Global| Jan 22 2016

Global| Jan 22 2016U.S. Index of Leading Indicators Slips in December

by:Sandy Batten

|in:Economy in Brief

Summary

The Conference Board's Index of Leading Economic Indicators fell 0.2% m/m in December, following revised 0.5% m/m increases in November (initially +0.4%) and October (initially +0.6%). The Action Economics Forecast Survey had looked [...]

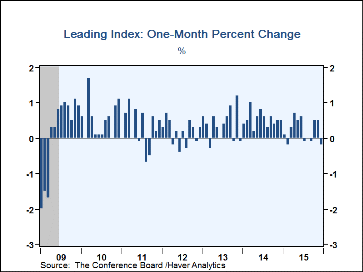

The Conference Board's Index of Leading Economic Indicators fell 0.2% m/m in December, following revised 0.5% m/m increases in November (initially +0.4%) and October (initially +0.6%). The Action Economics Forecast Survey had looked for a 0.1% m/m increase. Three-month growth in the index slowed to 3.3% (annual rate) in December from a downwardly revised 3.6% in November. This release contained annual benchmark revision, which align the indexes with revisions in the source data. Weaker ISM new orders and building permits were the major drags in December, while the most significant boost came from a steeper yield curve.

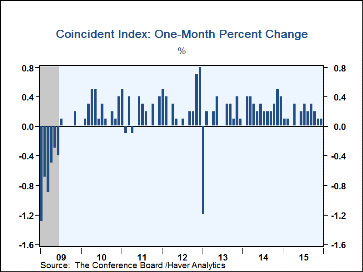

The coincident index edged up 0.1% m/m in December, after a 0.1% rise in November and a 0.2% increase in October. The three-month rate growth rate eased to 1.4% (annual rate) from 2.2% in November. Increases in nonfarm payrolls provided most of the December lift to this index with only industrial production exerting a slight drag.

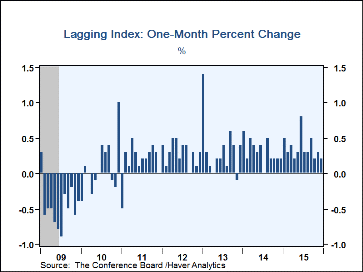

The lagging index rose 0.2% m/m, compared with a 0.3% m/m rise in November and a 0.2% m/m gain in October. The three-month growth rate slowed markedly to 2.7% (annual rate) from 4.1% in November. Weaker services CPI was the largest subtracter in December while shorter unemployment duration and a higher prime rate were the major contributors.

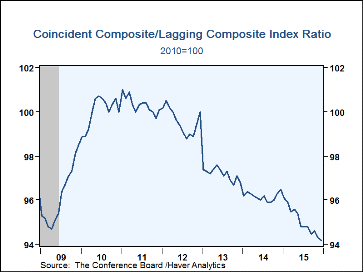

The ratio of coincident to lagging indicators is widely viewed also a leading indicator of economic activity. As an economic expansion matures, the rise in coincident indicators often slows relative to lagging indicators. This ratio continued its recent general decline, edging down to 94.2 in December; with the revisions, it is now slightly below its trough in the 2008-09 recession.

The Conference Board figures are available in Haver's BCI database; the components are available there, and most are also in USECON. The forecast figures for the Consensus are in the AS1REPNA database. Visit the Conference Board's site for coverage of leading indicator series from around the world.

| Business Cycle Indicators (%) | Dec | Nov | Oct | Dec Y/Y | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| Leading | -0.2 | 0.5 | 0.5 | 2.7 | 4.4 | 5.8 | 2.9 |

| Coincident | 0.1 | 0.1 | 0.2 | 1.7 | 2.5 | 2.6 | 1.4 |

| Lagging | 0.2 | 0.3 | 0.2 | 4.1 | 3.7 | 3.7 | 3.9 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.