Global| Dec 22 2005

Global| Dec 22 2005U.S. Personal Income rose As Expected

by:Tom Moeller

|in:Economy in Brief

Summary

Personal income rose an expected 0.3% last month following an upwardly revised 0.5% increase in October. Growth in wage & salary income eased to 0.2% (4.2% y/y) from the unrevised 0.6% pop in October as factory sector wages fell 0.1% [...]

Personal income rose an expected 0.3% last month following an upwardly revised 0.5% increase in October.

Growth in wage & salary income eased to 0.2% (4.2% y/y) from the unrevised 0.6% pop in October as factory sector wages fell 0.1% (+3.3% y/y). Service sector wages rose 0.2% (4.2% y/y) following 0.5% increases in October and September while government wages increased 0.2% (3.3% y/y).

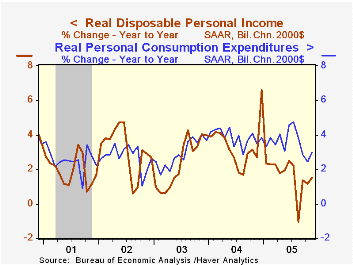

Disposable personal income rose 0.3% (4.3% y/y) following an upwardly revised 0.4% October gain. Adjusted for the 0.4% decline in prices, take home pay jumped 0.7% (1.5% y/y).

The PCE chain price index dropped 0.4% as gasoline prices fell. Less food & energy, prices rose the same 0.1% as in October. Durables prices fell 0.2% (-0.9% y/y) as new auto prices were flat. Appliance prices fell 0.7% (+3.7% y/y) and audio, video & computer prices dropped 1.2% (-9.9% y/y). Clothing & shoes prices rose 0.2% (-1.5% y/y) while services price rose 0.3% (3.2% y/y) following two months of 0.4% increase.

The 0.3% rise in personal consumption expenditures was a bit light of expectations. Nondurables outlays fell 1.0% (8.0% y/y) though less gasoline & oil, spending on nondurables jumped 1.1% (6.9% y/y) led by a 1.5% (5.8% y/y) jump in spending on clothing & shoes. Spending on motor vehicles & parts rose 5.4% m/m and that helped lift durables spending overall 2.7% (-0.8% y/y), helped by a 1.3% (5.9% y/y) increase in spending on furniture. Services spending increased 0.5% (6.0% y/y) for the second month and the gain was led by a 0.6% (17.5% y/y) rise in spending on electricity & gas services.

Great Expectations and the End of the Depression from the Federal Reserve Bank of New York is available here.

| Disposition of Personal Income | Nov | Oct | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Personal Income | 0.3% | 0.5% | 5.3% | 5.9% | 3.2% | 1.8% |

| Personal Consumption | 0.3% | 0.2% | 5.8% | 6.5% | 4.9% | 4.2% |

| Savings Rate | -0.2% | -0.3% | 1.3% (Nov '04) | 1.7% | 2.1% | 2.4% |

| PCE Chain Price Index | -0.4% | 0.1% | 2.7% | 2.6% | 1.9% | 1.4% |

| Less food & energy | 0.1% | 0.1% | 1.8% | 2.0% | 1.3% | 1.8% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates