Global| Jul 29 2005

Global| Jul 29 2005US GDP Growth About As Expected in 2Q

by:Tom Moeller

|in:Economy in Brief

Summary

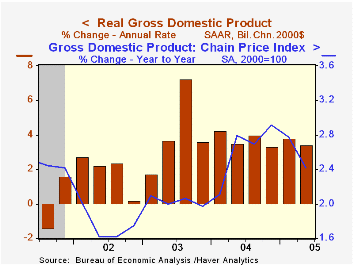

US real GDP in 2Q '05 grew 3.4% (AR) versus the Consensus expectation for 3.5% growth. Revisions to data from 2002 to 2004 lowered growth to an average 2.8% during the period from 3.1% estimated earlier. Growth in domestic demand [...]

US real GDP in 2Q '05 grew 3.4% (AR) versus the Consensus expectation for 3.5% growth. Revisions to data from 2002 to 2004 lowered growth to an average 2.8% during the period from 3.1% estimated earlier.

Growth in domestic demand continued firm last quarter at a 4.0% annual rate. The acceleration versus 1Q owed to faster growth in business fixed investment at 9.0% (AR, 9.2% y/y) which occurred because of 40.8% (AR) growth in transportation. Real PCE grew 3.3% (3.9% y/y), down slightly from last year's pace, and residential building grew a solid 9.8% (5.9% y/y).

Slower production growth occurred as inventories were drawn down for the first quarter in two years and lowered GDP growth by 2.3 percentage points. It was the third subtraction from GDP growth due to inventories in the last four quarters but it was the largest subtraction since 2000.

A smaller foreign trade deficit contributed 1.6% percentage points to growth last quarter as exports surged 12.6% (8.1% y/y) and easily outpaced imports which declined across categories; by 2.0% (5.2 y/y) in total.

The chain price index grew 2.4%, the slowest rate of growth since 3Q04. The slowdown was the result of foreign trade. The chain price index for domestic final demand grew 3.2% (2.8% y/y), up from 2.9% growth last year.

Happy-Hour Economics, or How an Increase in Demand Can Produce a Decrease in Price from the Federal Reserve Bank of Atlanta can be found here.

| Chained 2000$, % AR | 2Q '05 (Advance) | 1Q '05 | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| GDP | 3.4% | 3.8% | 3.6% | 4.2% | 2.7% | 1.6% |

| Inventory Effect | -2.3% | 0.3% | -1.3% | 0.3% | 0.0% | 0.4% |

| Final Sales | 5.8% | 3.5% | 4.3% | 3.9% | 2.7% | 1.2% |

| Foreign Trade Effect | 1.6% | -0.4% | 0.2% | -0.5% | -0.3% | -0.6% |

| Domestic Final Demand | 4.0% | 3.7% | 4.1% | 4.4% | 3.0% | 1.8% |

| Chained GDP Price Index | 2.4% | 3.1% | 2.4% | 2.6% | 2.0% | 1.7% |

by Tom Moeller July 29, 2005

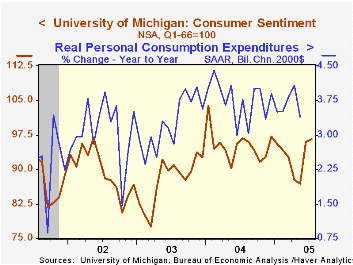

The University of Michigan's final reading of consumer sentiment in July matched Consensus expectations and held at the improved level of 96.5 reported mid-month. Sentiment rose 0.5% for the month on top of a 10.5% increase during June.

During the last ten years there has been a 74% correlation between the level of consumer sentiment and the y/y change in real PCE, although the correlation has fallen in recent years.

Consumer expectations rose slightly less than estimated earlier in the month. The 0.6% gain followed a 12.9% surge during June but the reading of current economic conditions rose slightly instead of declining as indicated earlier.

The University of Michigan survey is not seasonally adjusted.The mid-month survey is based on telephone interviews with 250 households nationwide on personal finances and business and buying conditions. The survey is expanded to a total of 500 interviews at month end.

| University of Michigan | July | June | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Consumer Sentiment | 96.5 | 96.0 | -0.2% | 95.2 | 87.6 | 89.6 |

| Current Conditions | 113.5 | 113.2 | 7.9% | 105.6 | 97.2 | 97.5 |

| Consumer Expectations | 85.5 | 85.0 | -6.3% | 88.5 | 81.4 | 84.6 |

by Tom Moeller July 29, 2005

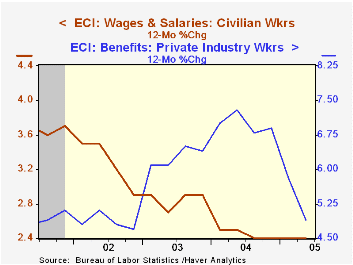

The employment cost index for private industry workers rose the same 0.6% last quarter as during 1Q05 and contrasted to Consensus expectations for a 0.8% increase.

The 0.8% increase in benefit costs was the slowest since early 2002 and reflected slower growth in the service sector while benefit costs grew more rapidly in manufacturing. The y/y gain in the cost of health benefits fell to 6.3%, the slowest since 1999.

Wage and salary growth was stable at 0.6%. Wages account for roughly 70% of the compensation index.

Labor Market Developments in the United States and Canada since 2000 from the Federal Reserve Bank of New York is available here.

| ECI- Private Industry Workers | 2Q '05 | 1Q '05 | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Compensation | 0.6% | 0.6% | 3.2% | 3.8% | 4.0% | 3.2% |

| Wages & Salaries | 0.6% | 0.6% | 2.4% | 2.4% | 3.0% | 2.7% |

| Benefit Costs | 0.8% | 1.1% | 4.9% | 6.9% | 6.4% | 4.7% |

by Tom Moeller July 29, 2005

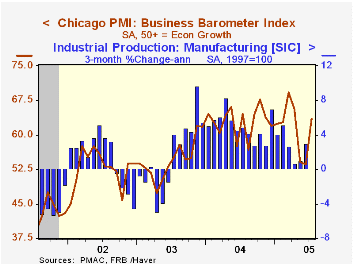

The Chicago Purchasing Managers Business Barometer in July reversed much of the decline during the prior two months with a near 10 point rise versus June. At 63.5 the index stood at its highest level since April. Consensus expectations had been for near stability at 55.0.

During the last ten years there has been a 65% correlation between the level of Chicago PMI and the three month change in factory sector industrial production.

New orders improved sharply to the highest level since April and the employment index recouped the prior month's weakness with a rise to 56.1. During the last ten years there has been a 75% correlation between the level of the employment index and the three month change in factory sector employment.

The index of prices also improved to its highest level since April. During the last ten years there has been an 86% correlation between the Chicago price index and the three month change in the "core" intermediate goods PPI.

| Chicago Purchasing Managers Index, SA | July | June | July '04 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Business Barometer | 63.5 | 53.6 | 64.5 | 62.9 | 54.6 | 52.8 |

| New Orders | 69.6 | 56.5 | 68.9 | 67.0 | 58.0 | 56.2 |

| Prices Paid | 61.3 | 59.7 | 80.0 | 80.1 | 55.8 | 56.9 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates