Global| Oct 17 2017

Global| Oct 17 2017U.S. Industrial Production Rebounds Following Hurricanes

by:Tom Moeller

|in:Economy in Brief

Summary

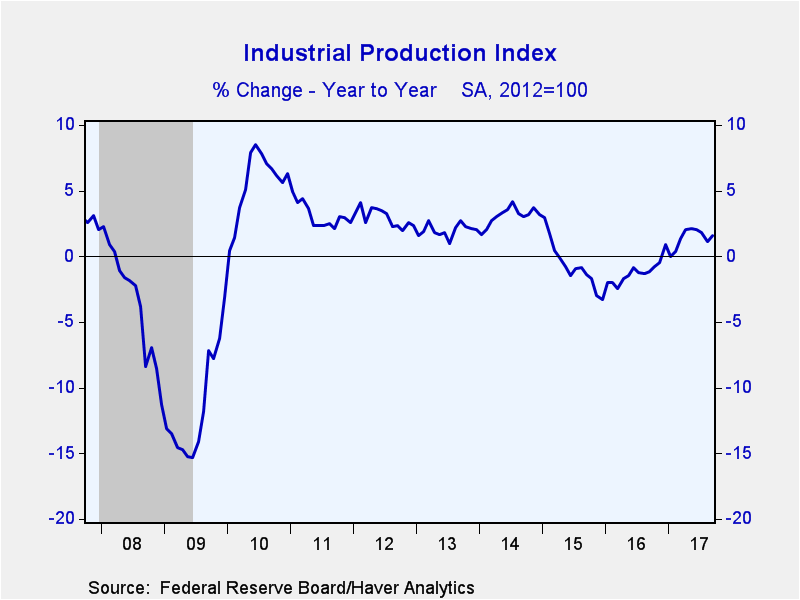

The Federal Reserve indicated that industrial production recovered 0.3% (1.6% y/y) during September following a 0.7% August decline, last month estimated as -0.9%. The Fed indicated that storm damage reduced September's increase in [...]

The Federal Reserve indicated that industrial production recovered 0.3% (1.6% y/y) during September following a 0.7% August decline, last month estimated as -0.9%. The Fed indicated that storm damage reduced September's increase in production by one-quarter of a percentage point. Last month's increase matched expectations in the Action Economics Forecast Survey. Factory output edged 0.1% higher (1.0% y/y) following a 0.2% decline, initially estimated as -0.3%.

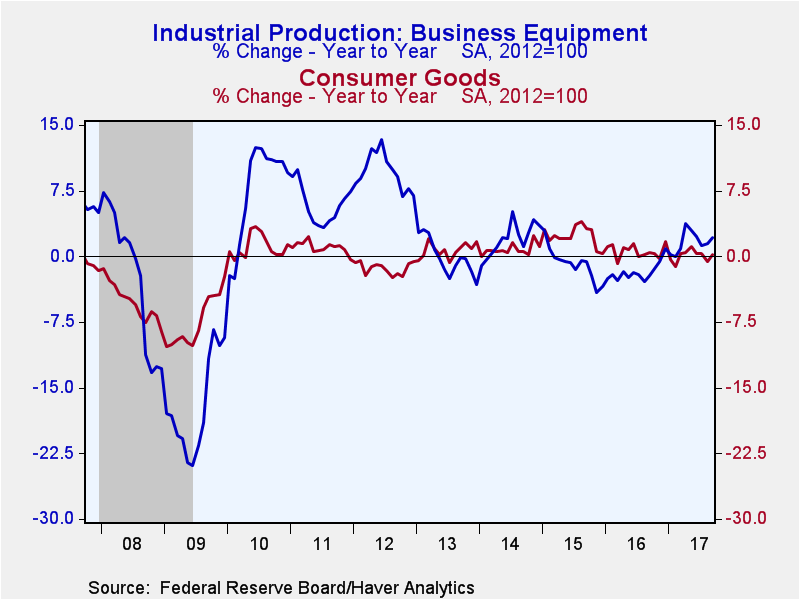

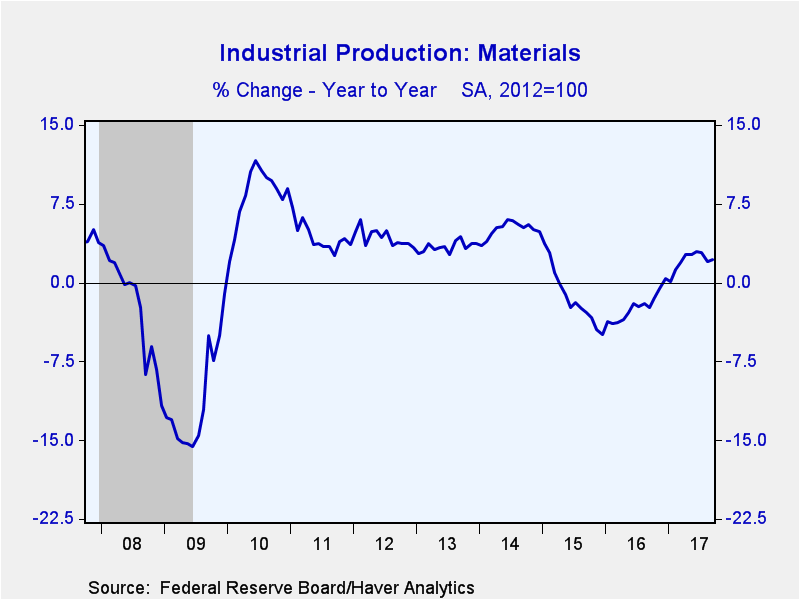

Production of consumer products increased 0.5% (0.2% y/y) and reversed August's decline. Motor vehicle & parts production improved 0.1% (-3.2% y/y), after a 3.6% jump. Computers, audio & video product production gained 1.9% (5.5% y/y), after a 2.4% increase. Appliance, furniture & carpeting production rose 1.4% (0.5% y/y), after two months of 1.4% decrease. Clothing output fell 1.0% (-9.4% y/y), the seventh monthly decrease this year. Chemical production partially offset these declines with a 0.8% rise (1.5% y/y), the fifth consecutive monthly gain. Business equipment production strengthened 0.8% (2.1%, following four straight months of decline. The increase was led by a 2.1% (4.0% y/y) in industrial equipment output, the first rise in five months. Materials production eased 0.2% (2.2% y/y) following a 0.8% drop. Production of energy materials recovered 0.8% (4.7% y/y), following a 1.1% decline.

In the special aggregate groupings, selected high-technology product production jumped 1.7% (2.3% y/y) after a 0.4% rise. Semiconductor & related product output jumped 2.8% while computer & peripheral production gained 0.2%. Factory sector production, excluding the auto & high-tech sectors, inched 0.1% higher (1.3% y/y) following a 0.6% decline.

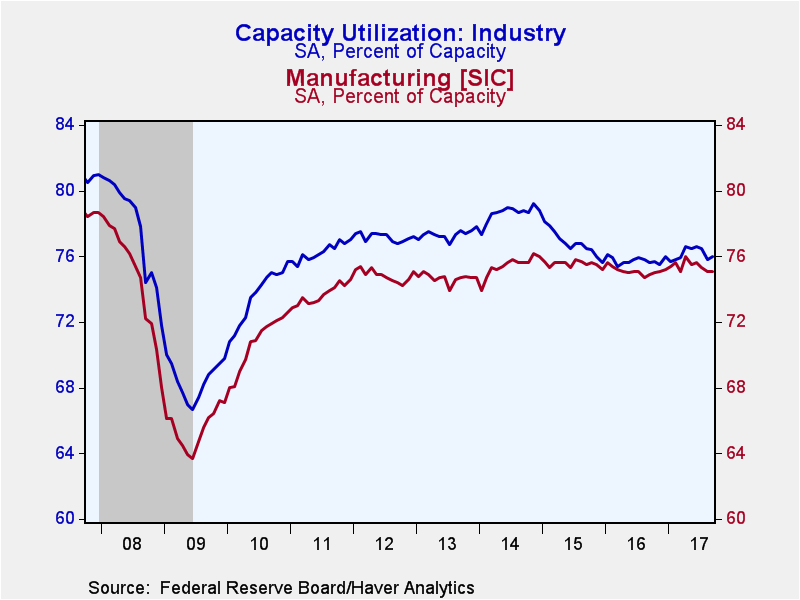

Capacity utilization rose to 76.0% from 75.8%, but remained down versus the 76.6% June high. Factory sector utilization held steady at 75.1%, but also remained lower than the 76.0% April high. Total factory sector capacity rose 0.7% y/y.

Industrial production and capacity data are included in Haver's USECON database, with additional detail in the IP database. The expectations figure is in the AS1REPNA database.

| Industrial Production (SA, % Change) | Sep | Aug | Jul | Sep Y/Y | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Total Output | 0.3 | -0.7 | -0.1 | 1.6 | -1.2 | -0.7 | 3.1 |

| Manufacturing | 0.1 | -0.2 | -0.4 | 1.0 | -0.0 | 0.1 | 1.2 |

| Consumer Goods | 0.5 | -0.6 | 0.0 | 0.2 | 0.6 | 2.3 | 0.8 |

| Business Equipment | 0.8 | -0.3 | -1.2 | 2.1 | -1.8 | -0.9 | 1.9 |

| Construction Supplies | 1.9 | -1.0 | -0.1 | 3.4 | 1.3 | 0.5 | 3.4 |

| Materials | -0.2 | -0.8 | 0.0 | 2.2 | -2.3 | -1.4 | 5.1 |

| Utilities | 1.5 | -4.9 | 0.5 | -4.0 | -0.3 | -0.7 | 1.4 |

| Mining | 0.4 | -0.2 | 0.5 | 9.8 | -9.1 | -4.3 | 10.7 |

| Capacity Utilization (%) | 76.0 | 75.8 | 76.5 | 75.6 | 75.7 | 76.8 | 78.6 |

| Manufacturing | 75.1 | 75.1 | 75.3 | 74.9 | 75.1 | 75.5 | 75.4 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates