Global| Dec 14 2023

Global| Dec 14 2023Dropping Inflation Puts Central Banks in an Undesired Spotlight

All of the countries in this table have inflation targets of some sort set up at the 2% mark. While inflation rates clearly have worked lower, this has only come after an extended period of inflation having overshot in each of these countries. However, central banks have generally raised interest rates quite a lot and concerns have been raised globally about the potential for recession- the Bank of Japan has been the exception to these circumstances, having expended effort trying to recover from deflation and avoid a low inflation trap.

Something in the water?- I don't know if there is something in the water- which I should note would imply the oceans- or more properly the global aquifers as well as the impact of global rainfall (climate change at work?). Something has caused central banks to change their tune as central bankers, in this cycle, have clearly acted differently than in the past and have not aggressively gone out to contain inflation overshooting. Instead, central banks have been slow to act and tolerant of inflation over their respective targets. I'm not aware of global monetary conference that established that this was now the correct way to approach inflation in the new millennium. However, this is the situation that has simply developed and seemingly developed in each country on its own.

Fed policy puts Europe’s central bankers on the spot- Key central banking decisions have been made over the last several days with the Federal Reserve opting to not change policy but to provide statements about its intent in the future as well as a procedure known as forward guidance that is encompassed in a collection of forecasts that the Fed makes public four times a year in a presentation known as the Summary of Economic Projections (SEPs) or sometimes somewhat more colloquially called ‘the dots.’ With its new guidance, the Federal Reserve put markets on notice for a likely easier policy in the period ahead and this caused expectations to ramp up for the policy meetings today at the Bank of England and the European Central Bank. However, neither of these banks took the bait that the Fed went for. The ECB went out of its way to say there was a large distance between raising rates and cutting rates and that rate reductions were not even discussed at this meeting.

Central bankers’ dilemma- Central banks are in this somewhat curious position where inflation has fallen sharply. Although I've only presented year-over-year, three-month, and six-month calculations for some of the more ‘popular’ inflation measures, there is also core inflation, which is inflation excluding food and energy, and there are inflation calculations that make other exclusions that can cause the short-term inflation rate to look much lower. This fact has raised pressure on central banks particularly on the Fed in the U.S. to begin to consider an easier policy. The Federal Reserve, of course, is in a different position than these other central banks because while the Fed has an inflation target, it also has a dual mandate. The ECB, for example, has no such dilemma. It only has an inflation mandate to keep inflation at 2%.

Saying you do not believe in gravity does not allow you to escape its pull- While the Fed in the U.S. always says it doesn't react to political pressure, the Fed has been under tremendous political pressure especially by progressive Democrats to do nothing to cause the unemployment rate to rise despite the height of inflation that U.S. economy has been laboring under. In addition, the U.S. faces presidential elections within the next year and that's been a burden that the Fed has had to deal with. And it simply isn't possible to have been involved in policy economics in the United States to not think this has been a factor regardless of what Jerome Powell or anybody at the Fed says about making policy.

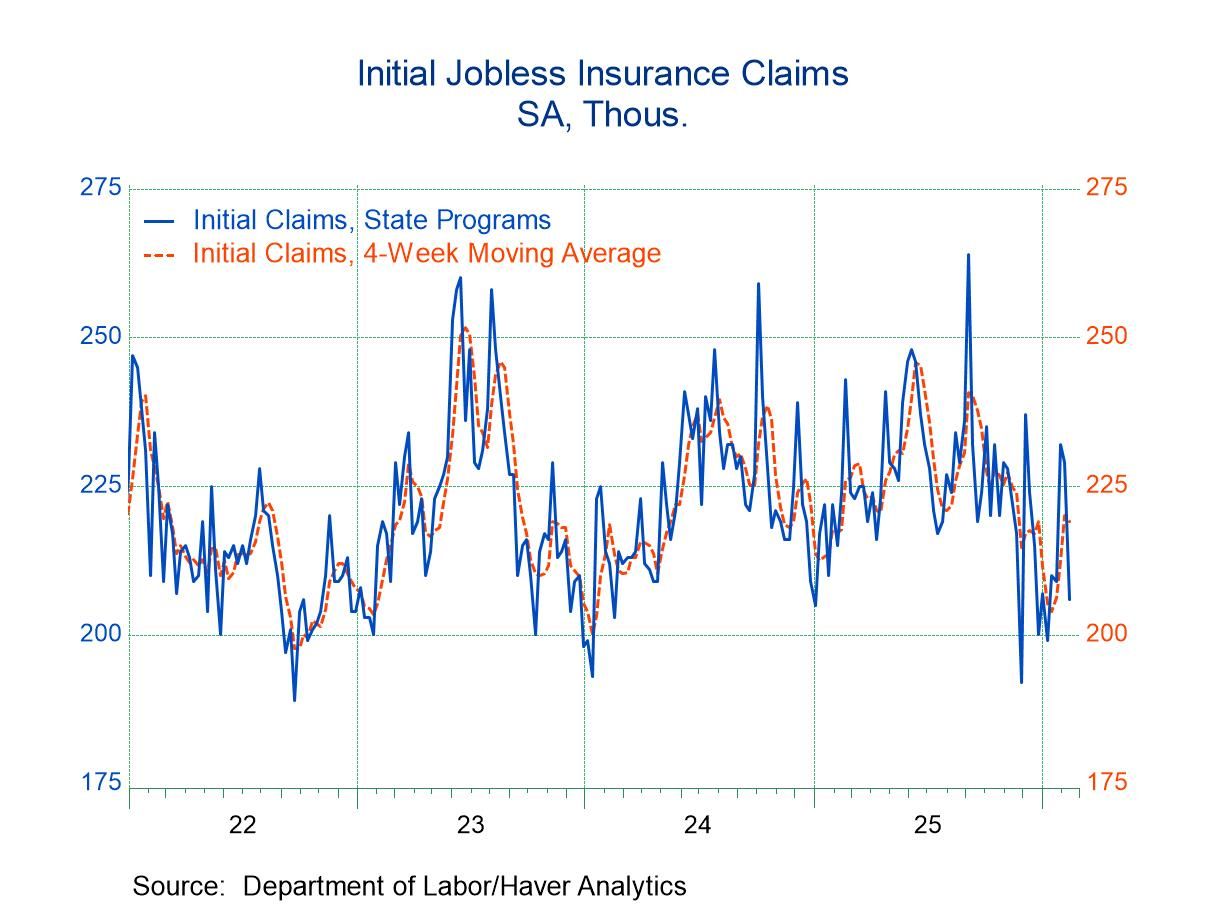

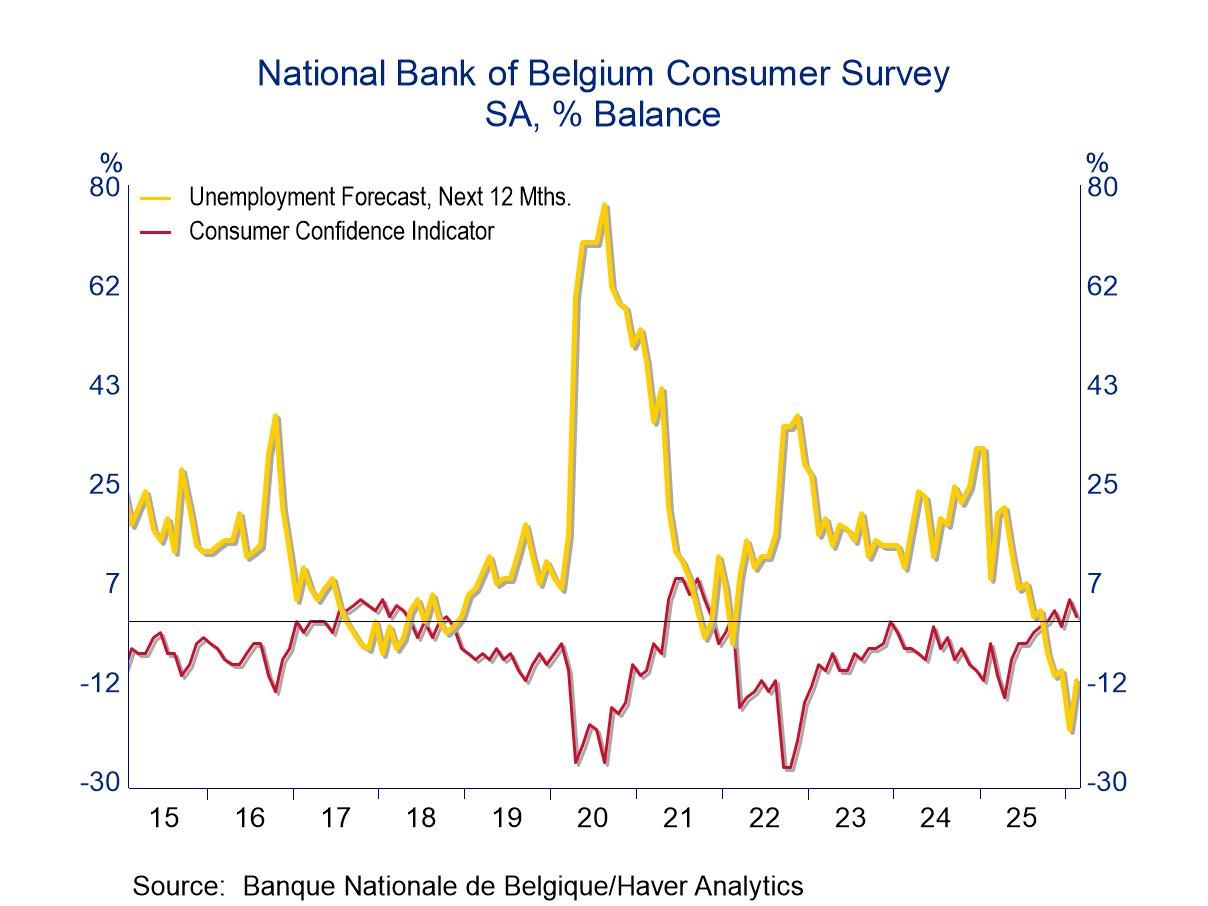

An uncomfortable reality- The situation all the central banks find themselves in is that inflation has been too high for too long. Year-over-year inflation is still too high, but over shorter periods inflation is running at a much lower pace and coming closer to their desired targets. And, of course, politicians in all countries whether they're running for office this year or not, want to keep the unemployment rates low as do other policymakers- hey it’s everyone’s objective, but within reason and context. Unemployment rates globally remain low; the European Monetary Union is experiencing among the lowest unemployment rates it has seen in its life; the U.S. unemployment rate is not far from the lowest it has experienced in the last 50 years; U.K. unemployment is not so well positioned. It may seem somewhat curious that in the case of the U.S. central bank that has a dual mandate it is protecting an unemployment rate near a 50-year low and tolerating an inflation rate that has had horrific overshoot that has been above its target for 34 months in a row -and may remain out of range for another 24 months – if you miss it for five year in a row, is it still relevant as a target? Still, we're supposed to believe that this set of decisions has occurred without any reference to politics.

Japan’s unique state- The Bank of Japan now faces the most consistent persisting inflation among this group of countries; however, it's in a different circumstance because prior to the impact of COVID and the global recession that resulted, it was chronically undershooting its inflation target and worried about that. In Japan, the concerns are rather opposite to those in the European Monetary Union, the U.K., and the U.S., as in Japan policymakers wonder if the increase in inflation is going to be permanent or not. Japan is still relatively more worried about a possible return to low inflation or even deflationary circumstances - although you can't see any evidence of that in the data presented in the table.

The growth backdrop- Monetary policy globally has entered a new phase. Central banks for the most part have their economies growing with low unemployment rates although in Europe -especially in Germany- growth has been a bit more touch and go. In the United States, third quarter growth was extremely robust although it is expected to slow in the fourth quarter. Growth in Japan remains positive but somewhat erratic, but the recent Tankan release was relative upbeat.

Five card monte? Looking back at monetary history here is what bothers me: Arthur F, Burns in the U.S. was Fed Chair in the 1970s and as a monetary expert would play ‘five card monte’ with the existing five U.S. monetary aggregates used to make policy at that time. Burns would jump from emphasizing one to another to justify the policy he wanted. At present, central bankers parse inflation into different gauges removing this or that and recalculating inflation, then looking at inflation over different time periods as well! There are now enough inflation gauges and time periods to confuse anyone and to make any point even though central bank targets are for one specific measure and for its year-on-year change. That reality no longer matters.

The way we were... There was a time that central bankers were focused on inflation and that was pretty much it. But these times no longer seem to be those times and it's becoming harder and harder to figure out what central banks are looking at to sort out their policy options. And the U.S. may face the strangest economic circumstances, because its unemployment rate is so extremely low by historic comparison and its inflation rate has been so high and overshot for so long and yet policy continues to focus on protecting this near 50-year low in the rate of unemployment. And with unemployment clinging to these low levels, the Fed apparently is already planning to cut interest rates and the Chairman has made it clear that he plans to cut interest rates before the inflation rate gets down to 2% even with unemployment near historic lows. What could possibly go wrong? I think we can look at the Fed’s dual mandates and clearly see which one of the mandates has won the duel. In Europe, policy seems to have returned to embrace the sanity of central bank responsibility. Japan is still finding its way. The U.K. is gaining control after a difficult period that is post-Brexit as well as post-Covid. Investors don’t care; they just love low rates…until they don’t.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.