U.S. Home Builders Sentiment Improves in December as Mortgage Rates Fall

by:Tom Moeller

|in:Economy in Brief

Summary

- Modest rebound recoups some of prior month’s decline.

- Prospective buyer traffic increases moderately.

- Improvement stretches across most regions of country.

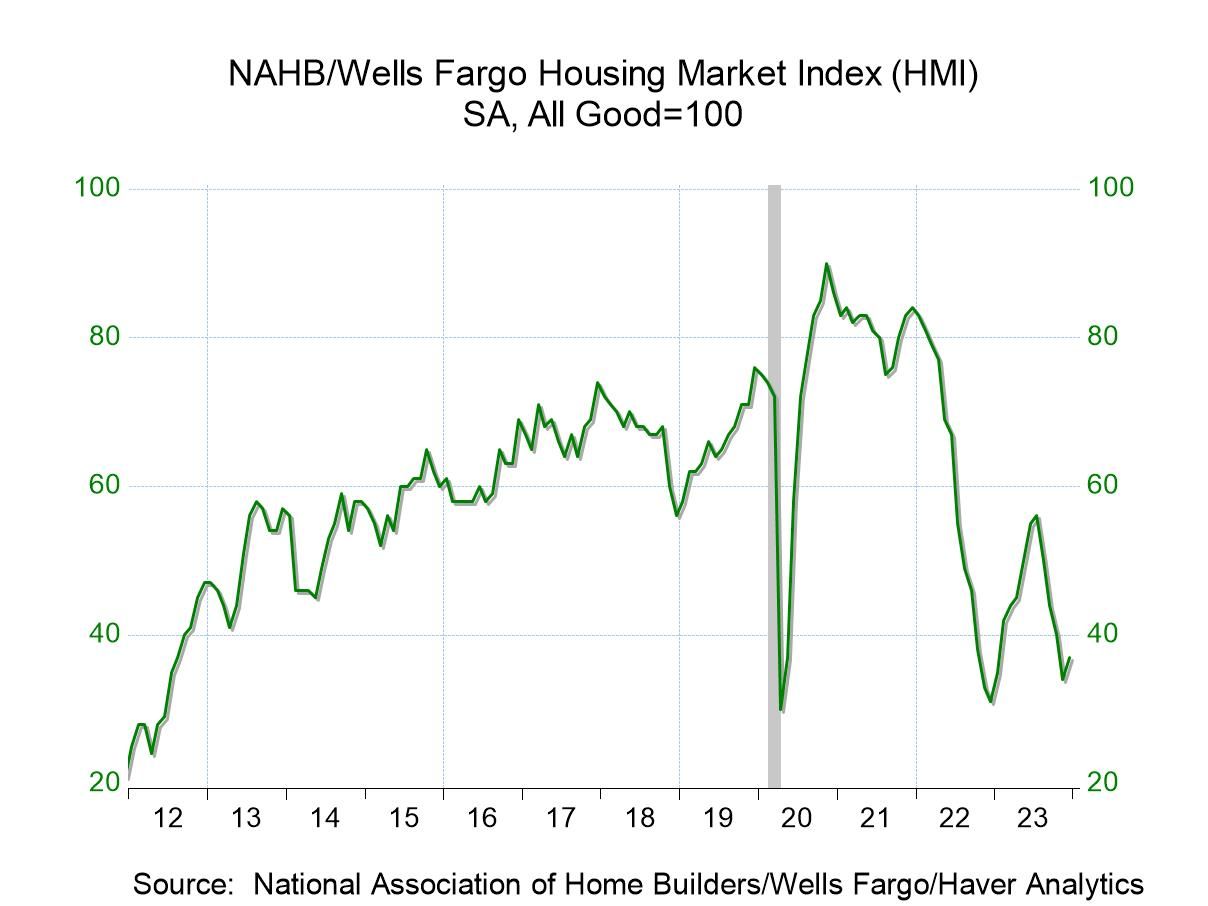

The Housing Market Index compiled by the National Association of Home Builders/Wells Fargo increased 8.8% (19.4% y/y) in December to 37 after falling 15.0% to an unrevised 34 during November. The increase followed four consecutive months of decline. Despite the recent improvement, the index remained below its recent peak of 56 in July. Looking back, the index peaked at 90 in November 2020.

The average rate on a 30-year fixed rate mortgage fell to 6.95% last week from a high of 7.79% in the last week of October, according to Freddie Mac.

Participants in this NAHB survey reported that their single-family sales measure held steady m/m at 40 this month, but has increased 11.1% y/y. December’s performance followed four straight months of decline. Prospective sales in six months figure rose 15.4% (28.6% y/y) to 45, its highest level in three months. The traffic of prospective buyers increased 14.3% (20.0% y/y) to 24 and recouped most of November’s 19.2% decline. The reading remained below the November 2020 high of 77.

Regionally, there was improvement in all but one region of the country. In the Northeast, the index rose 3.8% (71.9% y/y) to 55 following a 15.2% November gain. The index was above its low of 32 twelve months earlier. In other regions of the country, the index for the Midwest rose 12.9% (16.7% y/y) to 35 after falling 16.2% during November. In the South, the index rose 11.4% both month-to-month and year-to-year to 39, still well below the high of 90 in November 2020. The index held steady in the West at 28 (+12.0% y/y) after falling for four consecutive months.

The NAHB has compiled the Housing Market Index since 1985. It reflects survey questions which ask builders to rate sales and sales expectations as "good," "fair" or "poor" and traffic as "very high," "average" or "very low." The figures are diffusion indexes with values over 50 indicating a predominance of "good"/"very high" readings. In constructing the composite index, the weights assigned to the individual index components are: 0.5920 for single-family detached sales, present time, 0.1358 for single-family detached sales, next six months, and 0.2722 for traffic of prospective buyers. The regional indexes run back to December 2004.

These data are included in Haver's SURVEYS database.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates