Global| Nov 09 2018

Global| Nov 09 2018Wholesale Inventories and Sales Increase Modestly

by:Tom Moeller

|in:Economy in Brief

Summary

Wholesale inventories increased 0.4% (5.2% y/y) during September following a 0.9% August rise, revised from 1.0%. The September gain compared to a 0.3% rise expected in the Informa Global Markets Survey and a 0.4% increase reported in [...]

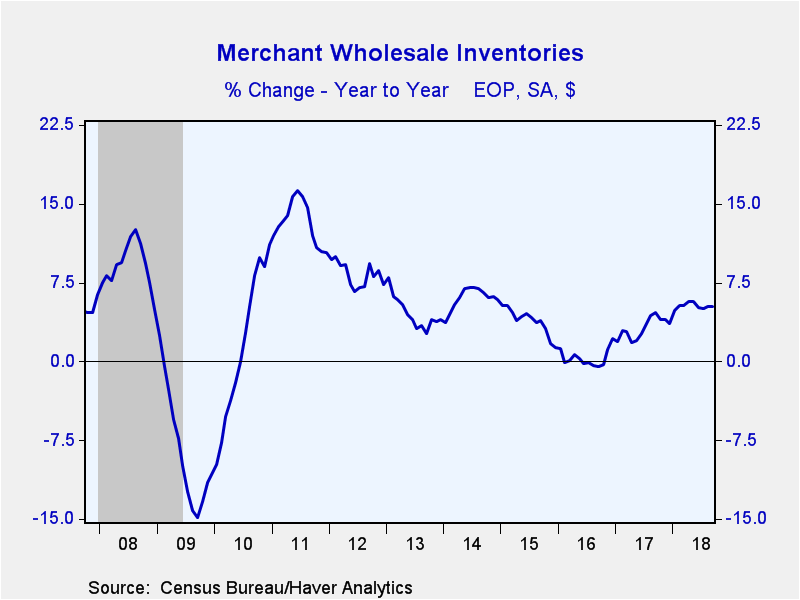

Wholesale inventories increased 0.4% (5.2% y/y) during September following a 0.9% August rise, revised from 1.0%. The September gain compared to a 0.3% rise expected in the Informa Global Markets Survey and a 0.4% increase reported in the advance report issued two weeks ago.

Durable goods inventories increased 0.8% (6.8% y/y) after a 1.0% gain. Automotive inventories surged 1.4% (2.6% y/y) and computer & office equipment inventories strengthened 1.9% (9.7% y/y). Machinery & equipment inventories rose 0.7% (9.1% y/y). Furniture inventories gained 0.2% (2.2% y/y) while electrical goods inventories improved 0.9% (4.1% y/y). Inventories of nondurable goods declined 0.4% (+2.8% y/y) as the value of farm product inventories fell 3.8% (+13.5% y/y). Paper product inventories were off 0.3% (+7.9% y/y) and chemical inventories eased 0.1% (+7.6% y/y). To the upside, petroleum inventories increased 5.0% (13.1% y/y). Apparel inventories rose 0.8 (-2.1% y/y) and grocery product inventories improved slightly (-2.5% y/y).

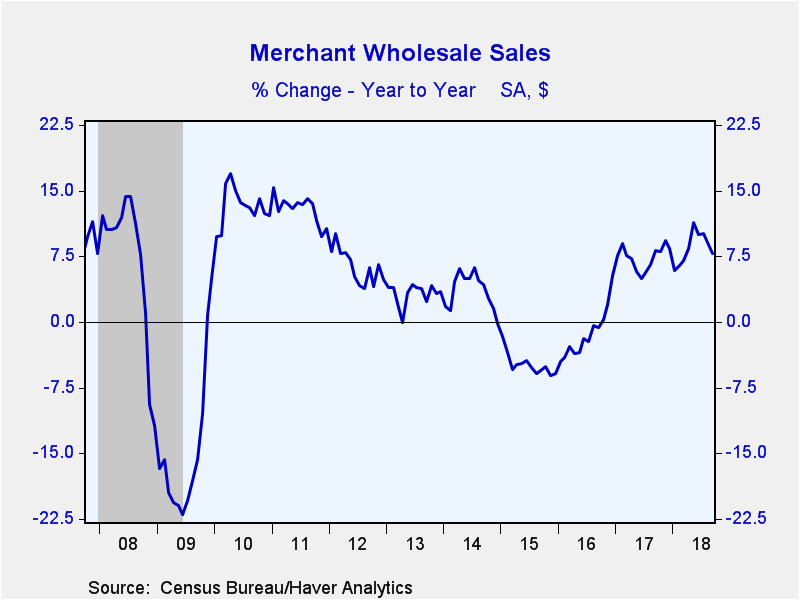

Wholesale sales increased 0.2% during September (7.8% y/y) after a 0.7% August rise, revised from 0.8%. The Action Economics Forecast Survey looked for a 0.4% m/m increase.

Sales of durable goods held steady (7.9% y/y) as computer equipment sales declined 4.2% (+1.5% y/y). This was countered by a 1.0% rise (16.8 y/y) in machinery purchases. Sales of furniture eased 0.3% (4.2% y/y), but hardware sales rose 2.1% (6.1% y/y). Automotive sales fell 0.6% (+4.0% y/y). Nondurable goods purchases gained 0.3% (7.7% y/y). Petroleum sales increased 2.4% (24.5% y/y) and chemical sales rose 1.7% (9.7% y/y). Apparel sales declined 2.3% (-6.6% y/y).

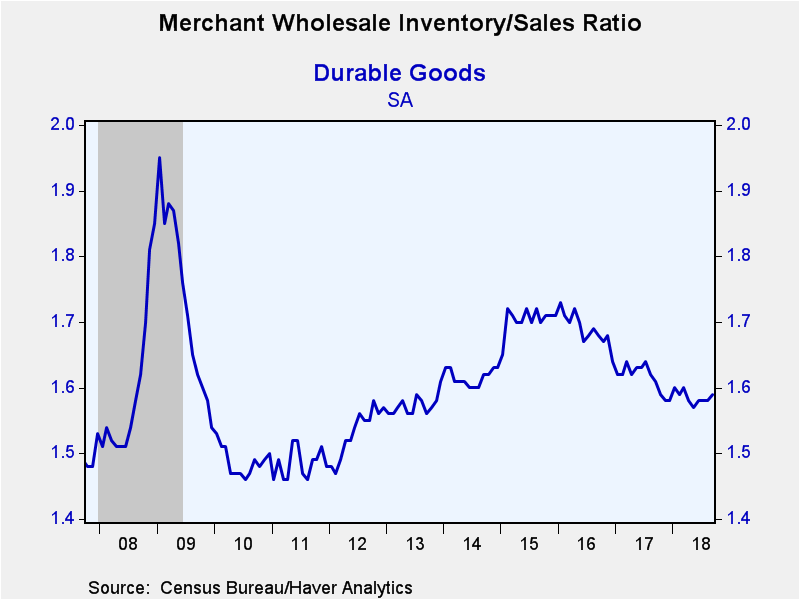

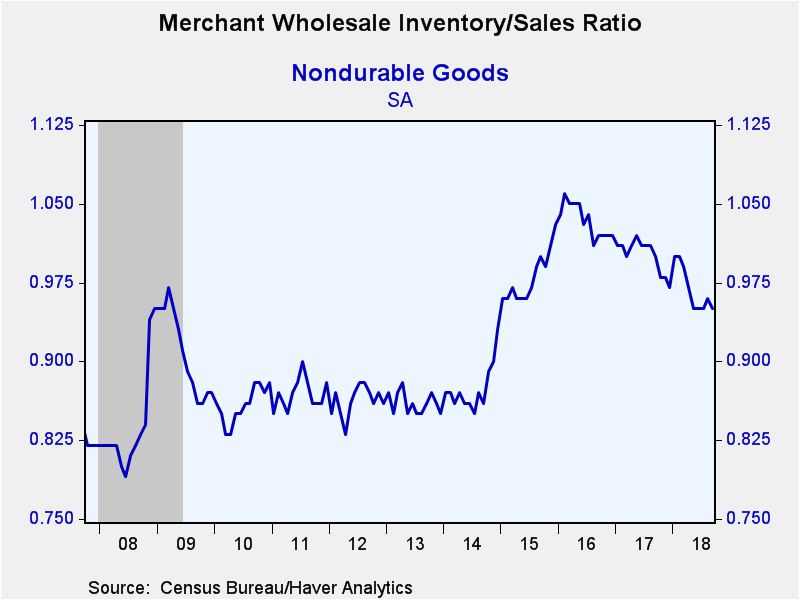

The inventory-to-sales (I/S) ratio at the wholesale level held steady m/m at 1.26 for the third straight month. This remained the second lowest reading since December 2014.

The I/S ratio for durable goods rose slightly to 1.59 after three months at 1.58. The machinery sector's ratio slipped to 2.52. The furniture sector's I/S ratio held at 1.81 while auto's ratio rose to 1.60. The nondurable goods I/S ratio slipped to 0.95 as the apparel ratio increased to 2.18. The paper products ratio slipped to 1.24 and the petroleum sector's ratio was steady at 0.38. The grocery product I/S ratio improved to 1.71.

The wholesale trade figures are available in Haver's USECON database. The expectations figure for inventories is contained in the MMSAMER database. Expectations for sales are in the AS1REPNA database.

| Wholesale Sector - NAICS Classification (%) | Sep | Aug | Jul | Sep Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Inventories | 0.4 | 0.9 | 0.6 | 5.2 | 3.6 | 2.2 | 1.3 |

| Sales | 0.2 | 0.7 | 0.2 | 7.8 | 7.4 | -1.3 | -4.9 |

| I/S Ratio | 1.26 | 1.26 | 1.26 | 1.29 (Sep. '17) | 1.30 | 1.35 | 1.33 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.