Global| Apr 21 2010

Global| Apr 21 2010UK Claimant Count Turns Lower Amid Reports With Conflicting Signals

Summary

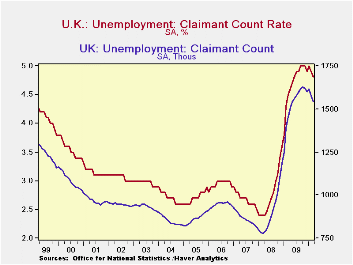

The UK claimant count continues to make its slow turn to lower levels. The unemployment rate calculated from claimant data also is trending lower. However, a broader ILO survey has shown the opposite to be true. On the ILO measure the [...]

The UK claimant count continues to make its slow turn to lower levels. The unemployment rate calculated from claimant data also is trending lower. However, a broader ILO survey has shown the opposite to be true. On the ILO measure the number of unemployed is up to its highest tally since 1994. As in the US, the ranks of the long-term unemployed are growing in the UK. The ILO rate of unemployment, also a separate calculation, went up to 8% from 7.8%.

These metrics take on added importance in the middle of UK elections. The claimant figures tend to grab the headlines in the UK but the ILO numbers are usually mentioned too. While the economy does seem to be turning the corner, the speed of the turn is slow and the political fighting over what it means is intense.

In a release of the minutes of the BOE’s last meeting there is mention of a growing risk of inflation. Up to now’ the BOE has been talking of an inflation overshoot of its target that was not a matter of concern. In these minutes for the first time there is talk of ‘upside risks’ to inflation laid at the feet of rising oil and commodity prices. Still, the bottom line is that the committee did not see these risks as substantial enough to call for any change in the current policy path.

The UK seems to be in the same boat as every other major economy in so far as its economic data blow hot then cold sometimes on the same day! This obviously this makes it hard to get a fix on what the economy is really doing. On top that, electioneering just muddies the waters even more as politicians try to take each number to make some political gain from it. Now the BOE is seeing shifting risks for inflation. With all of this in process the UK remains one of the most enigmatic economies in Europe.

| UK Claimant Count | ||||||

|---|---|---|---|---|---|---|

| Mar-10 | Feb-10 | Jan-10 | 3mo | 6-mo | 12-mo | |

| Level in Month | Avg in Period | |||||

| U-Rate:Claimants | 4.8 | 4.9 | 5.0 | 4.9 | 4.9 | 4.9 |

| Change in MO | Change over period | |||||

| Change on 000s | -32.9 | -40.1 | 16.2 | -56.8 | -73.4 | 90.1 |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates