Global| Aug 27 2010

Global| Aug 27 2010U.S. Mortgage Delinquencies & Foreclosures Remain High

by:Tom Moeller

|in:Economy in Brief

Summary

It's one of the main lessons the study of economics can teach. When something goes bad, less of it is wanted. This year, the percentage of underwritten mortgages in arrears broached 10.0%. Going back to 1972, when the data first [...]

It's one of the main lessons the study of economics

can teach. When something goes bad, less of it is wanted. This year, the

percentage of underwritten mortgages in arrears broached 10.0%. Going back to

1972, when the data first became available, that percentage varied close to

4.5%. Then in 2007 the percentage started its rise to the current level. Not

surprisingly, the number of underwritten mortgages also peaked in 2007 at 46

million when the phrase "credit crunch' first came in vogue. Details behind

the rise in the delinquency rate are in the table below.

It's one of the main lessons the study of economics

can teach. When something goes bad, less of it is wanted. This year, the

percentage of underwritten mortgages in arrears broached 10.0%. Going back to

1972, when the data first became available, that percentage varied close to

4.5%. Then in 2007 the percentage started its rise to the current level. Not

surprisingly, the number of underwritten mortgages also peaked in 2007 at 46

million when the phrase "credit crunch' first came in vogue. Details behind

the rise in the delinquency rate are in the table below.

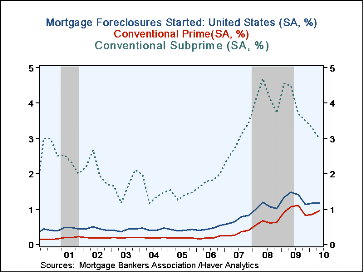

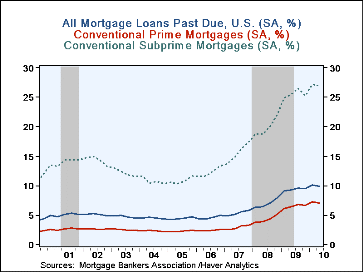

First and foremost, it is apparent that the rise in delinquencies spans both the prime and subprime borrowing groups. Since 2007, the increase in the percentage of delinquencies amongst so-called prime mortgages more-than-doubled. This increase really hurt lenders since prime loans account for roughly three-quarters of the loans on the books. During the period, the percentage of delinquent sub-prime mortgage delinquencies rose a lesser ten percentage points to a staggering 27%. It's no wonder that the size of the secondary loan market imploded.

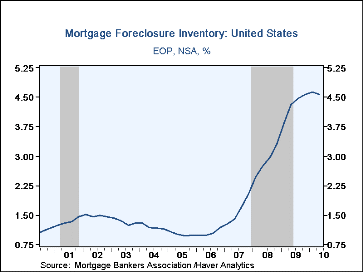

High delinquencies have bred an increased number of foreclosures. Though the number of foreclosures has fallen from the 2009 highs, the annualized foreclosure rate of 4.7% is triple the levels during 2006. The detail is eye-popping. While just 3.8% of prime mortgages are in foreclosure, that figure is up from 0.7% in 2005. The increase has been led by adjustable-rate loans where the recent foreclosure rate of 8.0% compares to 2.9% for fixed-rate loans. Then comes the sub-prime loan universe where 11.9% of loans are in foreclosure, though that is down sharply its peak. For fixed-rate loans the rate is 9.4% but for adjustable-rate sub-prime mortgages the rate is 14.0%.

The mortgage delinquency data is available in Haver's MBAMTG database.

| Mortgage Delinquencies (%) | Number of Mortgages(Q2) |

Q2 '10 | Q1 '10 | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|

| All Mortgages Past Due | 44,508,533 | 9.85 | 10.06 | 9.47 | 7.88 | 5.82 |

| Prime Conventional | 32,932,946 | 7.10 | 7.32 | 6.73 | 5.06 | 3.24 |

| Fixed Rate | 27,471,873 | 5.98 | 6.17 | 5.60 | 3.92 | 2.56 |

| Adjustable Rate | 4,613,443 | 13.75 | 13.52 | 12.10 | 9.69 | 5.51 |

| Subprime Conventional | 4,480,574 | 27.02 | 27.21 | 25.26 | 21.88 | 17.31 |

| Fixed Rate | 2.676,386 | 25.19 | 25.69 | 23.83 | 19.43 | 13.99 |

| Adjustable Rate | 1,694,395 | 29.50 | 29.09 | 26.69 | 24.22 | 20.02 |

| FHA | 5,801,588 | 13.29 | 13.15 | 13.57 | 13.73 | 13.05 |

| VA | 1,293,415 | 7.79 | 7.96 | 7.41 | 7.52 | 6.49 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates