Global| Jan 07 2021

Global| Jan 07 2021U.S. Trade Deficit Widens As Imports Surge

by:Tom Moeller

|in:Economy in Brief

Summary

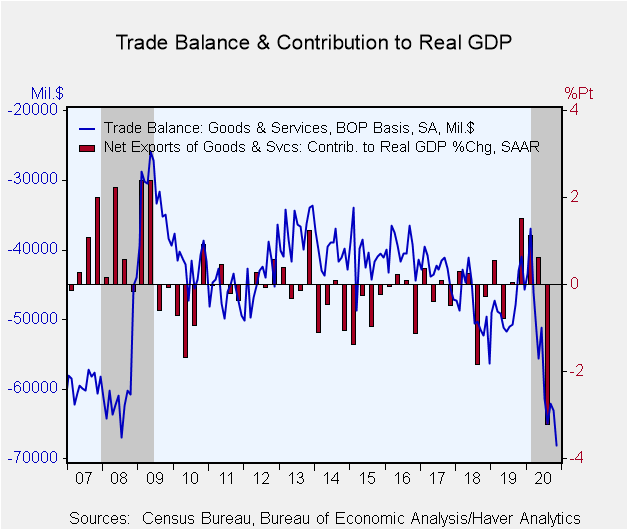

• Trade deficit increases to highest level since August 2006. • Import rise fueled by higher oil prices. • Exports decline y/y as overseas economies remain weak. The U.S. trade deficit in goods and services widened to $68.1 billion [...]

• Trade deficit increases to highest level since August 2006.

• Import rise fueled by higher oil prices.

• Exports decline y/y as overseas economies remain weak.

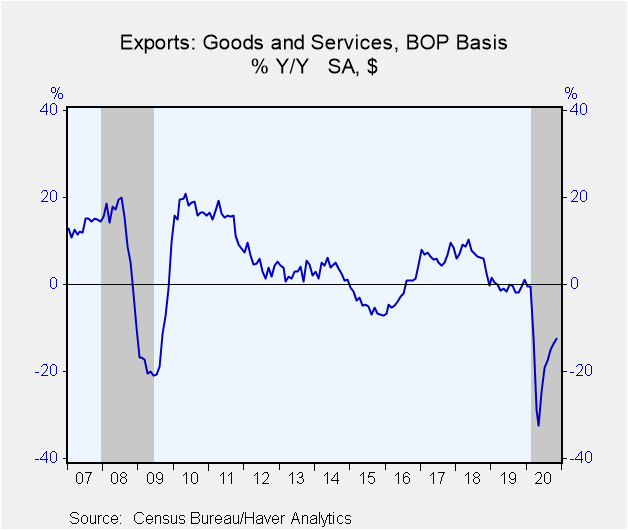

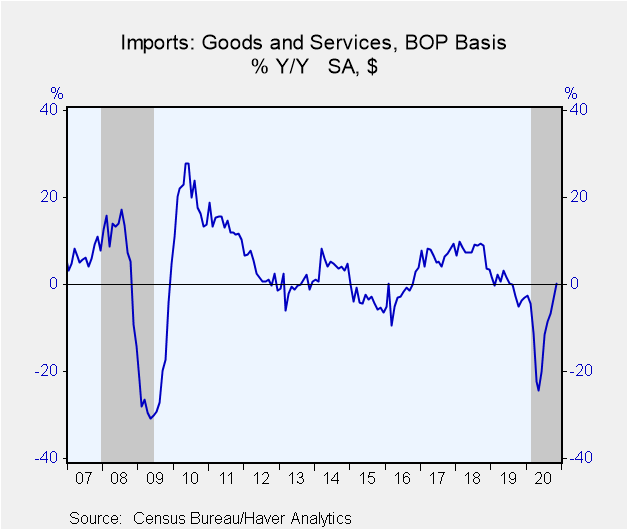

The U.S. trade deficit in goods and services widened to $68.1 billion during November from an unrevised $63.1 billion in October. September also was unrevised at $62.1 billion. The Action Economics Forecast Survey anticipated $65.2 billion. Imports increased 2.9% (0.3% y/y) while exports rose 1.2% (-12.5% y/y).

The deficit in goods trade increased to $86.4 billion in November from $81.4 billion. Exports of goods rose 1.0% (-6.7% y/y) as non-auto consumer goods improved 1.1% (-2.4% y/y). Imports of goods gained 3.1% (6.0% y/y), driven by a 7.0% increase in nonauto consumer goods imports (17.9% y/y). Petroleum imports grew 1.7% (-34.1% y/y). Oil import volumes declined 4.9% (-6.4% y/y). Non-petroleum imports rose 3.2% (9.2% y/y). Greater detail covering international trade in goods can be found here.

The surplus on trade in services held steady m/m at $18.2 billion. The value of services exports grew 1.5% (-23.4% y/y) led by an 11.4% gain in travel (-72.3%). Charges for the use of intellectual property eased 0.5% (+0.3% y/y). Imports of services gained 2.4% (-22.5% y/y) also led by a 19.9% (-77.7% y/y) rise in travel. Charges for imports of intellectual property eased 0.7% (+14.0% y/y).

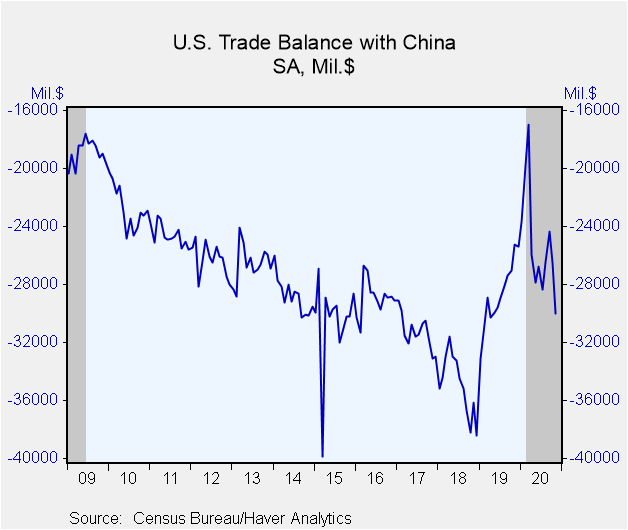

The goods trade deficit with China widened to $30.0 billion in November from $26.5 billion in October. Exports to China fell 3.8% (+40.5% y/y) while imports rose 7.5% (24.5% y/y). The trade deficit with the European Union grew to $16.7 billion. Exports to the EU rose 4.9% (-8.4% y/y) while imports gained 5.6% (0.7% y/y). The deficit with Japan deepened to -$6.6 billion. Exports to Japan declined 1.3% (-12.4% y/y) and imports rose 8.1% (2.6% y/y).

The international trade data, including relevant data on oil prices, can be found in Haver's USECON database. Detailed figures on international trade are available in the USINT database. The expectations figures are from the Action Economics Forecast Survey, which is carried in AS1REPNA.

| Foreign Trade in Goods & Services (Current $) | Nov | Oct | Sep | Nov Y/Y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| U.S. Trade Deficit ($ bil.) | 68.1 | 63.1 | 62.1 | 41.1 (11/19) |

576.9 | 579.9 | 513.8 |

| Exports of Goods & Services (% Chg) | 1.2 | 2.2 | 2.4 | -12.5 | -0.4 | 6.4 | 6.7 |

| Imports of Goods & Services (% Chg) | 2.9 | 2.1 | 0.6 | 0.3 | -0.5 | 7.5 | 6.7 |

| Petroleum (% Chg) | 1.7 | 2.9 | 0.1 | -34.1 | -14.0 | 20.8 | 27.2 |

| Nonpetroleum Goods (% Chg) | 3.2 | 2.3 | 0.0 | 9.2 | -0.4 | 7.4 | 5.5 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates