Global| Jun 09 2020

Global| Jun 09 2020U.S. Small Businesses Optimism Rebounds in May

by:Sandy Batten

|in:Economy in Brief

Summary

• NFIB Small Business Optimism Index rebounded to 94.4 in May from a seven-year low in April. • Eight out of ten components rose in May. • Respondents are optimistic about future business conditions and expect the recession to be [...]

• NFIB Small Business Optimism Index rebounded to 94.4 in May from a seven-year low in April.

• Eight out of ten components rose in May.

• Respondents are optimistic about future business conditions and expect the recession to be short-lived.

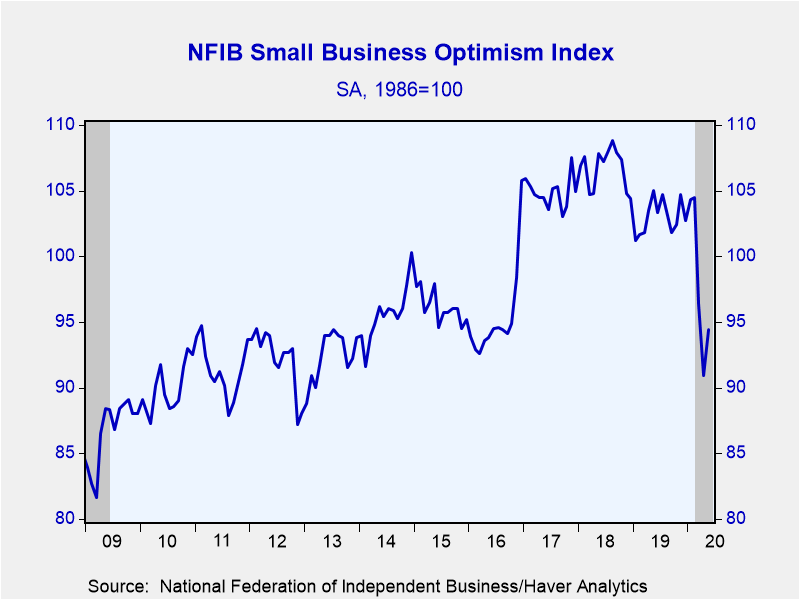

The National Federation of Independent Business (NFIB) Small Business Optimism Index rebounded in May, rising 3.5 points to 94.4. However, it still has some way to go to recoup the 13.6 points it lost in March and April.

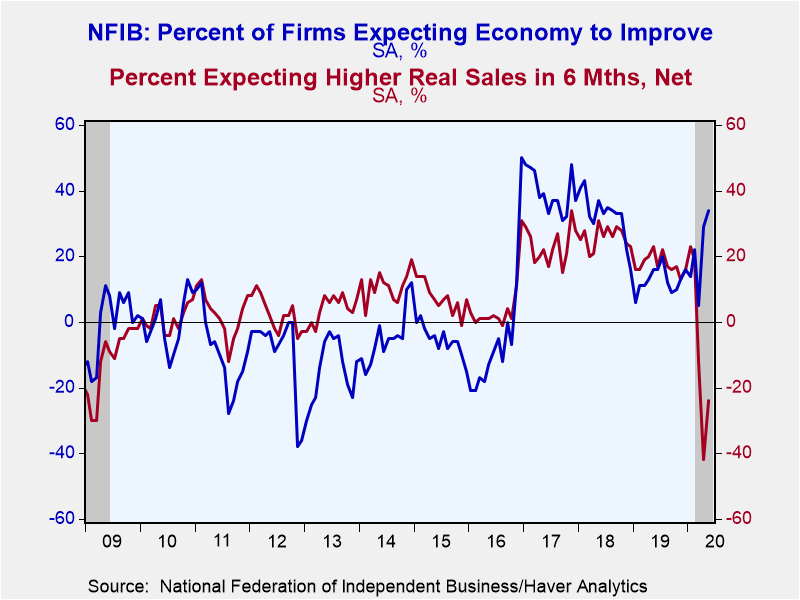

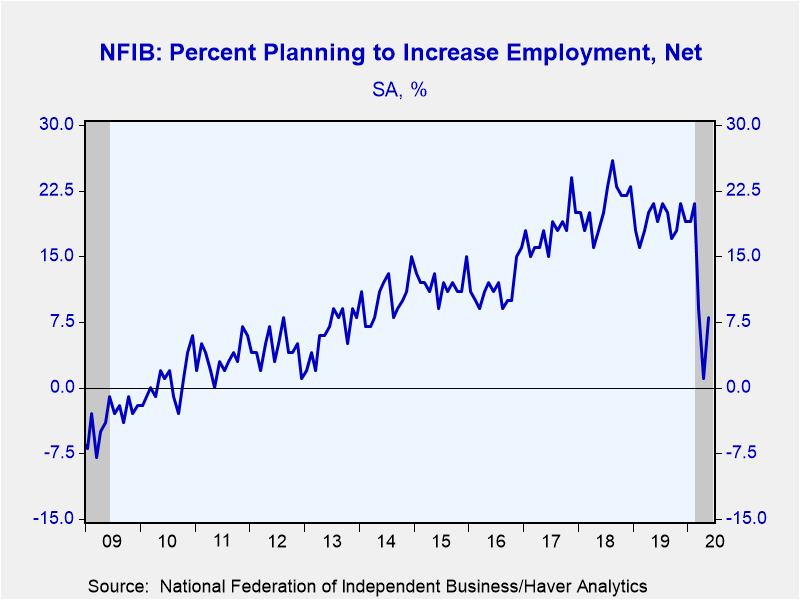

Eight of the ten components in the index rose in May, led by expectations that the economy will improve. This component rose to a net 34% (the percent expecting economy to improve minus the percent expecting it to weaken), its highest reading since August 2018. Businesses also plan to increase hiring (at least modestly) with a net 8% intending to increase employment in May. This is still well below the reading of 21% in February but a big improvement from 1% in April and likely reflects in part the ramping up of the Payroll Protection Program by the federal government.

The balance of real sales expectations over the next three months rose markedly, but remains firmly negative, increasing from -42 in April (the lowest reading for this measure in the history of the series) to -24 in May. While this is clearly an improvement, it still portrays extremely weak sales expectations. Moreover, current sales are also very weak with the balance reporting higher sales this quarter versus last falling to -19 in May, the lowest reading since the global financial crisis in 2008-09, from -11 in April.

Interestingly, the NFIB Uncertainty Index increased to 82 in May from 75 in April. However, this could be a positive development. In April, respondents reported that they were “quite certain that the economy will weaken in the near term.” They now appear to be less certain of further weakness but also of the nature of the economy's reopening and revival.

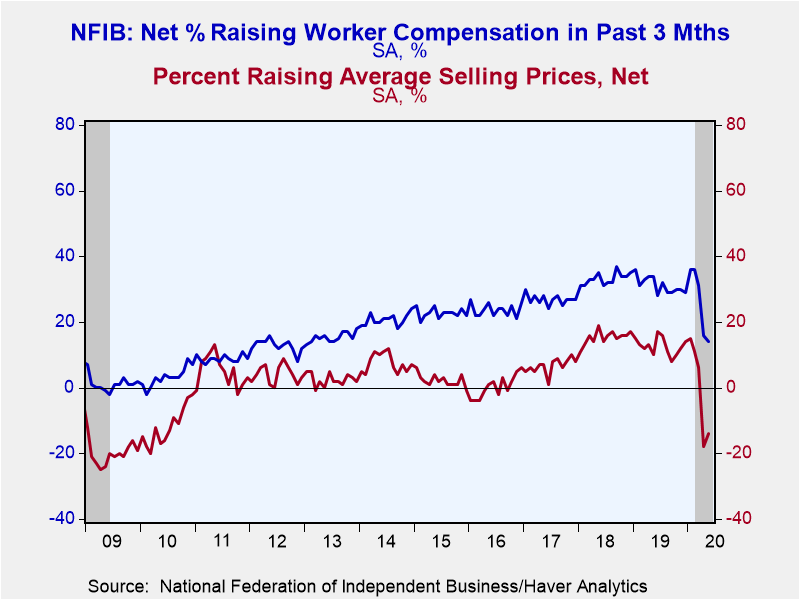

Disinflationary pressures remained as a net -14% of respondents are raising prices. This is up from -18 in April but well below the readings mostly in the teens that preceded the coronavirus lockdown.

This survey inquires about problems facing small business. The most pressing problem in May was again poor sales with 18% of respondents indicating this as their major problem, down only slightly from a seven-year high of 19% in April. In contrast, access to quality labor, which had been the biggest problem for quite a while prior to the lockdown, remained subdued, edging up to 17% from 15%.

Roughly 24 million small businesses exist in the U.S. and they create 80% of all new jobs. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year. The NFIB figures can be found in Haver's SURVEYS database.

| National Federation of Independent Business (SA, Net % of Firms) | May | Apr | Mar | May'19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Small Business Optimism Index (1986=100) | 94.4 | 90.9 | 96.4 | 105.0 | 103.0 | 106.7 | 104.9 |

| Firms Expecting Economy to Improve | 34.0 | 29.0 | 5.0 | 16.0 | 13.0 | 32.0 | 39.0 |

| Firms Expecting Higher Real Sales | -24.0 | -42.0 | -12.0 | 23.0 | 18.0 | 26.0 | 23.0 |

| Firms Reporting Now Is a Good Time to Expand the Business | 5.0 | 3.0 | 13.0 | 30.0 | 25.0 | 30.0 | 23.0 |

| Firms Planning to Increase Employment | 8.0 | 1.0 | 9.0 | 21.0 | 19.0 | 21.0 | 18.0 |

| Firms With Few or No Qualified Applicants for Job Openings (%) | 37.0 | 41.0 | 47.0 | 54.0 | 52.0 | 51.0 | 49.0 |

| Firms Reporting that Credit Was Harder to Get | 2.0 | 4.0 | 3.0 | 4.0 | 4.0 | 4.0 | 4.0 |

| Firms Raising Average Selling Prices | -14.0 | -18.0 | 6.0 | 10.0 | 13.0 | 15.0 | 7.0 |

| Firms Raising Worker Compensation | 14.0 | 16.0 | 31.0 | 34.0 | 31.0 | 33.0 | 27.0 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.