Global| Jun 10 2014

Global| Jun 10 2014U.S. Small Business Optimism Improves Further

by:Tom Moeller

|in:Economy in Brief

Summary

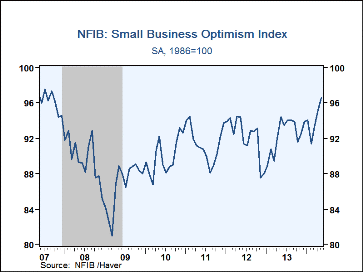

The National Federation of Independent Business reported that its Small Business Optimism Index gained to 96.6 during May after improvement to 95.2 in April. The latest level was its highest since September 2007, just before the [...]

The National Federation of Independent Business reported that its Small Business Optimism Index gained to 96.6 during May after improvement to 95.2 in April. The latest level was its highest since September 2007, just before the recession began.

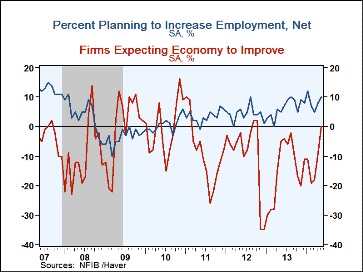

Plans for the future remained constructive. The increase in total optimism again reflected improvement in the index covering those who expected economic improvement, bringing it to the highest level (0%) since October 2012. The percentage of firms expecting higher real sales in six months gained moderately to the highest level (15%) since January. The percentage of firms planning to increase employment (10%) was the highest, also since January.

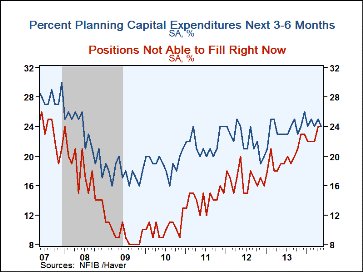

Holding back small business optimism were the readings related to near-term economic activity. The percentage with few or no qualified applicants for job openings jumped to its highest point (46%) since October 2007. The percentage of firms indicating that inventories were too low (-2%) reversed the improvement during the last four months and the percentage looking to raise capital expenditures equaled the lows (24%) of the last nine months.

The percentage of firms with positions not able to fill right now (24%) held at its highest level since January 2008 and those indicating that credit was harder to get (6%) ticked up after it plunged in April to its lowest level since September.

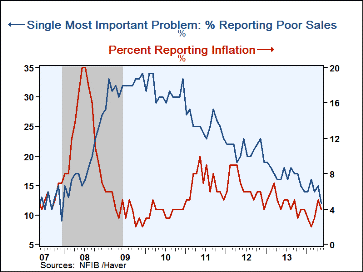

On the pricing front, a stable 12% of firms raised average selling prices and a lessened 21% of firms planned to raise them in the future. A higher 15% planned to increase worker compensation, the most early 2008.

The most important problems faced by small business were taxes (25%), government requirements (20%), poor sales (12%), quality of labor (10%), insurance cost & availability (9%), competition from large businesses (8%), cost of labor (4%), inflation (4%) and financial & interest rates (3%).

Roughly 24 million small businesses exist in the U.S. and they create 80% of all new jobs. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year. The NFIB figures can be found in Haver's SURVEYS database.

| National Federation of Independent Business | May | Apr | Mar | May'13 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Small Business Optimism Index (SA, 1986=100) | 96.6 | 95.2 | 93.4 | 94.4 | 92.4 | 92.2 | 91.4 |

| Firms Expecting Higher Real Sales In Six Months (Net %) | 15 | 10 | 12 | 8 | 4 | 2 | 3 |

| Firms Expecting Economy To Improve (Net %) | 0 | -9 | -18 | -5 | -15 | -9 | -9 |

| Firms Planning to Increase Employment (Net %) | 10 | 8 | 5 | 5 | 6 | 4 | 3 |

| Firms With Few or No Qualified Applicants For Job Openings (Net %) | 46 | 41 | 41 | 38 | 39 | 35 | 32 |

| Firms Reporting That Credit Was Harder To Get (Net %) | 6 | 5 | 8 | 5 | 6 | 8 | 10 |

| Firms Raising Average Selling Prices (Net %) | 12 | 12 | 9 | 2 | 2 | 4 | 5 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates