Global| Jan 02 2015

Global| Jan 02 2015U.S. ISM Manufacturing Index Slows in December; 2014 Best Year Since 2010

Summary

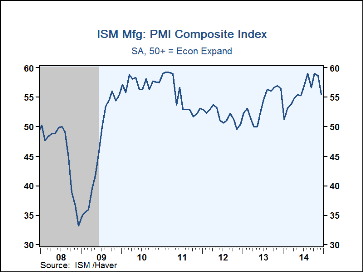

The ISM Report on Business Manufacturing Index decreased 3.2 points in December to 55.5 from November's 58.7, indicating somewhat slower but still expanding activity in the manufacturing sector. Expectations in the Action Economics [...]

The ISM Report on Business Manufacturing Index decreased 3.2 points in December to 55.5 from November's 58.7, indicating somewhat slower but still expanding activity in the manufacturing sector. Expectations in the Action Economics Forecast Survey had looked for a smaller decline, to 57.5. In 2014 as a whole, the index averaged 55.8, the highest annual number since 57.3 in 2010. The ISM indexes are diffusion measures, where readings above 50 indicate expansion and those below 50, contractions.

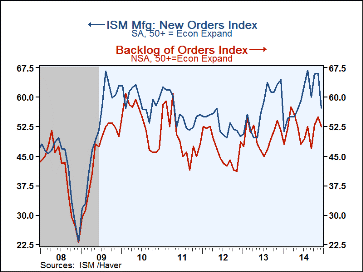

The December decrease in the overall index included reductions in three of the components: new orders, production and inventories. New orders, while still expanding on balance, did drop from 66.0 in November to 57.3 last month; the proportion of firms reporting better order flow fell from 38% to 25% and those with falling orders increased from 15% to 18%. The production index fell to 58.8 in December from 64.4 the prior month. Inventories showed an outright decline last month, and at 45.5, compared to 51.5 in November. The share of firms with larger inventories went down from 21% to 17%, while those with smaller stocks rose from 18% to 26%, the highest number since last January.

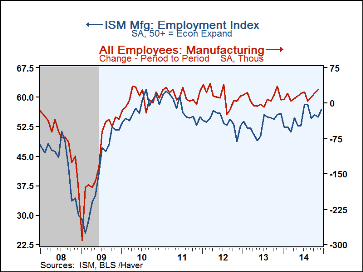

Other components did show improvements in December. Employment moved to 56.8 from 54.9. During the last ten years, there has been an 88% correlation between this index level and the m/m change in factory sector payroll employment. Supplier deliveries increased to 59.3 from 56.8, indicating that more firms were waiting longer for suppliers to provide materials, a sign of increased activity at the suppliers.

After a gain in November to a seven-month high of 55.0, order backlogs basically retraced that gain, moving to 52.5.

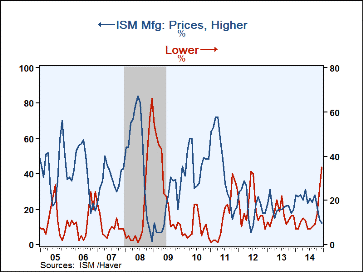

The prices paid index showed an outright decline in December for a second consecutive month, and that decline was more widespread as the index fell another six points to 38.5 from 44.5. The share of firms paying lower prices rose from 25% to 35% and those paying higher prices edged down from 14% to 12%.

The figures from the Institute for Supply Management (ISM) are found in Haver's USECON database. The Action Economics expectations number is in the AS1REPNA database.

| ISM Nonmanufacturing Survey (SA) | Dec | Nov | Oct | Dec'13 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|

| Composite Index | 55.5 | 58.7 | 59.0 | 56.5 | 55.8 | 53.9 | 51.8 |

| New Orders | 57.3 | 66.0 | 65.8 | 64.4 | 59.2 | 57.2 | 53.1 |

| Production | 58.8 | 64.4 | 64.8 | 61.7 | 59.5 | 57.7 | 53.8 |

| Employment | 56.8 | 54.9 | 55.5 | 55.8 | 54.5 | 53.2 | 53.8 |

| Supplier Deliveries (NSA) | 59.3 | 56.8 | 56.2 | 53.7 | 55.0 | 51.9 | 50.0 |

| Inventories | 45.5 | 51.5 | 52.5 | 47.0 | 50.8 | 49.4 | 48.2 |

| Prices Paid Index (NSA) | 38.5 | 44.5 | 53.5 | 53.5 | 55.8 | 53.8 | 53.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates