Global| Feb 14 2017

Global| Feb 14 2017Zew Expectations Tail as EMU and German GDP Fail to Delight

Summary

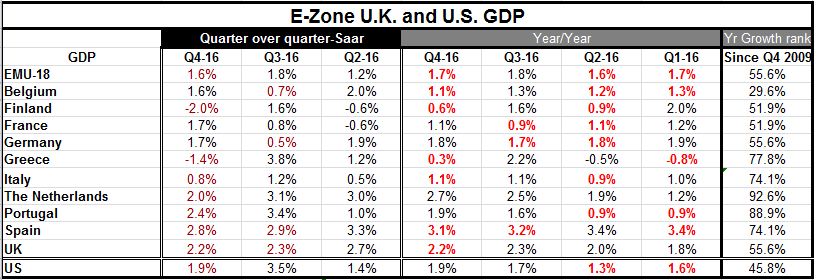

GDP in the EU economy was up at a 1.6% annualized rate in Q4 and up by 1.7% year-on-year. German GDP recovered after a weak Q3 to expand at a 1.7% annualized Q4 pace and is up by 1.8% over four-quarters. The top annualized Q4 growth [...]

GDP in the EU economy was up at a 1.6% annualized rate in Q4 and up by 1.7% year-on-year. German GDP recovered after a weak Q3 to expand at a 1.7% annualized Q4 pace and is up by 1.8% over four-quarters.

GDP in the EU economy was up at a 1.6% annualized rate in Q4 and up by 1.7% year-on-year. German GDP recovered after a weak Q3 to expand at a 1.7% annualized Q4 pace and is up by 1.8% over four-quarters.

The top annualized Q4 growth rates come from Spain (2.8%), Portugal (2.4%) the U.K (2.2%; still an EU member) and the Netherlands (2%). These are hardly eye-popping numbers. The US' Q4 growth rate compares at a 1.9% pace.

The weakest growth on the quarter is from Finland (-2%), Greece (-1.6%) and Italy (0.8%).

Over 12-months the best growth is from Spain (3.1%), The Netherlands (2.7%) and the U.K. (2.2%). The weakest year-on-year growth is in Greece (0.3%), Finland (0.6%) and Italy, Belgium and France (each at 1.1%).

Over the four quarters of 2016 EMU wide year-over-year growth has been very stable at growth rates of 1.6% to 1.8%. In the U.S. growth has crept slightly higher from 1.6% and 1.3% in the first two quarters of 2016 and at 1.7% in Q3 and at 1.9% Q4.

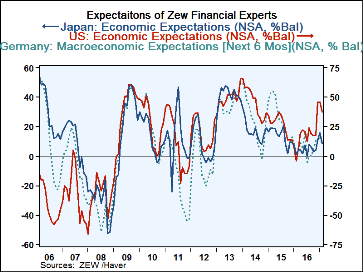

The German Zew index which has detail on the German economy and a breadth of responses for other countries delivered new readings. The German look-ahead expectations index took a surprising step back in February. The US expectations index also stepped back decisively. France and Japan also showed pullbacks while Italy's expectation reading eroded in February. These are bigger pullbacks than expected for the most part and come at a time that many other indices have actually been showing some sense of acceleration.

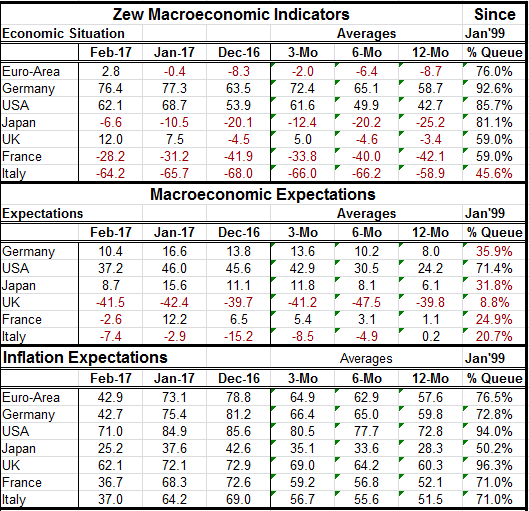

The current economic situation, however, mostly improved in February with the US and Germany as two exceptions each showing some step back in February from their respective January readings. Still, Germany and the US each have very high readings on an historic timeline back to January of 1999. The German current standing index is stronger less than 8% of the time but the EMU index is better only 16% of the time. France and Italy, the second and third largest economies, respectively, in EMU have current economic situations that are much more moderate with the French reading at its 59th percentile and Italy at its 45th percentile.

Expectations' standings are lower overall than current readings' standings. Despite the large step back in expectations for the US economy its 71st percentile standing is the best of the lot. In EMU Germany has the best ranking for expectations and that is only in its 35th percentile. The French and German percentiles are in the 20th percentile decile. Expectations on the U.K. have been weaker only about 8% of the time. Concerns over Brexit are not eroding.

Inflation expectations across this group all are above their middle (the 50 percentile level is the median for each). But all readings are lower than they were in January and in December even in the face of a continued rise in oil prices. The US has the highest inflation expectation with an index in its 94th percentile and an economy with a very low rate of unemployment. The UK reading's percentile standing is higher than the US standing on currency weakness. Germany, a country located in a currency bloc with a weak currency and a very low rate of unemployment does not have the same elevation in inflation expectations as the U.S. And the U.S. central bank is hiking rates while the ECB is still pedal to the metal easing.

The assessment of these economies is somewhat complicated with economic performance having improved overall but also having taken somewhat of a step backward or in terms of GDP, the Q4 pace has posted growth that was not quite as robust as expected. Growth continues and optimism is warranted but risks remain.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates