Global| Sep 19 2007

Global| Sep 19 2007U.S. Housing Starts Fall Yet Again

Summary

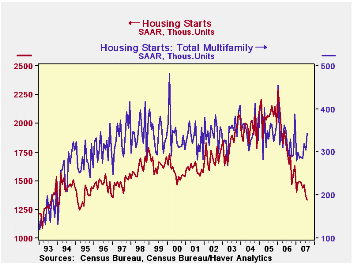

Housing starts fell in August by 2.6% to 1.331M units. This result undershot Consensus expectations, which called for a decrease to 1.35M starts. July volume was revised from 1.38M to 1.367M.The August number was the smallest since [...]

Housing starts fell in August by 2.6% to 1.331M units. This result undershot Consensus expectations, which called for a decrease to 1.35M starts. July volume was revised from 1.38M to 1.367M.The August number was the smallest since May 1995.

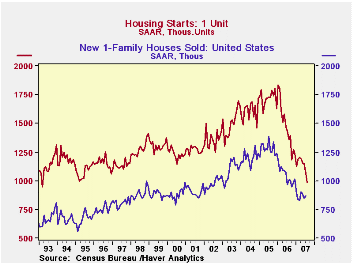

Single-family starts declined 7.1% to 988,000 units. This pace is the first under 1.0M since March 1995 and the lowest since March 1993.

Single-family starts again fell in every region of the country in August. They were down 19.6% in the Northeast to just 74,000 (-37.7% y/y). In the West, they also had a big drop, 18.1% from July to 213,000 (-32.4% y/y). There is, though, a hint of stabilizing in the Midwest with "just" a 3.4% decrease to 172,000 (-14.4% y/y) and a mere 0.8% in the South to 529,000 (-26.6% y/y).

Starts of multi-family structures offset some of the weakness with a 12.8% increase to 343,000; July however was revised to 304,000 from the 311,000 reported last month. The August gain took place in the South, +77,000 in August and in the Midwest, +16.000; the Northeast saw a decline of 40,000, the West by 14,000.

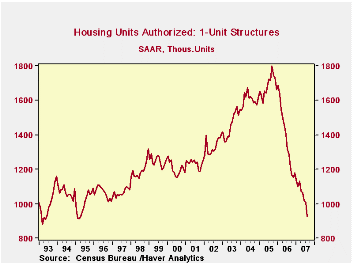

Building permits were also weak, falling 5.9% m/m to 1.307M, their lowest level since March 1995. Permits to build a single-family home plunged 8.1% to just 926,000, their lowest since April 1995.

The Federal Reserve Board in one of its periodic "Bulletin" articles, presents the 2006 Home Mortgage Disclosure Act (HMDA) Data. This article, which emphasizes the cross-tabulation by county of home prices and serious mortgage delinquencies, can be found here.

| Housing Starts (000s, AR) | Aug | July | June | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Total | 1,331 | 1,367 | 1,468 | -19.1% | 1,812 | 2,073 | 1,950 |

| Single-Family | 988 | 1,063 | 1,147 | -27.1% | 1,474 | 1,719 | 1,604 |

| Multi-Family | 343 | 304 | 321 | +17.9% | 338 | 354 | 345 |

| Building Permits | 1,307 | 1,389 | 1,413 | -24.5% | 1,842 | 2,159 | 2,058 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates