Global| Aug 17 2017

Global| Aug 17 2017Widespread Gain for U.S. Leading Economic Indicators in July

by:Sandy Batten

|in:Economy in Brief

Summary

The Conference Board's Composite Index of Leading Economic Indicators increased 0.3% m/m (3.9% y/y) in July following an unrevised 0.6% m/m rise in June. A 0.3% monthly rise had been expected in the Action Economics Forecast Survey. [...]

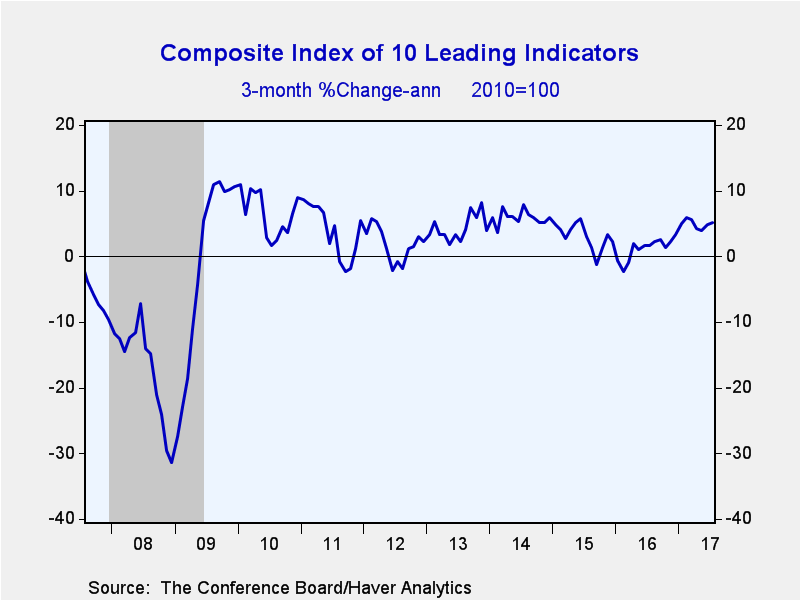

The Conference Board's Composite Index of Leading Economic Indicators increased 0.3% m/m (3.9% y/y) in July following an unrevised 0.6% m/m rise in June. A 0.3% monthly rise had been expected in the Action Economics Forecast Survey. Three-month growth increased to 5.1% (AR) versus 4.8% in June, pointing to improvements in economic activity in the second half of this year.

Eight of the ten component series contributed positively to the leading index in July. Building permits subtracted meaningfully while the average workweek was neutral. The remaining made positive contributions: weekly unemployment claims, new orders for consumer goods, nondefense capital goods orders, ISM new orders index, equity prices, the leading credit index, the interest rate spread, and consumer expectations.

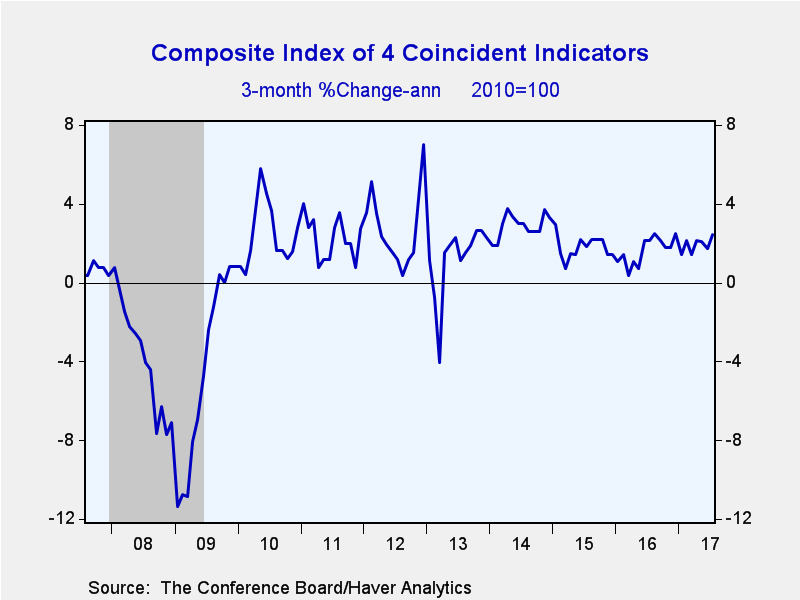

The Index of Coincident Economic Indicators also rose 0.3% m/m (1.9% y/y) in July following a downwardly revised 0.1% m/m gain in June. The July rise strengthened this index's three-month growth to 2.5% (AR), its best since December 2016. Each of the component series contributed positively to the latest increase, including payroll employment, real personal income less transfers, industrial production, and manufacturing and trade sales.

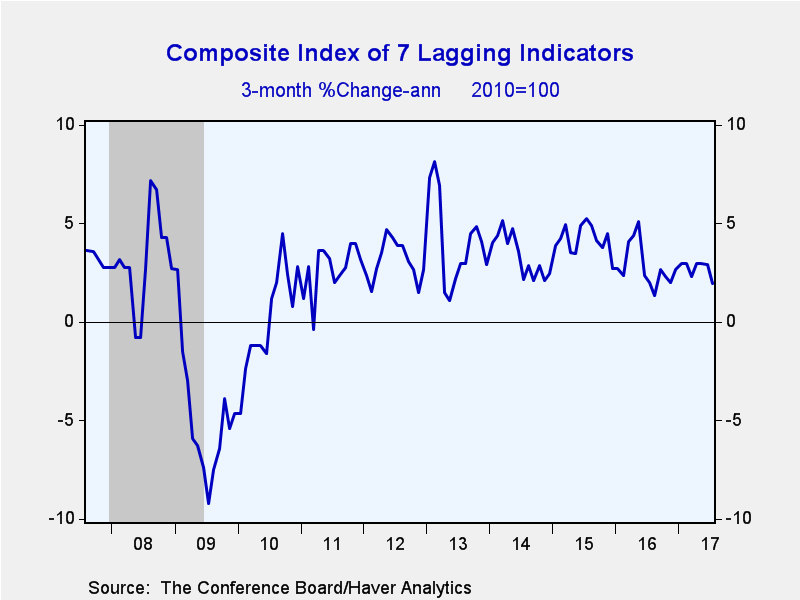

The Index of Lagging Economic Indicators edged up 0.1% m/m (2.5% y/y) in July after an unrevised 0.2% m/m rise in June. Three-month growth slowed to 1.9% (AR) from 2.9%. Three of the index's seven components made positive contributions in July (prime rate, commercial and industrial loans, ratio of consumer credit to income), three subtracted (duration of unemployment, unit labor costs, services CPI), and one was neutral (ratio of manufacturing inventories to sales).

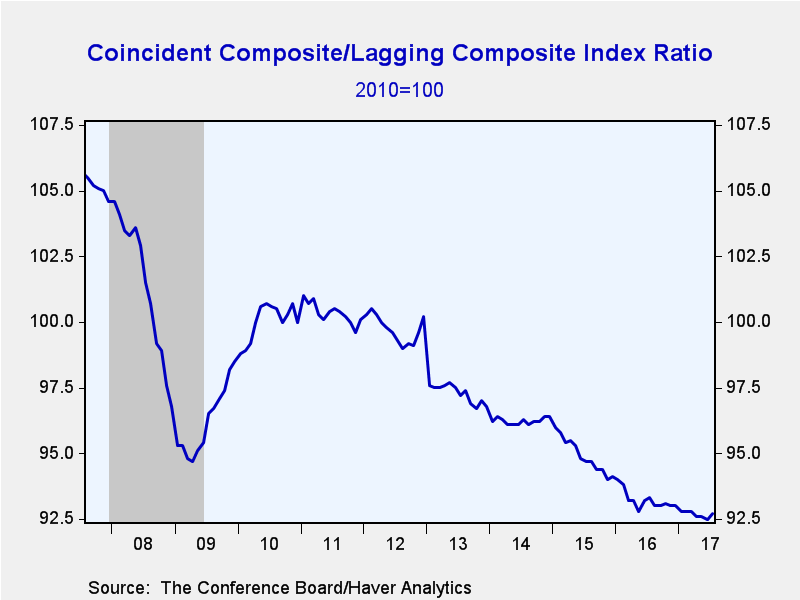

The ratio of coincident to lagging indicators is often considered to be a leading indicator of economic activity. If an economy is slowing, its lagging performance will be better than its current performance. This ratio edged up in July, but has generally declined over the past several years--running counter to the upbeat message from the index of leading indicators.

The Conference Board figures are available in Haver's BCI database; the components are available there, and most are also in USECON. The expectations are in the AS1REPNA database. Visit the Conference Board's site for coverage of leading indicator series from around the world.

| Business Cycle Indicators (%) | Jul | Jun | May | Jul Y/Y | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Leading | 0.3 | 0.6 | 0.3 | 3.9 | 1.2 | 4.4 | 5.6 |

| Coincident | 0.3 | 0.1 | 0.3 | 1.9 | 1.6 | 2.3 | 2.5 |

| Lagging | 0.1 | 0.2 | 0.2 | 2.5 | 3.4 | 3.7 | 3.6 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.