Global| Mar 08 2019

Global| Mar 08 2019U.S. Housing Starts Rebounded in January

by:Sandy Batten

|in:Economy in Brief

Summary

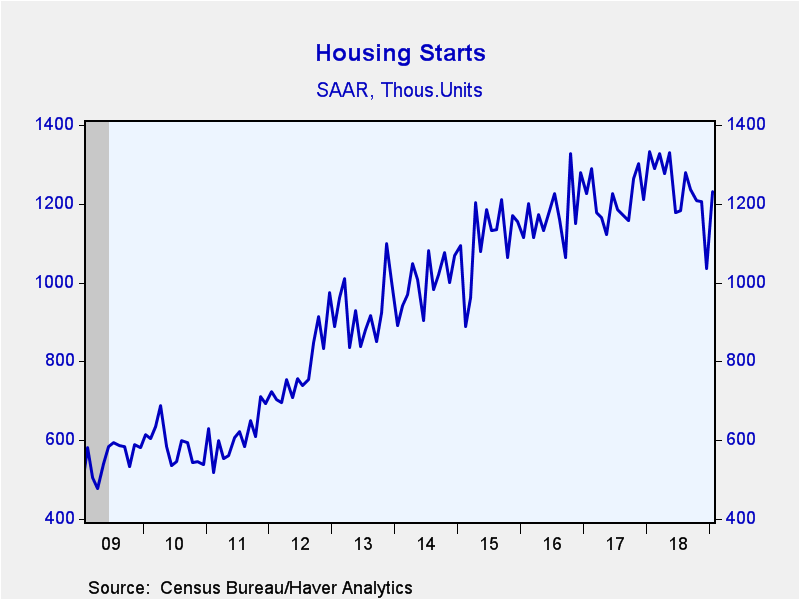

Total housing starts rebounded markedly in January, surging 18.6% m/m (but still down 7.8% y/y) to 1.230 million units at an annual rate after having collapsed 14.0% m/m in December to a slightly downwardly revised 1.037 million units [...]

Total housing starts rebounded markedly in January, surging 18.6% m/m (but still down 7.8% y/y) to 1.230 million units at an annual rate after having collapsed 14.0% m/m in December to a slightly downwardly revised 1.037 million units (initially 1.078 million). The January increase was the largest monthly percentage increase since October 2016. The Action Economics survey had expected a more modest rebound to 1.201 million units. In the release, the Census Bureau noted that data collection and processing had been delayed by the federal government shutdown, which could have impacted the data. However, the Bureau said that it had monitored data quality and no "systematic issues were identified."

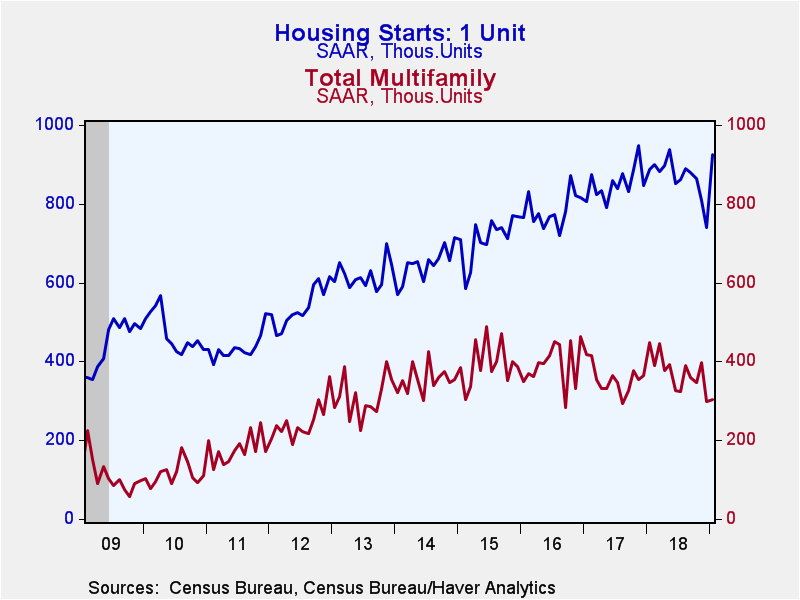

An outsize jump in single family starts accounted for most of the January surge in total starts. Single-family starts exploded 25.1% m/m (4.5% y/y) to 926,000 units following an 8.4% m/m drop in December. This was the largest monthly percentage increase since 1979 but only raised single-family starts up to their May 2018 level. Multi-family starts rose a more modest 2.4% (-32.1% y/y) in January to 304,000 units, falling far short of making up for their 25.4% m/m plunge in December.

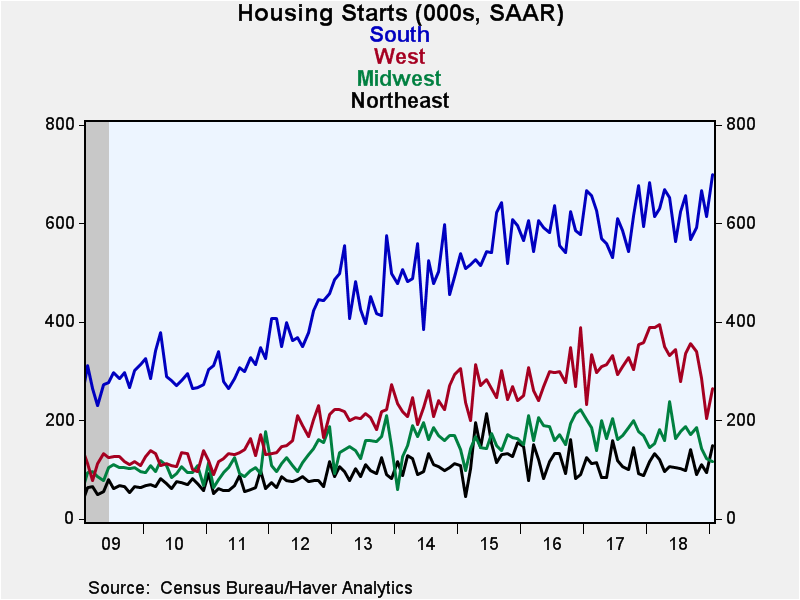

Starts rose in three of the four major regions in January after having fallen in each major region in December. In January, only the Midwest experienced a decline, a 5.7% m/m fall (-20.0% y/y) to 116,000 units. The third consecutive monthly decline in January pushed Midwest starts down to their lowest level since early 2015. Starts in the Northeast, typically significantly affected by weather at this time of year, surged 58.5% m/m (+28.4% y/y) to 149,000 units. Starts in the South rose 13.8% m/m (+2.3% y/y) to 700,000 units. And starts in the West jumped up 29.3% m/m (-31.9% y/y) to 265,000 units.

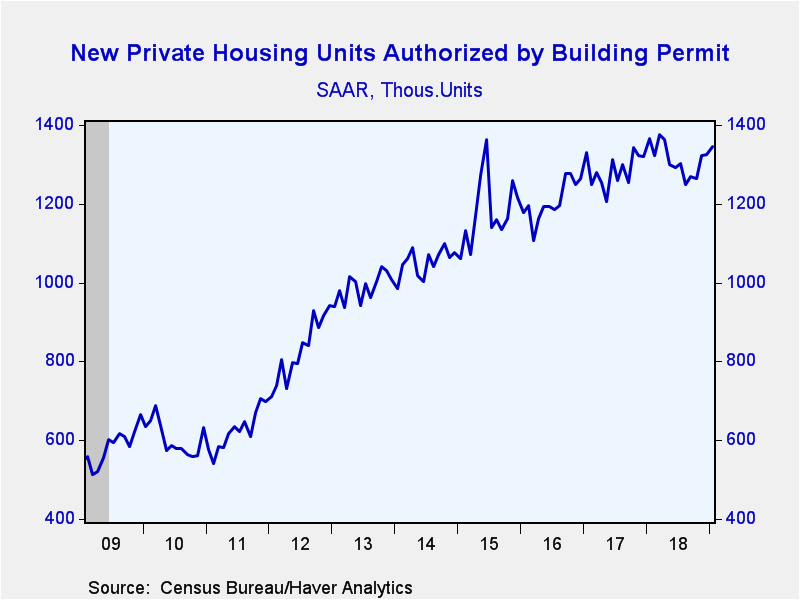

By comparison, building permits only rose slightly in January, edging up 1.4% m/m (-1.5% y/y) to 1.345 million units. Gains in multi-family permits more than accounted for the January increase. Multi-family permits rose 7.2% m/m (7.5% y/y) to 533,000 in January from 497,000 in December. Single-family permits fell 2.1% m/m (-6.7% y/y) to 812,000 in January from 829,000 in December.

The housing starts and permits figures can be found in Haver's USECON database. The expectations figure is contained in the AS1REPNA database.

| Housing Starts (000s, SAAR) | Jan | Dec | Nov | Jan Y/Y % | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Total | 1,230 | 1,037 | 1,206 | -7.8 | 1,241 | 1,208 | 1,177 |

| Single-Family | 926 | 740 | 808 | 4.5 | 866 | 852 | 785 |

| Multi-Family | 304 | 297 | 398 | -32.1 | 374 | 356 | 393 |

| Starts By Region | |||||||

| Northeast | 149 | 94 | 110 | 28.4 | 110 | 111 | 116 |

| Midwest | 116 | 123 | 144 | -20.0 | 170 | 180 | 185 |

| South | 700 | 615 | 666 | 2.3 | 630 | 603 | 585 |

| West | 265 | 205 | 286 | -31.9 | 335 | 314 | 292 |

| Building Permits | 1,345 | 1,326 | 1,322 | -1.5 | 1,313 | 1,286 | 1,206 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.