Global| Jul 02 2020

Global| Jul 02 2020U.S. Trade Deficit Widened Further in May

by:Sandy Batten

|in:Economy in Brief

Summary

• The foreign trade deficit in goods and services widened further in May. • Both exports and imports fell in May though by much less than in April. • Trade is on course to subtract meaningfully from Q2 GDP. The U.S. trade deficit in [...]

• The foreign trade deficit in goods and services widened further in May.

• Both exports and imports fell in May though by much less than in April.

• Trade is on course to subtract meaningfully from Q2 GDP.

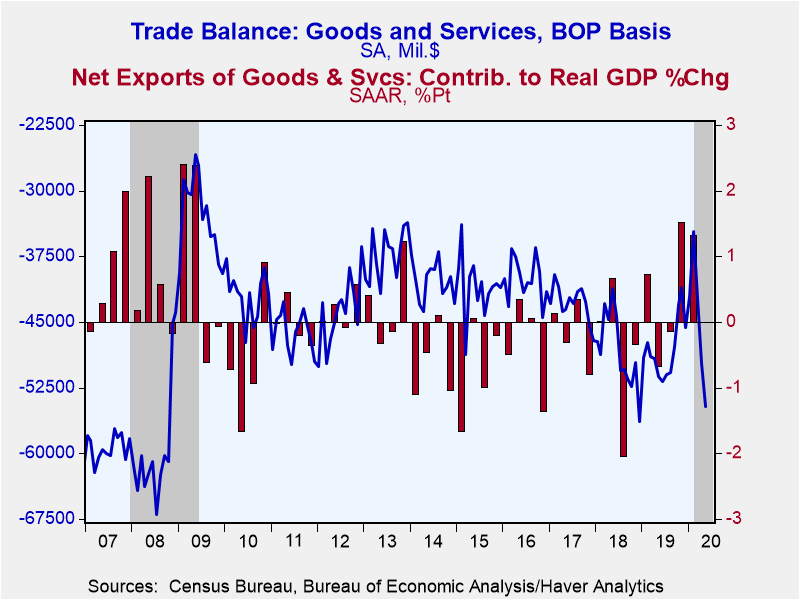

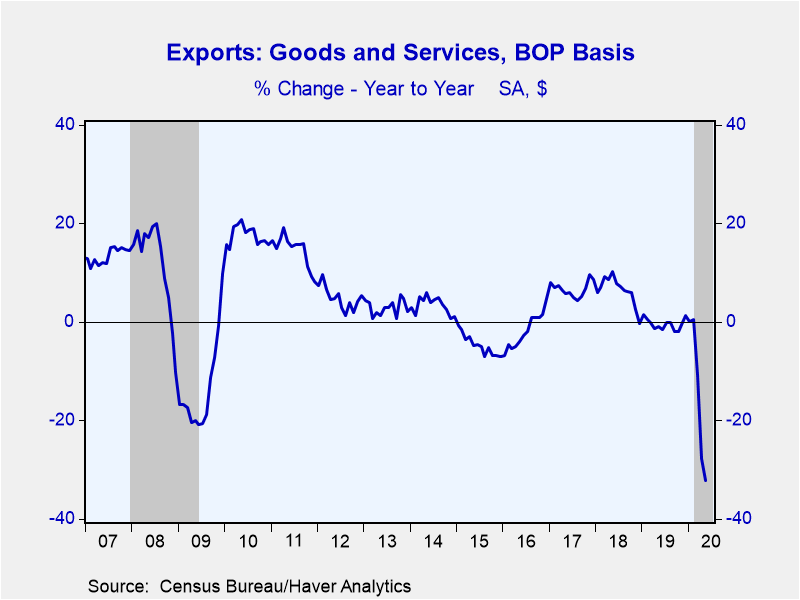

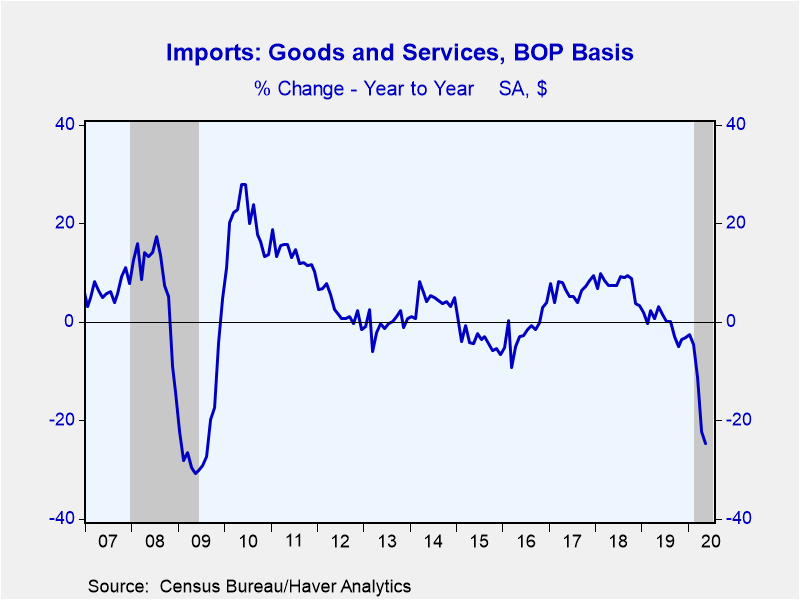

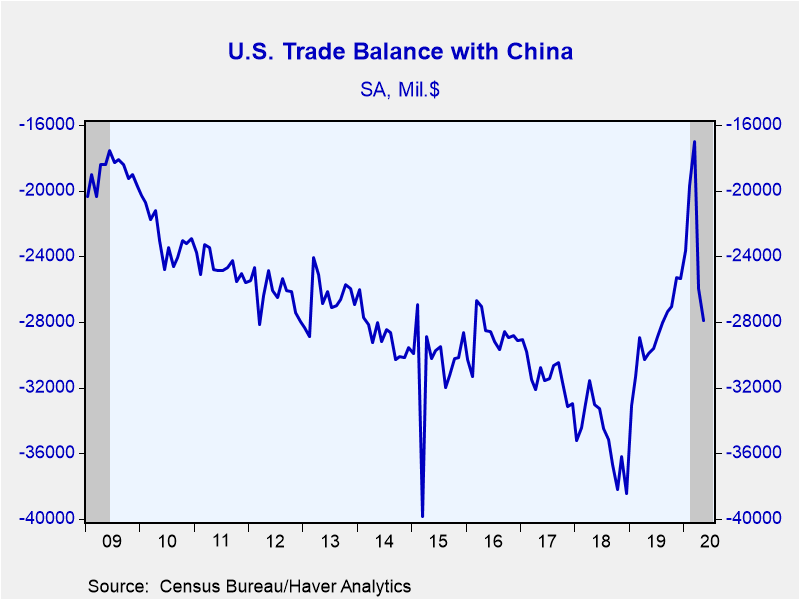

The U.S. trade deficit in goods and services widened to $54.60 billion in May from a slightly revised $49.76 billion in April (initially $49.41 billion). The Actions Economics Forecast panel had expected the deficit to widen to $53.0 billion. Both exports and imports fell further in May, but by much less than in April. Exports declined 4.4% m/m (-32.1% y/y) in May but this paled in comparison to the 20.5% m/m collapse in April. Imports edged down 0.9% m/m (-24.6% y/y) in May versus a 24.6% m/m drop in April. Over the past three months, exports are down 31.8% while imports have fallen 19.2%. This is a record three-month decline for exports (the series dates to 1992). However, imports fell more in the three months to January 2009 (-22.3%) in the wake of the global financial crisis.

The trade deficit in goods widened to $76.1 billion in May from $71.8 billion in April. Exports of goods declined 5.8% m/m in May following a 25.0% m/m drop in April. All major categories fell in May except for nonfood consumer goods excluding autos. Auto exports fell 11.1% m/m on top of a 65.8% m/m drop in April and a 16.7% m/m fall in March. Over the three months to May, auto exports are down 74.7%. Exports of nonfood consumer goods excluding autos rebounded slightly, rising 5.4% in May after having declined in each of the previous three months. For the three months to May, these exports were down 31.2%.

Imports of goods edged down 0.6% m/m in May for the fifth consecutive monthly decline. They had fallen 13.6% m/m in April and are down 15.9% in the three months to May. A 32.8% m/m drop in imports of autos and parts more than accounted for the overall decline in goods imports. Imports of industrial supplies rose 5.5% m/m in May and imports of nonfood consumer goods excluding autos increased 4.4% m/m.

The trade surplus in services shrank to $21.5 billion in May $22.1 billion, the third consecutive month in which the surplus has narrowed. Exports of services slipped 2.0% m/m, the fourth monthly decline in the past five months, following marked declines of 10.9% and 15.0% in April and March respectively. Over the three months to May, exports of services slumped 25.8%. Exports of travel services fell only 1.1% m/m in May after having collapsed 42.9% m/m in April and 50.4% m/m in March. For the three months ending in May, travel service exports are down 72.0%. Imports of services fell 1.4% m/m in May following declines of 13.4% m/m in April and 19.6% m/m in March. For the three months ending in May services imports were down 31.4%. The decline in services imports has been dominated by the collapse in travel. Imports of travel services slumped 14.0% m/m in May on top of a 75.2% m/m collapse in April and a 63.6% m/m tumble in March. For the three months ending in May, travel services imports have almost evaporated, falling 92.3%.

The real (chained 2012$) trade deficit widened to $86.5 billion in May from $80.4 billion in April. The marked widening of the deficit in both April and May points to net exports subtracting 2-3 percentage points from Q2 GDP, which is expected to post the largest quarterly decline in the history of the national accounts (dating back to 1947).

The international trade data can be found in Haver's USECON database. Detailed figures on international trade are available in the USINT database. The expectations figures are from the Action Economics Forecast Survey, which is carried in AS1REPNA.

| Foreign Trade in Goods & Services (Current $) | May | Apr | Mar | May Y/Y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| U.S. Trade Deficit ($ bil.) | 54.60 | 49.76 | 42.34 | 51.26 | 576.86 | 579.94 | 513.79 |

| Exports of Goods & Services (% Chg) | -4.4 | -20.5 | -10.2 | -32.1 | -0.4 | 6.4 | 6.7 |

| Imports of Goods & Services (% Chg) | -0.9 | -13.6 | -5.6 | -24.6 | -0.5 | 7.5 | 6.7 |

| Petroleum (% Chg) | -2.0 | -48.8 | -22.5 | -68.7 | -14.0 | 20.8 | 27.2 |

| Nonpetroleum Goods (% Chg) | -0.6 | -11.3 | -0.3 | -18.0 | -0.4 | 7.4 | 5.5 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.