Global| Jun 27 2012

Global| Jun 27 2012U.S. Personal Income & Spending Turn Positive in May; Saving Rate Higher

Summary

Personal income regained its footing in May with a 0.5% gain; April's move, originally reported as down very marginally, was revised to a 0.1% rise. Year-on-year, income was up 3.3%, compared to the 2.8% reported last month for April. [...]

Personal income regained its footing in May with a 0.5% gain; April's move, originally reported as down very marginally, was revised to a 0.1% rise. Year-on-year, income was up 3.3%, compared to the 2.8% reported last month for April. Consensus expectations were looking for 0.2% on the month. Wages and salaries were up 0.3% in May (3.7% y/y), following 0.1% in April, which was originally reported as flat. The stronger income total came from gains in dividend income, 1.6% on the month (8.0% y/y), interest income, 1.9% m/m (2.3% y/y) and transfer payments, which rebounded by 0.8% m/m (3.4% y/y) after April's 0.6% decline. In the last item, Social Security and Medicare had upturns following declines in April; unemployment insurance extended its recent downtrend. Rental income and proprietors' income both ticked lower by 0.1% in May, with rental income up 13.4% on the year and proprietors' income 6.3%.

Personal income regained its footing in May with a 0.5% gain; April's move, originally reported as down very marginally, was revised to a 0.1% rise. Year-on-year, income was up 3.3%, compared to the 2.8% reported last month for April. Consensus expectations were looking for 0.2% on the month. Wages and salaries were up 0.3% in May (3.7% y/y), following 0.1% in April, which was originally reported as flat. The stronger income total came from gains in dividend income, 1.6% on the month (8.0% y/y), interest income, 1.9% m/m (2.3% y/y) and transfer payments, which rebounded by 0.8% m/m (3.4% y/y) after April's 0.6% decline. In the last item, Social Security and Medicare had upturns following declines in April; unemployment insurance extended its recent downtrend. Rental income and proprietors' income both ticked lower by 0.1% in May, with rental income up 13.4% on the year and proprietors' income 6.3%.

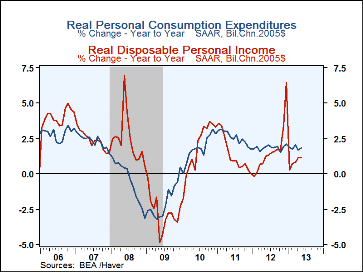

Personal consumption expenditures also regained their footing in May, increasing 0.3% (2.9% y/y) after April's 0.3% fall, a revision from 0.2% reported a month ago. The result was in line with the Consensus forecast of 0.3%. Durable goods outlays picked up by 0.9% (6.7% y/y), after two monthly decreases; motor vehicle purchases in particular were up 1.0% after edging lower for three months. Outlays on nondurable goods rose 0.3% (1.5% y/y) after the food and energy-driven decline of 1.6% in April; in May there were modest upturns in both food and gasoline items. Spending on services edged up just 0.1% (2.7% y/y) after being unchanged in April.

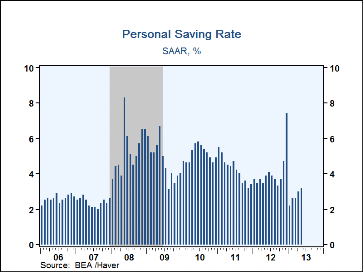

The personal saving rate rose to 3.2% in May, and April's figure was revised to 3.0% from 2.5% in the initial report. It was 3.9% in May 2012.

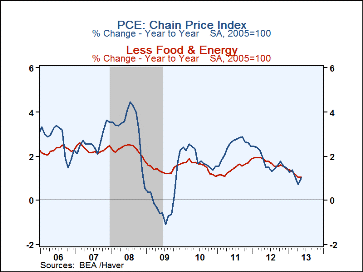

The PCE chain price index increased 0.1% in May (1.0% y/y) after April's 0.3% decline. Energy goods and services prices rose 0.2% after their drop in April of 4.5%; Gasoline prices continued lower modestly, but other energy costs rose markedly, especially natural gas for household utilities, which was up 2.4% (16.6% y/y). Elsewhere, durable goods prices were down 0.1% (-1.9% y/y) while apparel prices rose 0.2% (unchanged y/y). Food prices decreased 0.2% (+1.0% y/y) while services prices also were up 0.2% (1.8% y/y), including the natural gas item. The overall price index excluding food & energy was up 0.1% (1.0% y/y).

Adjusted for price changes, disposable income gained 0.4% in May (1.1% y/y) while real spending rose 0.2% (1.8% y/y).

The personal income & consumption figures are available in Haver's USECON and USNA databases. The consensus expectation figure is in the AS1REPNA database.

| Personal Income & Outlays (%) | May | Apr | Mar | Y/Y | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Personal Income | 0.5 | 0.1 | 0.2 | 3.3 | 3.7 | 5.1 | 3.8 |

| Wages & Salaries | 0.3 | 0.1 | 0.2 | 3.7 | 3.7 | 4.0 | 2.1 |

| Disposable Personal Income | 0.5 | 0.1 | 0.2 | 2.9 | 3.5 | 3.8 | 3.8 |

| Personal Consumption Expenditures | 0.3 | -0.3 | 0.2 | 2.9 | 3.6 | 5.0 | 3.8 |

| Personal Saving Rate | 3.2 | 3.0 | 2.6 | 3.9 (May'12) |

3.9 | 14.2 | 5.1 |

| PCE Chain Price Index | 0.1 | -0.3 | -0.1 | 1.0 | 1.8 | 2.4 | 1.9 |

| Less Food & Energy | 0.1 | 0.0 | 0.1 | 1.1 | 1.7 | 1.4 | 1.5 |

| Real Disposable Income | 0.4 | 0.3 | 0.8 | 1.1 | 1.7 | 1.3 | 1.8 |

| Real Personal Consumption Expenditures | 0.2 | -0.1 | 0.3 | 1.8 | 1.9 | 2.5 | 1.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates