Global| Sep 10 2013

Global| Sep 10 2013U.S. JOLTS: Job Openings Rate Dips in July

Summary

The Bureau of Labor Statistics reported in its July Job Openings & Labor Turnover Survey (JOLTS) that the job openings rate eased in July to 2.6% from 2.8% in June, which was unrevised. The job openings rate is the number of job [...]

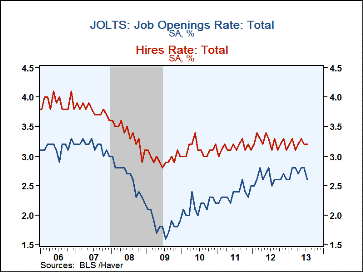

The Bureau of Labor Statistics reported in its July Job Openings & Labor Turnover Survey (JOLTS) that the job openings rate eased in July to 2.6% from 2.8% in June, which was unrevised. The job openings rate is the number of job openings on the last business day of the month as a percent of total employment plus job openings. The actual number of job openings, 3.689 million, declined 4.7% from June's number, which was revised downward to a 1.0% decline from the original 0.7% increase. July's total was, however, 5.4% above July 2012. The 2.6% rate, while down to its low since January, has been range-bound from 2.5% to 2.8% since late in 2011.

The Bureau of Labor Statistics reported in its July Job Openings & Labor Turnover Survey (JOLTS) that the job openings rate eased in July to 2.6% from 2.8% in June, which was unrevised. The job openings rate is the number of job openings on the last business day of the month as a percent of total employment plus job openings. The actual number of job openings, 3.689 million, declined 4.7% from June's number, which was revised downward to a 1.0% decline from the original 0.7% increase. July's total was, however, 5.4% above July 2012. The 2.6% rate, while down to its low since January, has been range-bound from 2.5% to 2.8% since late in 2011.

The private-sector job openings rate came down to 2.8% in July from a downward revised 2.9% in June, originally reported at the recovery high of 3.0%. The drop was most noticeable in professional & business services, which moved down to 3.0% from 3.6% in June. The openings rate in construction fell to 1.7% from 2.0% in June and that in trade and transportation to 2.5% in July from 2.7% the month before. Education and health and arts and recreation each ticked down 0.1% and government was unchanged at 1.8%. On the improving side, accommodation and food services rose from 3.5% in June to 3.6%, its highest since June 2008. And manufacturing rebounded to 1.9% in July from the weak 1.7% the prior month.

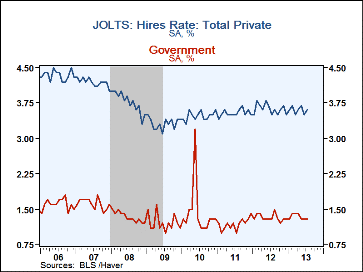

The hires rate held at June's 3.2% level, but that was revised up from the original 3.1%. The hires rate is the number of hires during the month divided by employment. The hires rate in the private sector rose to 3.6% and was revised up slightly in June. The hire rate in government again held steady at 1.3%. In arts and entertainment, the hiring rate fell to 5.3% from 6.5% in June, and that in accommodation and food services held at 5.4%. In professional & business services the hires rate was revised upward to 5.0% in June and held there in July. In construction the hiring rate was also flat in July, at 5.3%. The factory sector hires rate rose to 2.0% in July from 1.9% in June. In education & health services the rate was revised from ab initial 2.2% in June to 2.3% and recovered further to 2.5% in July.

The number of hires increased 2.3% in July after falling 3.8% in June and were 5.9% ahead of a year ago. Professional & business services hiring, as its rate, was revised upward in June and for July amounted to 13.6% more than July 2012. Factory sector hires were off 1.3% year-on-year, a relative improvement from June's 20.5% y/y drop. Government sector hiring was up 2.9% y/y. Education & health services hiring reversed a June drop and was 6.8% larger in July than a year ago. Transportation and trade moved the same way; after a y/y decline in June, July hiring was 5.9% above July 2012. Arts and entertainment went the other way, reversing a strong June comparison to show a 3.6% y/y fall for July. Accommodation and food services is on a four-month uptrend in year-to-year gains but July was the slowest of these at 6.5%.

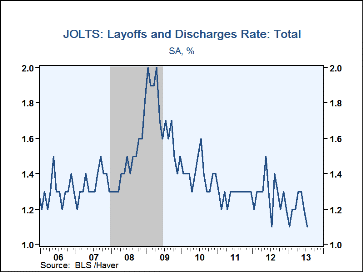

The job separations rate was 3.0% in July, down from 3.1% in June. The actual number of separations was up 3.3% y/y. Separations include quits, layoffs, discharges, and other separations as well as retirements. The layoff & discharge rate was 1.1% in July after an upward revised 1.2% in June; 1.1% remains the series low, with a recession peak of 2.0% in early 2009. The private sector layoff rate eased to 1.2% in July and in government it slipped to 0.4%.

The JOLTS survey dates only to December 2000 and the figures are available in Haver's USECON database.

| JOLTS (Job Openings & Labor Turnover Survey, SA) | Jul | Jun | May | Jul'12 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Job Openings, Total | |||||||

| Rate (%) | 2.6 | 2.8 | 2.8 | 2.5 | 2.6 | 2.5 | 2.2 |

| Total (000s) | 3,689 | 3,869 | 3,907 | 3,499 | 3,612 | 3,384 | 2,930 |

| Hires, Total | |||||||

| Rate (%) | 3.2 | 3.2 | 3.3 | 3.1 | 38.9 | 37.7 | 37.4 |

| Total (000s) | 4,419 | 4,308 | 4,490 | 4,171 | 51,946 | 49,644 | 48,637 |

| Layoffs & Discharges, Total | |||||||

| Rate (%) | 1.1 | 1.2 | 1.3 | 1.3 | 15.4 | 15.4 | 16.8 |

| Total (000s) | 1,513 | 1,602 | 1,752 | 1,534 | 20,670 | 20,320 | 21,747 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates