Global| Dec 24 2009

Global| Dec 24 2009U.S. Initial Jobless Insurance Claims Fall Back To New Low

by:Tom Moeller

|in:Economy in Brief

Summary

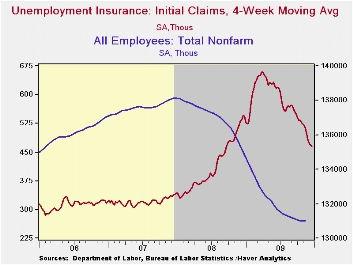

The jobs market resumed its recent trend toward improvement. The Labor Department reported that initial claims for unemployment insurance fell to 452,000 from an unrevised 480,000 during the prior week. Claims now stand at the lowest [...]

The jobs

market resumed its recent trend toward improvement. The Labor

Department reported that initial claims for unemployment insurance fell

to 452,000 from an unrevised 480,000 during the prior week. Claims now

stand at the lowest level since the first week of September 2008 and

were down from the recession peak of 674,000 hit in March. The

four-week moving average of claims also fell to a new low of 465,250.

The latest weekly figure was lower than Consensus expectations for

470,000 claims.

The jobs

market resumed its recent trend toward improvement. The Labor

Department reported that initial claims for unemployment insurance fell

to 452,000 from an unrevised 480,000 during the prior week. Claims now

stand at the lowest level since the first week of September 2008 and

were down from the recession peak of 674,000 hit in March. The

four-week moving average of claims also fell to a new low of 465,250.

The latest weekly figure was lower than Consensus expectations for

470,000 claims.

Continuing claims for unemployment insurance during the latest week fell 127,000 after an upwardly revised 40,000 gain during the prior week. Continuing claims were at the lowest level since February. The overall decline is a function of the improved job market but also reflects the exhaustion of 26 weeks of unemployment benefits. Continuing claims provide an indication of workers' ability to find employment. The four-week average of continuing claims fell to 5,233,000. This series dates back to 1966.

Extended

benefits for unemployment insurance dropped sharply to 393,956 during

the first week of December. The latest was down from the peak during

last month of 597,688.

Extended

benefits for unemployment insurance dropped sharply to 393,956 during

the first week of December. The latest was down from the peak during

last month of 597,688.

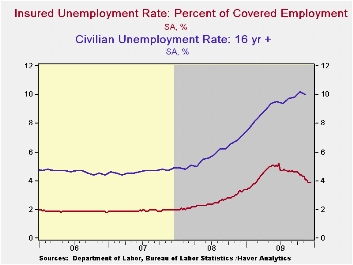

The insured rate of unemployment remained stable at 3.9%, the lowest level since February. The rate reached a high of 5.2% during late-June. During the last ten years, there has been a 93% correlation between the level of the insured unemployment rate and the overall rate of unemployment published by the Bureau of Labor Statistics.

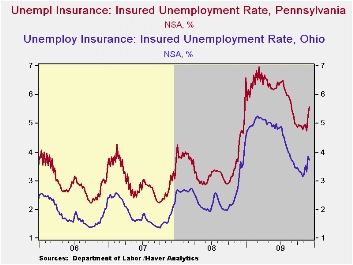

p> The highest insured unemployment rates in

the week ending December 5 were in Puerto Rico (6.4%), Oregon

(5.9), Pennsylvania (5.6), Wisconsin (5.6), Alaska (5.5), Nevada (5.2),

Michigan (4.9), California (4.9) and South Carolina (4.7). The lowest

insured unemployment rates were in North Dakota (1.7%), Virginia (2.0),

Texas (2.5), Wyoming (3.0), Maine (3.3), Maryland (3.4), Mississippi

(3.4), Florida (3.5), New York (3.7) and Ohio (3.7). The data are not

seasonally adjusted but the overall insured unemployment rate is.

The highest insured unemployment rates in

the week ending December 5 were in Puerto Rico (6.4%), Oregon

(5.9), Pennsylvania (5.6), Wisconsin (5.6), Alaska (5.5), Nevada (5.2),

Michigan (4.9), California (4.9) and South Carolina (4.7). The lowest

insured unemployment rates were in North Dakota (1.7%), Virginia (2.0),

Texas (2.5), Wyoming (3.0), Maine (3.3), Maryland (3.4), Mississippi

(3.4), Florida (3.5), New York (3.7) and Ohio (3.7). The data are not

seasonally adjusted but the overall insured unemployment rate is.

The unemployment insurance claims data is available in Haver's WEEKLY database and the state data is in the REGIONW database.

| Unemployment Insurance (000s) | 12/19/09 | 12/12/09 | 12/05/09 | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 452 | 480 | 475 | -19.9% | 420 | 321 | 313 |

| Continuing Claims | -- | 5,076 | 5,203 | 17.2% | 3,342 | 2,552 | 2,459 |

| Insured Unemployment Rate (%) | -- | 3.9 | 3.9 | 3.3 (12/2008) | 2.5 | 1.9 | 1.9 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates