| Demand Components | |||||||

| Personal Consumption | 2.6 | 2.2 | 1.9 | 1.9 | -1.2 | -0.3 | 2.4 |

| Business Fixed Investment | 9.8 | 17.2 | 7.8 | 8.1 | -17.1 | 0.3 | 6.7 |

| Residential Investment | -29.1 | 25.6 | -12.3 | 6.2 | -22.9 | -24.0 | -18.7 |

| Government Spending | 3.3 | 3.9 | -1.6 | 1.0 | 1.6 | 2.8 | 1.3 |

| Prices | |||||||

| Chained GDP Price Index | 2.3 | 1.9 | 1.0 | 1.2 | 0.9 | 2.2 | 2.9 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates