Global| Dec 16 2020

Global| Dec 16 2020U.S. Mortgage Applications Rebound as Rates Fall to Record Low

by:Sandy Batten

|in:Economy in Brief

Summary

• Mortgage applications rise moderately. • Mortgage interest rates decline to another survey low. The Mortgage Bankers Association Mortgage Loan Applications Index rebounded modestly in the week ended December 11, rising 1.1% w/w [...]

• Mortgage applications rise moderately.

• Mortgage interest rates decline to another survey low.

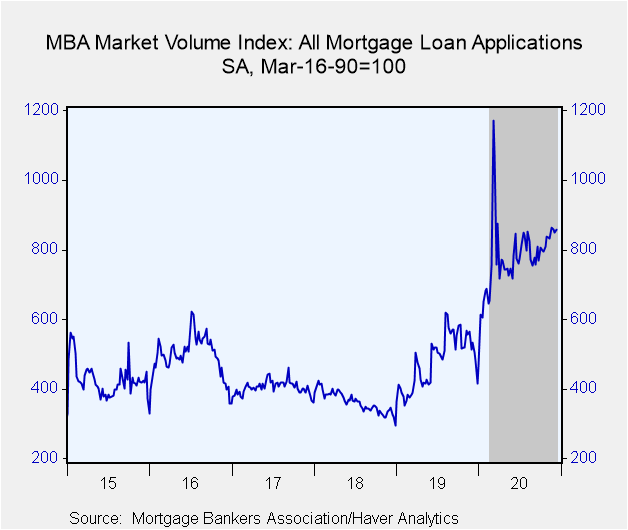

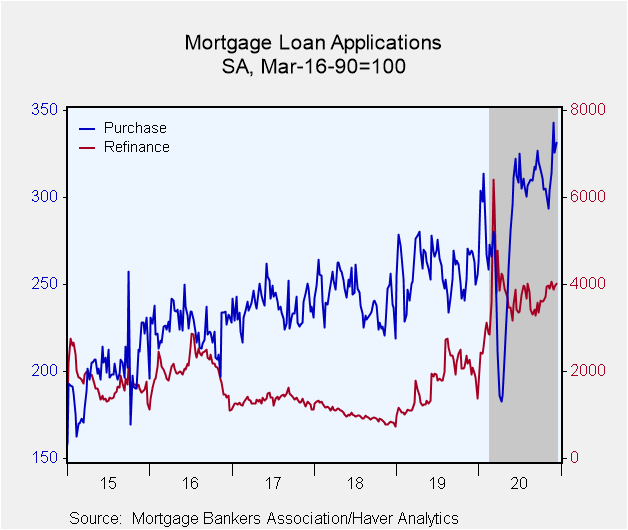

The Mortgage Bankers Association Mortgage Loan Applications Index rebounded modestly in the week ended December 11, rising 1.1% w/w (69.7% y/y) after having declined in each of the previous two weeks. Applications for purchase increase 1.8% w/w (26.3% y/y) following a 5.0% weekly decline in the previous week. Refinancing applications gained 1.4% w/w (105.0% y/y) on top of a 1.8% w/w rise in the previous week. The refinance share of mortgage activity increased to 72.7% of total applications from 72.0% the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 1.8% of total applications.

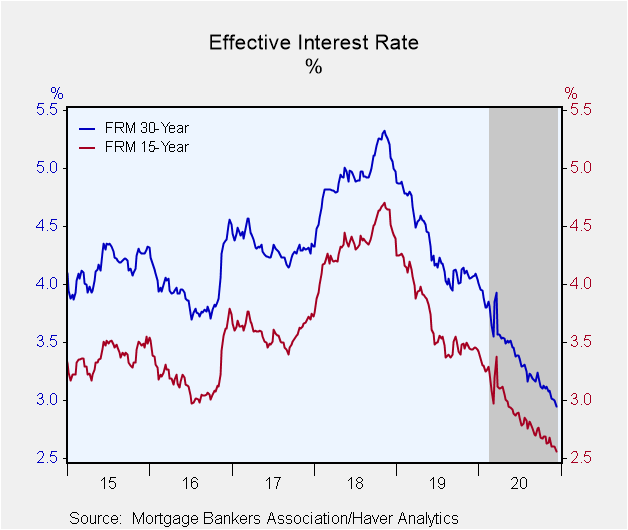

The effective interest rate on a 30-year mortgage dropped five basis points to a new survey low of 2.95% and the 15-year rate declined four basis points to 2.56%, also a new low. These surveys began in January 1990. The effective rate for a Jumbo mortgage declined six basis points to 3.22%, just three basis points above its survey low reached in the week of November 13. The rate on a five-year ARM fell four basis points to 2.71%, its lowest since April 2013.

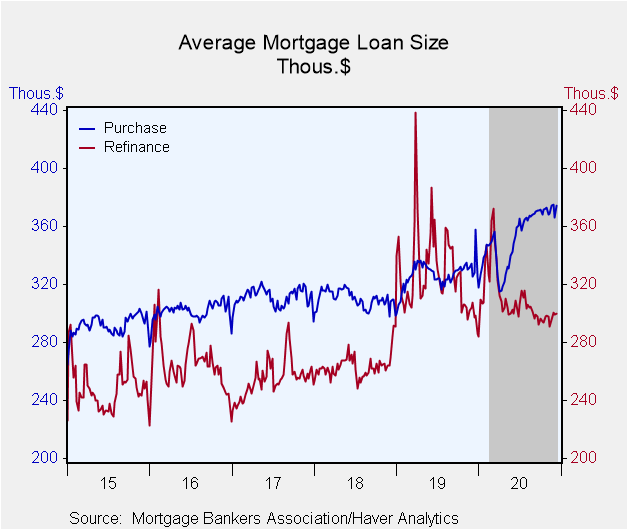

The average mortgage loan size increased to $320,600 (+3.9% y/y) from $317,800 in the previous week. The average size of a purchase loan rose to $374,700 (+14.2% y/y), just $500 shy of the survey high set in the week of November 27, from $366,100. The average size of a refinanced loan edged up to $300,300 (+1.1% y/y) from $299,000.

Applications for fixed-rate loans increased 1.0% w/w (+74.7% y/y) and applications for adjustable-rate mortgages rebounded 7.0% w/w (-34.0% y/y).

This survey covers over 75% of all U.S. retail residential mortgage applications and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. The base period and value for all indexes is March 16, 1990=100. The figures for weekly mortgage applications and interest rates are available in Haver's SURVEYW database.

| MBA Mortgage Applications (%, SA) | 12/11/20 | 12/04/20 | 11/27/20 | Y/Y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Total Market Index | 1.1 | -1.2 | -0.6 | 69.7 | 32.4 | -10.4 | -17.8 |

| Purchase | 1.8 | -5.0 | 9.0 | 26.3 | 6.6 | 2.1 | 5.6 |

| Refinancing | 1.4 | 1.8 | -4.6 | 105.0 | 71.1 | -24.3 | -34.0 |

| 30-Year Effective Mortgage Interest Rate (%) | 2.95 | 3.00 | 3.01 | 4.07

(Dec '19) |

4.34 | 4.94 | 4.32 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.