Global| Mar 18 2021

Global| Mar 18 2021U.S. Leading Economic Indicators Index Improves Moderately in February

by:Tom Moeller

|in:Economy in Brief

Summary

• Leaders' gain is slowest since last April's decline. • Breadth of component growth continues to moderate. • Coincident indicators ease. The Conference Board's Composite Index of Leading Economic Indicators increased 0.2% (-1.3% y/y) [...]

• Leaders' gain is slowest since last April's decline.

• Breadth of component growth continues to moderate.

• Coincident indicators ease.

The Conference Board's Composite Index of Leading Economic Indicators increased 0.2% (-1.3% y/y) during February after an unrevised 0.5% January gain. The Action Economics Forecast Survey anticipated a 0.3% rise. The Leading Index is comprised of 10 components which tend to precede changes in overall economic activity.

Performance amongst the component series varied greatly. Fewer initial unemployment insurance claims, higher stock prices, a higher ISM new orders index and the slope of the interest rate yield curve provided the bulk of the upward influence on the overall leading index. Fewer building permits, a shorter average workweek and diminished consumer expectations for business/economic conditions offset these gains.

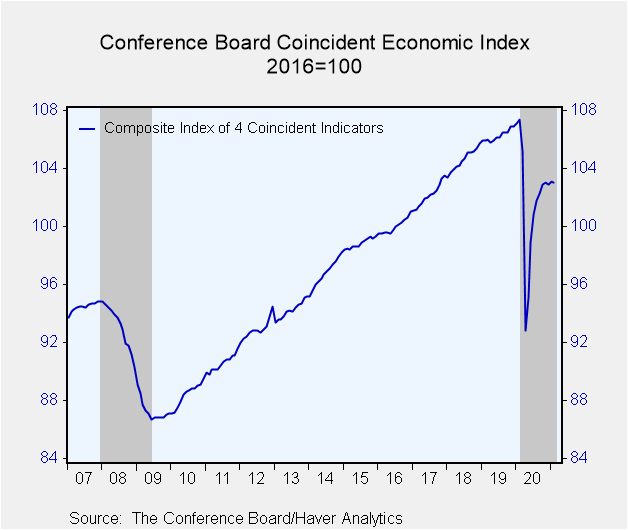

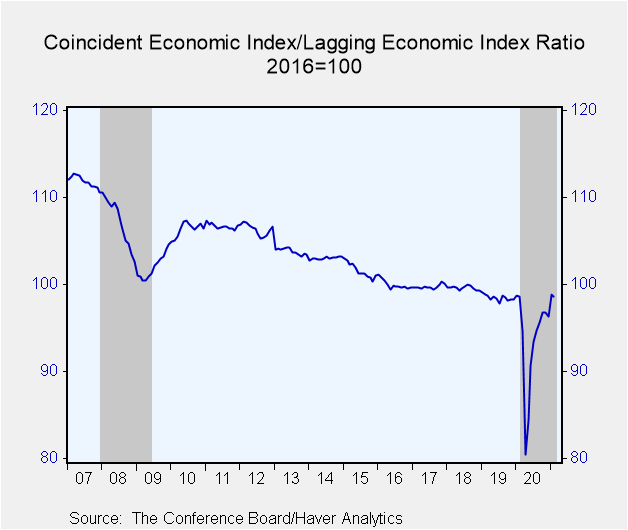

The Index of Coincident Economic Indicators eased 0.1% (-4.1% y/y) during February for the second month in the last three. Three of the four component series contributed positively to the index including payroll employment, personal income less transfers and manufacturing & trade sales. A decline in industrial production offset these gains.

The Index of Lagging Indicators improved 0.2% (-4.0% y/y) during February following a 2.3% January decline, revised from -0.6%. Higher labor costs, a higher consumer installment credit/income ratio, and an increased change in the services CPI contributed positively but was offset by a shorter average duration of unemployment.

The Conference Board figures are available in Haver's BCI database; the components are available there, and most are also in USECON. The expectations are in the AS1REPNA database. Visit the Conference Board's site for coverage of leading indicator series from around the world.

| Business Cycle Indicators (%) | Feb | Jan | Dec | Feb Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Leading | 0.2 | 0.5 | 0.4 | -1.3 | -4.9 | 1.6 | 5.6 |

| Coincident | -0.1 | 0.2 | -0.1 | -4.1 | -4.3 | 1.6 | 2.4 |

| Lagging | 0.2 | -2.3 | 0.4 | -4.0 | 1.0 | 2.8 | 2.5 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates