Global| Apr 17 2019

Global| Apr 17 2019U.S. Mortgage Loan Applications Decline as Interest Rates Edge Up

Summary

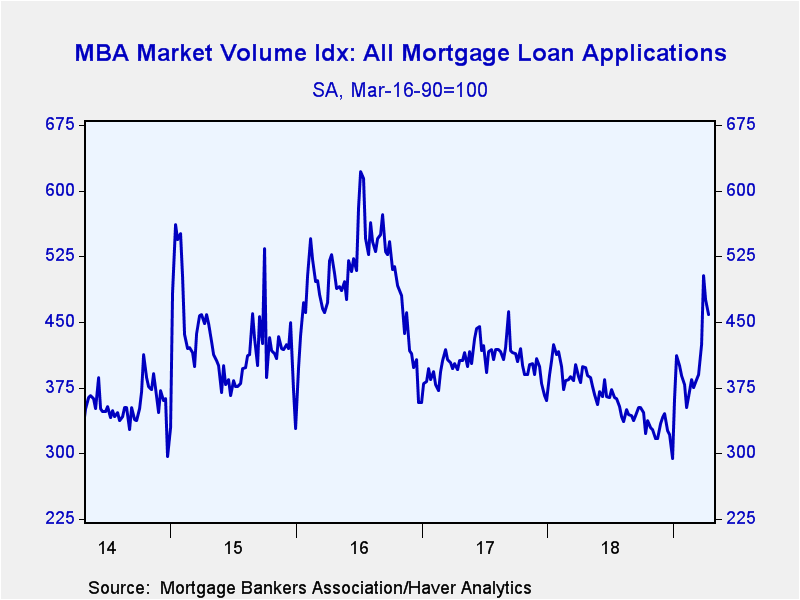

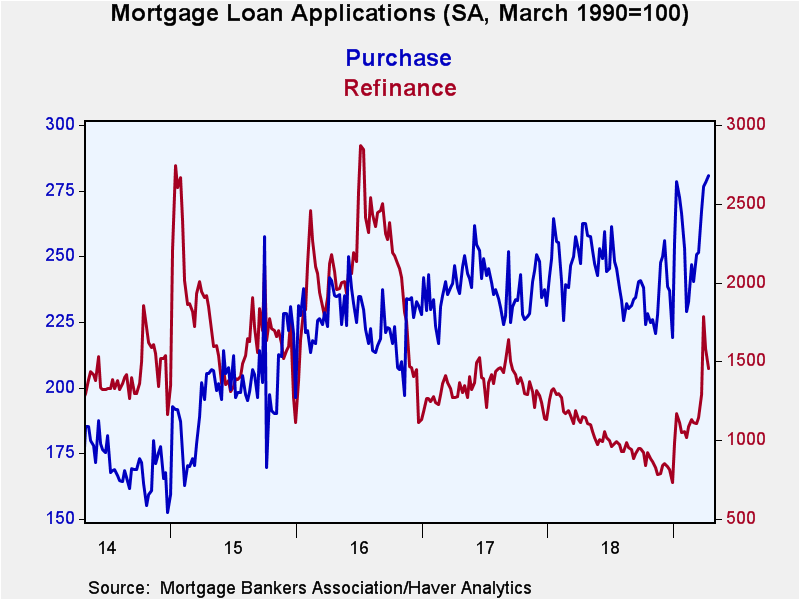

The Mortgage Bankers Association reported that its total Mortgage Applications Index decreased 3.5% (+14.9% year-on-year) during the week ending April 12. Applications to purchase a home increased 0.9% (7.0% y/y), while refinance [...]

The Mortgage Bankers Association reported that its total Mortgage Applications Index decreased 3.5% (+14.9% year-on-year) during the week ending April 12. Applications to purchase a home increased 0.9% (7.0% y/y), while refinance activity fell 8.2% (+26.4% y/y).

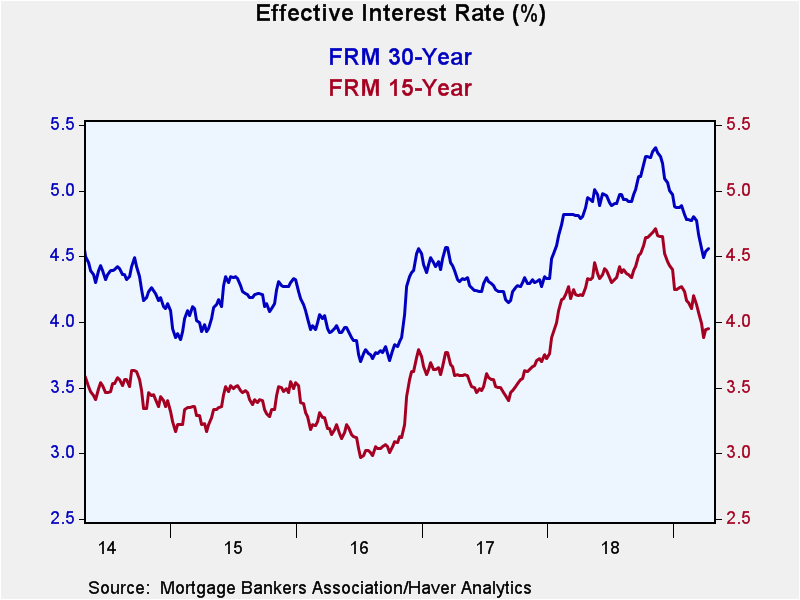

The effective interest rate on a 15-year fixed-rate mortgage edged up to 3.95%. Mortgage rates had fallen to a 14-month low of 3.88% in March after hitting a seven-and-a-half year high of 4.71% in November 2018. The effective rate on a 30-year fixed-rate loan increased to 4.56%, while 30-year Jumbo rates rose to 4.40%. Adjustable 5-year mortgage rates stepped up to 3.95%.

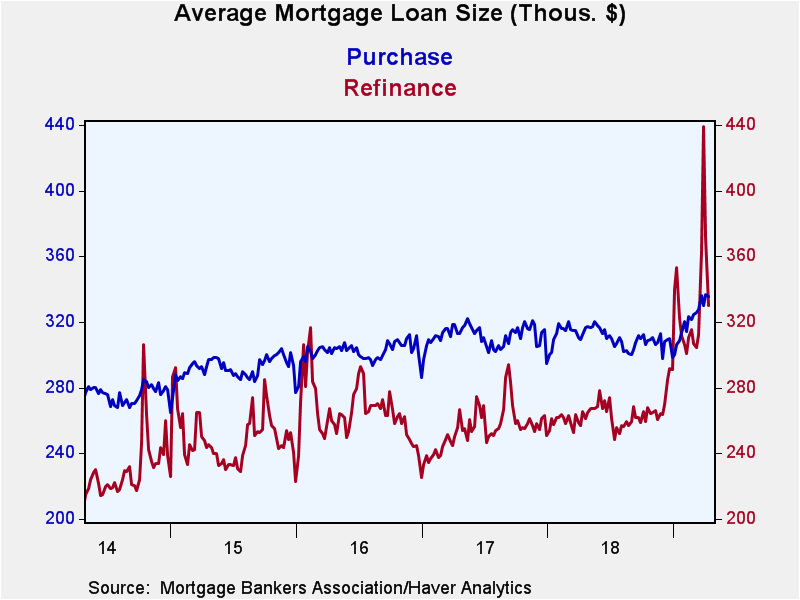

The average mortgage loan size continued declined to $333,100 (+13.0% y/y), down meaningfully from late March's record of $381,700. For purchases, the average loan size edged down to $335,300 (7.4% y/y) from last week's record level of 336,800. The average refinance loan size fell to $329,900 (24.3% y/y), after spiking to $438,900 in late March. Data for all these series go back to 1990.

Applications for fixed- and adjustable-rate loans were up 14.9% y/y and 15.2% respectively.

The survey covers over 75% of all U.S. retail residential mortgage applications and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. The base period and value for all indexes is March 16, 1990=100. The figures for weekly mortgage applications and interest rates are available in Haver's SURVEYW database.

| MBA Mortgage Applications (%, SA) | 4/12/2019 | 4/05/2019 | 3/29/2019 | Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Total Market Index | -3.5 | -5.6 | 18.6 | 14.9 | -10.4 | -17.8 | 15.6 |

| Purchase | 0.9 | 0.5 | 3.4 | 7.0 | 2.1 | 5.6 | 13.3 |

| Refinancing | -8.2 | -11.4 | 38.5 | 26.4 | -24.3 | -34.0 | 17.3 |

| 15-Year Mortgage Effective Interest Rate (%) | 3.95 | 3.94 | 3.88 | 4.25 (Apr '18) | 4.35 | 3.59 | 3.22 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.