U.S. Initial Unemployment Insurance Claims Steady at Prior Week’s Level

by:Tom Moeller

|in:Economy in Brief

Summary

- Claims remain at highest level since October 2021.

- Continuing claims drop, reversing most of prior week’s rise.

- Insured unemployment rate stays steady & low for 8th straight week.

Initial unemployment insurance claims at 264,000 held steady (21.2% y/y, NSA) in the week ended June 17 with the previous week, revised from 262,000 reported initially. Initial claims totaled 262,000 in the first week of June. These figures remined the highest level of claims since the week of October 30, 2021. The Action Economics Forecast Survey expected 257,000 initial claims in the latest week.

The four-week moving average of initial claims rose to 255,750 last week from 247,250 in the prior week. This was the highest level since the second week of November 2021.

The number of continued weeks claimed, or “insured unemployment,” was 1.759 million (30.3% y/y) in the week ended June 10, down from a little-revised 1.772 million in the prior week. The four-week moving average of continued weeks claimed declined to 1.770 million from 1.778 million in the prior week. The latest level remained the lowest since the second week of March.

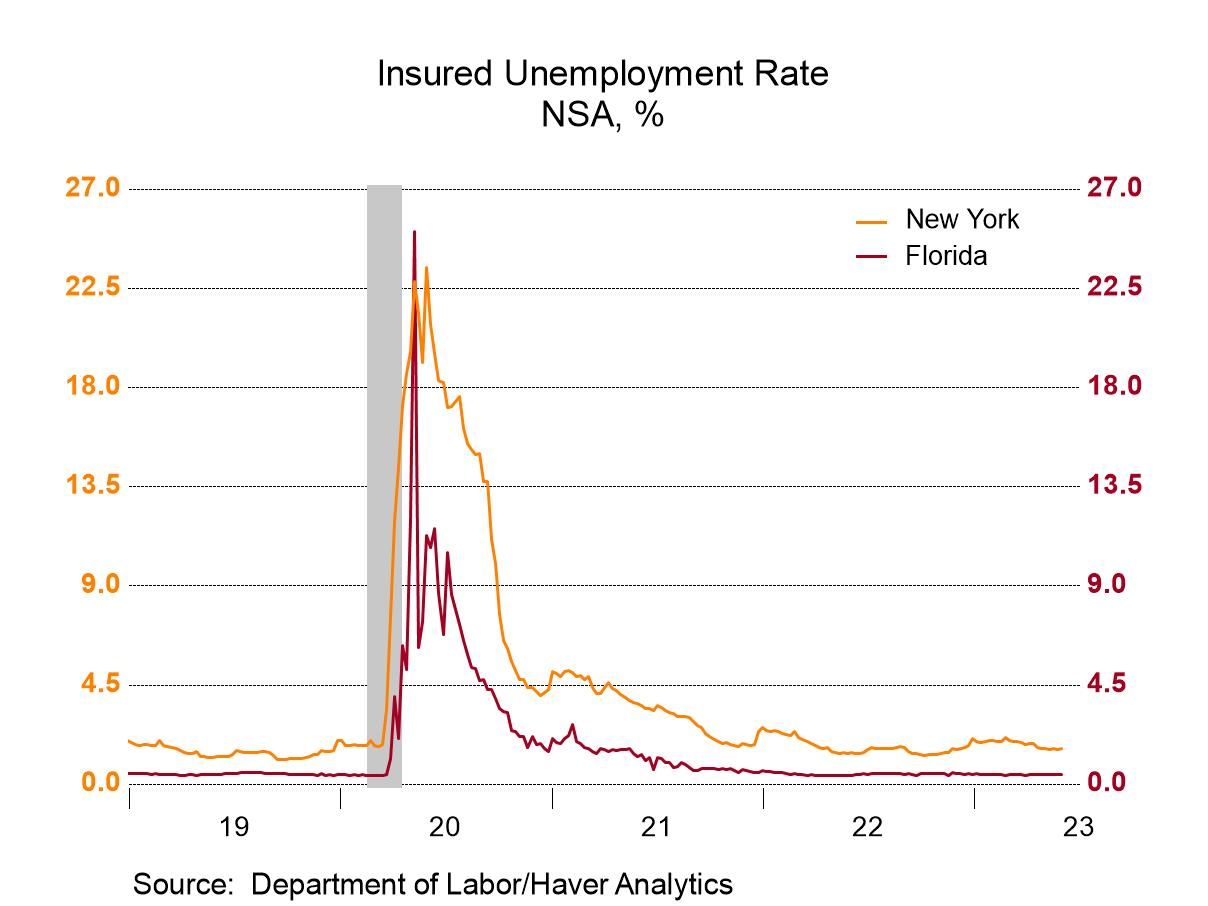

The insured unemployment rate, that is, continued claims as a percent of covered employment, held at 1.2% for the eighth consecutive week. This rate has been between 1.2% and 1.3% since late-January and compares with 0.9% in September and early-October of last year.

In the week ended June 3, the total number of continued weeks claimed for all unemployment insurance programs was 1.675 million (+29.2% y/y), the highest level in five weeks. The recent high was 2.000 million in late February. The total includes federal employees, newly discharged veterans, extended benefits and other specialized programs and is not seasonally adjusted. Claims in the Pandemic Unemployment Assistance program and Pandemic Emergency Unemployment Compensation are no longer included in the main Labor Department press release.

The insured rates of unemployment in regular programs vary widely across states. In the week ended June 3, the highest insured rates of unemployment were in California (2.29%), New Jersey (2.10%), Massachusetts (1.86%), New York (1.61%) and Oregon (1.57%). The lowest rates were in South Dakota (0.20%), Virginia (0.34%), North Dakota (0.35%), Kansas (0.37%) and New Hampshire (0.38%). Rates in other large states include Illinois (1.39%), Pennsylvania (1.36%), Texas (1.02%) and Florida (0.43%). These state data are not seasonally adjusted.

Data on weekly unemployment claims go back to 1967 and are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates