Global| Feb 13 2004

Global| Feb 13 2004U.S. Trade Deficit Deepened

by:Tom Moeller

|in:Economy in Brief

Summary

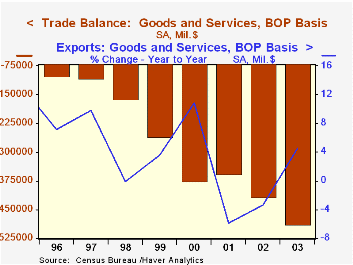

The U.S. foreign trade deficit deepened sharply in December to $42.5. November's deficit was revised slightly deeper to $38.4B. Consensus expectations had been for a deficit of $39.5B. For 2003, the deficit of $489.4B by far set the [...]

The U.S. foreign trade deficit deepened sharply in December to $42.5. November's deficit was revised slightly deeper to $38.4B. Consensus expectations had been for a deficit of $39.5B.

For 2003, the deficit of $489.4B by far set the record.

Exports fell 0.2% (+11.5% y/y) in December. It was the first m/m decline in exports since August. Exports of capital goods retraced 4.5% (+15.7% y/y) of the huge gains made earlier in the year. Non-auto consumer goods exports also dropped 2.2% (+13.6% y/y) but auto exports rose (7.2% y/y).

Imports surged 3.0% as the value of petroleum imports jumped 10.2% (+19.2% y/y) on higher volumes & prices. Non-petroleum imports rose 2.6% as capital goods imports jumped 4.8% (8.9% y/y). Imports of non-auto consumer goods rose 1.5% (6.2% y/y).

By country, the US trade deficit with China narrowed for the second month to $9.9B as imports fell again (+13.5% y/y). The US trade deficit with the European Union deepened sharply to $10.3B.

| Foreign Trade | Dec | Nov | Y/Y | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|

| Trade Deficit | $42.5B | $38.4B | $42.3B(12/02) | $489.4 | $418.0B | $357.8B |

| Exports - Goods & Services | -0.2% | 2.8% | 11.5% | 4.6% | -3.3% | -5.8% |

| Imports - Goods & Services | 3.0% | -0.6% | 7.7% | 8.3% | 2.0% | -5.5% |

by Tom Moeller February 13, 2004

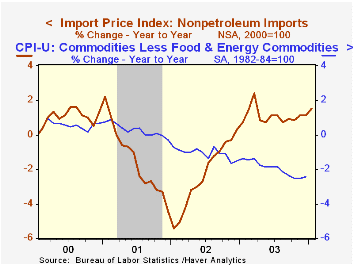

Imported commodities prices jumped 1.3% in January and far outpaced the Consensus expectations for a 0.3% rise. The price gain in December was revised up to 0.5% from 0.2% mostly due to a raised estimate of petroleum prices.

Higher petroleum prices were the source for much of the strength in import prices last month as they rose 6.2%. The price of Brent Crude Oil has dipped this month to the $29-30 /bbl. range versus $31.26 averaged in January.

Additional strength in import prices stemmed from a 0.7% surge in nonpetroleum import prices. This gain was due mostly to a 20.8% spike in natural gas prices (+16.0% y/y), though metal prices also were strong. Capital goods prices rose just 0.1% (-0.9% y/y) following a 0.3% December drop. Nonauto consumer goods prices rose 0.3% (0.4% y/y) and auto prices rose a moderate 0.2% (1.1% y/y).

During the last fifteen years there has been a (negative) 54% correlation between the trade-weighted exchange value of the dollar and the y/y change in nonpetroleum import prices

Export prices rose a firm 0.5%. Again the strength was due mostly to higher fuel prices. Capital goods export prices fell 0.3% (-1.1% y/y) and non-auto consumer goods price rose just 0.1% (1.0% Y/Y)

| Import/Export Prices (NSA) | Jan | Dec | Y/Y | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|

| Import - All Commodities | 1.3% | 0.5% | 1.8% | 2.9% | -2.5% | -3.5% |

| Petroleum | 6.2% | 3.0% | 2.8% | 20.8% | 3.0% | -17.2% |

| Non-petroleum | 0.7% | 0.2% | 1.5% | 1.1% | -2.4% | -1.5% |

| Export - All Commodities | 0.5% | 0.2% | 2.3% | 1.6% | -1.0% | -0.8% |

by Tom Moeller February 13, 2004

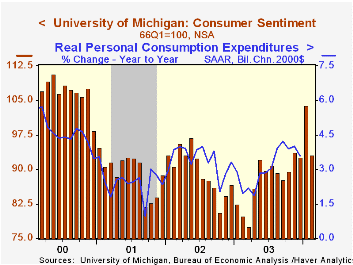

The University of Michigan’s consumer sentiment index fell to 93.1 in mid February, down 10.3% m/m. The decline reversed much of the 12.1% pop in January. Consensus expectations had been for a reading of 104.0.

During the last ten years there has been an 75% correlation between the level of consumer sentiment and the y/y change in real PCE. That correlation has risen to 84% during the last five years.

The current conditions index fell 8.3% m/m to 100.4 and the expectations index dropped 11.7% m/m to the lowest level since November.

The University of Michigan survey is not seasonally adjusted.It is based on telephone interviews with 250 households nationwide on personal finances and business and buying conditions. The survey is expanded to a total of 500 interviews at month end.

| University of Michigan | Mid-Feb | Jan | Y/Y | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|

| Consumer Sentiment | 93.1 | 103.8 | 16.5% | 87.6 | 89.6 | 89.2 |

| Current Conditions | 100.4 | 109.5 | 5.2% | 97.2 | 97.5 | 100.1 |

| Consumer Expectations | 88.4 | 100.1 | 26.5% | 81.4 | 84.6 | 82.3 |

by Tom Moeller February 13, 2004

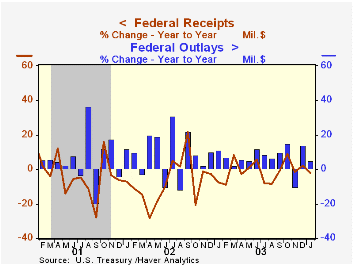

The U.S. Government budget deficit deepened to $1.4B in January versus a surplus in January of 2003 and was below expectations for a $3.0B surplus. For the first four months of FY04 the deficit ran at a $390B rate

Net receipts for the first four months of FY04 rose 1.6% versus in the first four months of FY03. Much of the gain reflected higher corporate tax receipts, up 39.1% y/y. Contributions for social insurance, estate taxes, and miscellaneous taxes also rose. Individual income tax receipts fell 2.6% y/y.

Federal net expenditures rose 5.9% versus the first four months of last fiscal year. Defense expenditures surged 15.9% and veterans benefits jumped 9.3%. Growth in Medicare outlays was 2.2% and spending on health programs rose 10.1%. Interest expense fell 4.4% y/y.

The latest Budget and Economic Outlook from the Congressional Budget Office is available here.

| US Government Finance | Jan | Dec | Jan '03 | FY2003 | FY2002 | FY2001 |

|---|---|---|---|---|---|---|

| Budget Balance | $-1.4B | $-16.2B | $10.6B | $-374.2B | $-157.8B | $127.3B |

| Revenues | $184.3B | $186.7B | -1.9% | -3.8% | -6.9% | -1.7% |

| Outlays | $185.6B | $202.9B | 4.7% | 7.2% | 7.9% | 4.2% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates