Global| Sep 20 2017

Global| Sep 20 2017U.S. Mortgage Loan Applications Decline as Interest Rates Rise

by:Tom Moeller

|in:Economy in Brief

Summary

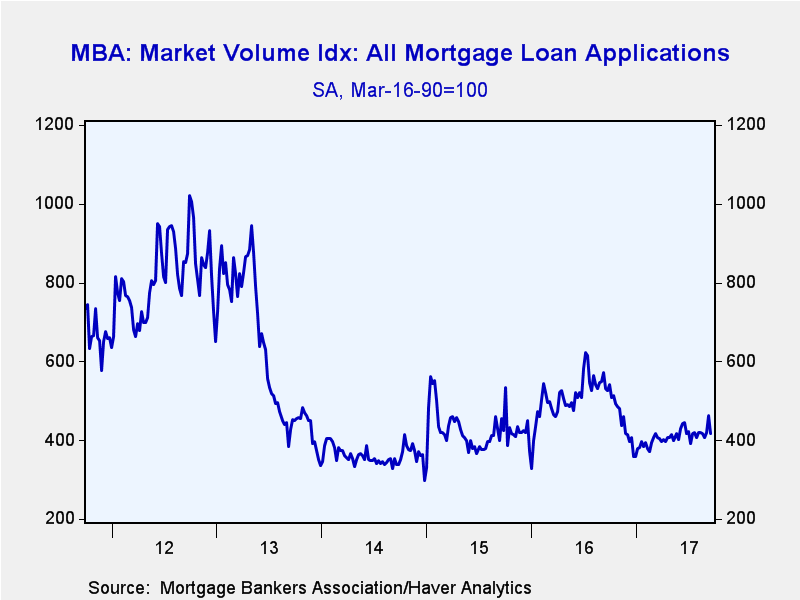

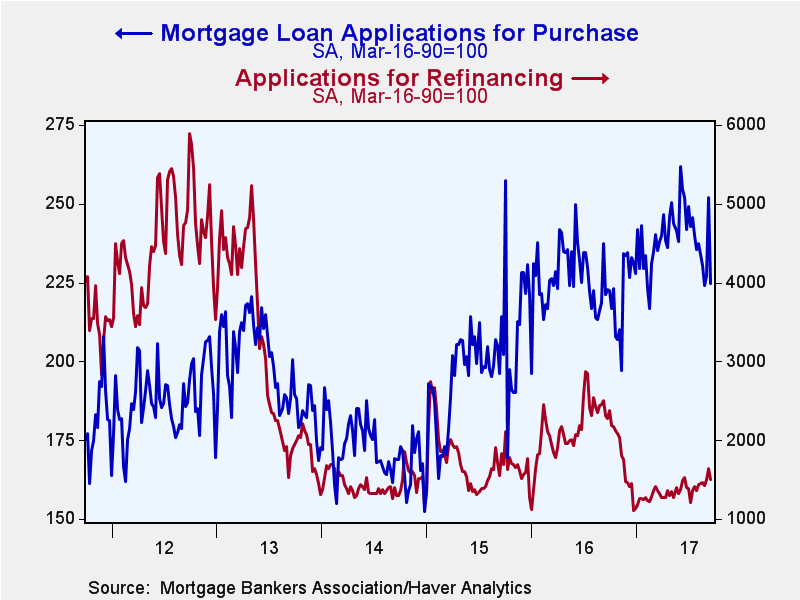

The Mortgage Bankers Association reported that its total Mortgage Applications Volume Index backpedaled 9.7% (-21.3% y/y) in the week ended September 15 and reversed the prior week's gain. Purchase applications fell 10.8% (+1.6% y/y) [...]

The Mortgage Bankers Association reported that its total Mortgage Applications Volume Index backpedaled 9.7% (-21.3% y/y) in the week ended September 15 and reversed the prior week's gain. Purchase applications fell 10.8% (+1.6% y/y) following a 10.9% rise. Applications to refinance were off 8.5% and remained down by roughly one-third y/y.

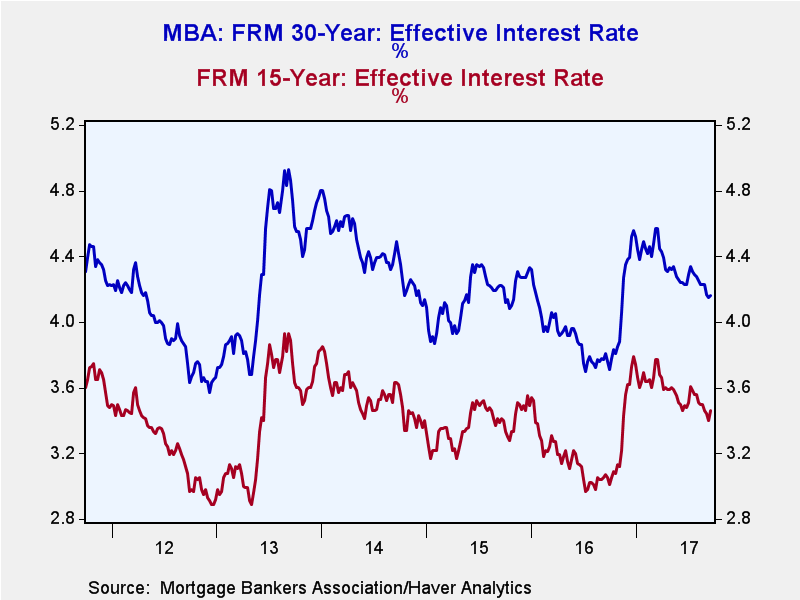

The effective interest rate on a 15-year mortgage rose to 3.46% from 3.40%. The effective rate on a 30-year fixed-rate loan was little-changed at 4.16%. The rate on a Jumbo 30-year loan eased slightly to 4.05%. For adjustable 5-year mortgages, the effective interest rate rose to 3.42%.

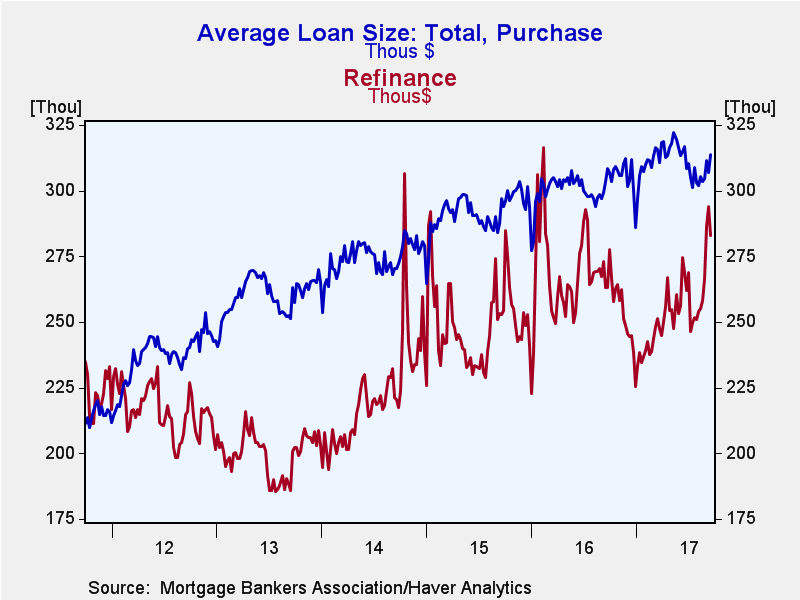

The average mortgage loan size slipped to $297,800, up 7.1% y/y. For purchases, the average loan size rose to $313,900 (3.4% y/y); for refinancings, it declined to $282,900 (+7.4% y/y).

Applications for adjustable rate loans rose 22.5% y/y, while applications for fixed rate loans fell 23.3% y/y.

The survey covers over 75% of all U.S. retail residential mortgage applications and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. The base period and value for all indexes is March 16, 1990=100. The figures for weekly mortgage applications and interest rates are available in Haver's SURVEYW database.

| MBA Mortgage Applications (%, SA) | 09/15/ 17 | 09/08/17 | 09/01/17 | Y/Y | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Total Market Index | -9.7 | 9.9 | 3.3 | -21.3 | 15.6 | 17.9 | -41.4 |

| Purchase | -10.8 | 10.9 | 1.4 | 1.6 | 13.3 | 15.5 | -12.9 |

| Refinancing | -8.5 | 8.9 | 5.1 | -35.1 | 17.3 | 19.7 | -52.8 |

| 15-Year Mortgage Effective Interest Rate (%) | 3.46 | 3.40 | 3.44 | 3.04 (Sep. '16) | 3.22 | 3.37 | 3.54 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.