Global| Aug 29 2007

Global| Aug 29 2007World Liquidity

Summary

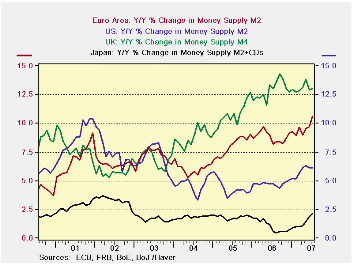

A look at global money and credit trends should be somewhat reassuring to those worried about the recent stock market downturn. Evidence shows that year/year money growth in countries/regions all around the globe had been quite [...]

In the UK M4 growth has hovered at a 13% pace.

In the Euro area money supply has accelerated to over 11%.

In Japan money growth edged higher to 2.5%.

In the US growth had flattened at 6%.

Among major countries only the US shows a clear pattern of sequential growth rates becoming weaker (significantly weaker at that) as the pace of growth stepped down in its rate steadily from 3 years to 2 years, and from that to one year, then to six months and then to three months - with the three-month pace at just 3.6%. That is too low to fuel what has been strong nominal GDP growth in Q2 in the US (these figures are all through July 2007). But money generally acts with a lag on the real sector so it’s hard to blame the market problems on a slowing in money growth that occurs only in the US.

In the Euro area in particular, credit to residents and loan growth have remained strong and along with money (M2) have slightly accelerated through July despite some tepid steps by the ECB to hike rates.

On balance, there is no sense of there being deficient liquidity among this grouping of major global money centers. The liquidity problems markets now face are all of their own making, not due to the actions of the central banks.

The lesser ease of transactability is a function of the uncertainty over the value of some key assets in this system - that is far different from it being a quantity problem. There is no quantity problem. What there is, is a quality and an informational problem.

Until there is a way to clearly identify the troubled assets and to establish within reasonable grounds their true market value, markets and certain asset classes in particular – as well those who own them - will continue to suffer this liquidity problem of their own making. It’s a micro- not a macro-liquidity problem. Don’t blame the central banks.

Central banks rightly worry about the other sort of liquidity problem right now - have they made too much? The levels of the growth rates in the table below sure argue for the answer ‘yes’ to that question everywhere but in Japan – there, of course, there are special things in play. Unfortunately this is the wrong time for central banks to be taking up this fight.

Only the Fed seems to have taken action to date to squeeze some of the excess liquidity from the market. And with that, markets now are begging for the Fed to re-inject what it has taken out (or, more correctly, slowed down its injecting).

It’s a curious time for markets and central bankers alike.

| SAARl | Euro Measures (E13): Money & Credit | G-10 Major Markets: Money | ||||

| €-Supply M2 | Credit: Res | Loans | $US M2 | £UK M4 | ¥Japan M2+CDs | |

| 3-MO | 11.4% | 12.8% | 11.6% | 3.6% | 13.1% | 2.5% |

| 6-MO | 11.0% | 12.7% | 11.3% | 5.6% | 13.6% | 2.0% |

| 12-MO | 10.6% | 11.6% | 10.7% | 6.1% | 13.0% | 2.1% |

| 2Yr | 6.2% | 11.5% | 10.8% | 5.4% | 13.0% | 1.4% |

| 3Yr | 13.9% | 16.3% | 15.4% | 7.5% | 19.0% | 2.2% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates