Global| Jul 24 2008

Global| Jul 24 2008U.S. Initial Unemployment Insurance Claims Shoot Back Up

by:Tom Moeller

|in:Economy in Brief

Summary

Initial claims for unemployment insurance shot higher last week to 406,000. The latest level compared to an upwardly revised 372,000 during the prior week. It reached a level not seen since this past March which was the highest point [...]

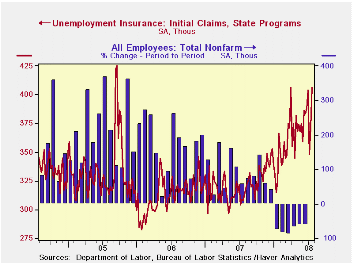

Initial claims for unemployment insurance shot higher last week to 406,000. The latest level compared to an upwardly revised 372,000 during the prior week. It reached a level not seen since this past March which was the highest point since mid-2005. The latest weekly surge surpassed Consensus expectations for a rise to 380,000 claims.

As a result of the latest weekly jump in initial claims the four-week moving average increased, but just modestly, to 382,500 (23.1% y/y). During June claims averaged 391,000.

A claims level below 400,000 typically has been associated with growth in nonfarm payrolls. During the last ten years there has been a (negative) 76% correlation between the level of initial claims and the m/m change in nonfarm payroll employment. Over the longer period of time, the level of claims for jobless insurance has not trended higher with the size of the labor force due to a higher proportion of self-employed workers who are not eligible for benefits.

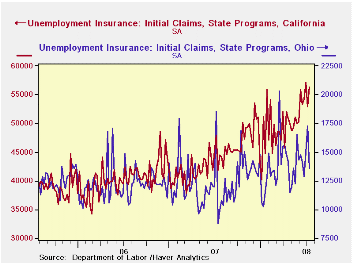

Initial claims claims for jobless insurance in California are up 34.7% y/y. They also are up 46.0% in New York and by 55.1% in Ohio. In Massachusetts the gain in claims moderated to 10.7% and in Michigan the rise fell to 8.2% after the doubling this past May. In Pennsylvania claims fell 12.1% from last year.

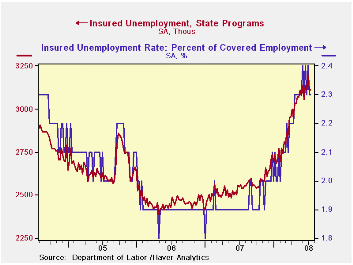

Continuing claims for unemployment insurance during the latest week fell by 9,000 following a little-revised 87,000 worker decline during the prior week. The four-week moving average of continuing claims slipped slightly but remained near the cycle high of 3,142,750. That was roughly a quarter higher than a year ago and the highest level since early 2004.

Continuing claims provide some indication of workers' ability to find employment and they lag the initial claims figures by one week.

The insured rate of unemployment was unchanged at 2.3%.

The Congressional Budget Office's Cost Estimate of the Foreclosure Prevention Act of 2008 can be found here.

| Unemployment Insurance (000s) | 07/19/08 | 07/12/08 | Y/Y | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|

| Initial Claims | 406 | 372 | 31.8% | 322 | 313 | 331 |

| Continuing Claims | -- | 3,107 | 22.2% | 2,552 | 2,459 | 2,662 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates