World Money Growth Is Back on Track...Is Inflation Too?

Money growth has turned positive and the main money center areas show net money growth. Money growth is at 1.9% year-over-year in the European Monetary Union, up by 2% in the U.S., up by 1.8% in the U.K., and by 1.3% in Japan. Comparing the 12-month growth rate to the three- and six-month growth rates in all these countries, we see a progression with money growth becoming stronger. The exception to this observation is Japan, where the M2 plus CDs measure grows 1.3% over 12 months and then reduces its pace over three and six months to 0.3% and 0.4% annualized.

In the European Monetary Union, credit growth is consistently positive and accelerating.

The monetary financial side of the ledger is starting to look very positive from the standpoint of creating growth, however, to the extent that it does that it is also being much less of a factor in terms of restraining inflation.

Real money balances Real money balances over 12 months are still declining in the EMU, in the U.S., in the U.K., and in Japan. However, the situation is in flux; over three months, real money balances are growing in the monetary union- and growing fairly strongly in the U.S.; it is advancing in the U.K. Over three months only Japan shows declines in real money balances.

EMU credit growth The European Monetary Union shows real credit growth contracting over 12 months but at growth rates of 1% or less. These negative growth rates are diminishing over three months. Credit to residents and private credit growth are declining at growth rates less than one-half of 1% as real credit in the monetary union begins to head for inflation-adjusted positive growth.

A tailwind for growth—at last? With these changes in the provision of liquidity and the impact on credit growth, nominal and real GDP growth are going to find more of a tailwind… and so will inflation…

The inflation worm is turning The overview for some of the key economic variables in these countries is in the table below. It shows inflation above target and all these major money centers to a greater or lesser extent. The table provides the headline inflation figures, although in most cases core inflation looks much higher than these since oil prices have been weak and falling. The bottom panel of the inflation chart shows changes in the year-over-year inflation rates over six months. There you can see the tendency for inflation to decline is diminishing. Japan is already looking at inflation increasing on balance in each of the last three months when we compare current year-over-year growth and inflation to its result six months ago.

Industry remains weak but that weakness may be transitioning Our statistics are such that we are inundated with data on the industrial side of the economy. The table presents data for industrial production growth year-over-year and on that we have a sea of red figures indicating declines across all these countries and areas for at least the last six months. However, the rate of decline in industrial production has been diminishing.

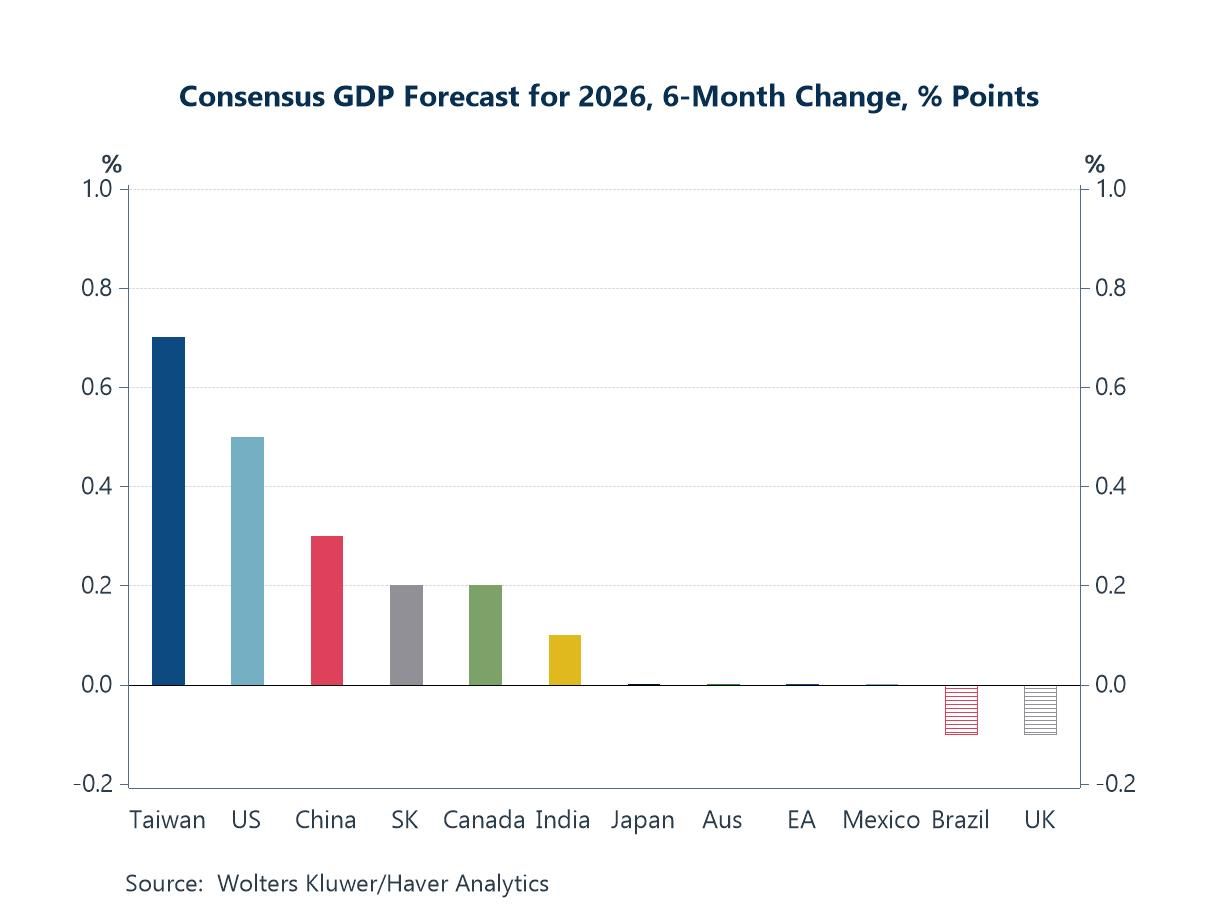

Changes in activity broadly The second lower panel looks at changes in composite PMI levels year-over-year. There, the story changes significantly, with year-over-year gains reported in the composite activity surveys. The EMU, the U.K., and Japan show increases. The U.S. is the outlier with weaker PMI values compared to a year ago-and in each of the last three months. However, these indicators aren't always the final word. All these countries and areas are continuing to show GDP growth. In the U.S., a popular statistic for tracking GDP known as GDP-Now updated by the Atlanta Fed has been consistently looking for a third quarter growth in the U.S. to be between 2.5% and 3%. That's not too shabby despite the U.S. PMI signals.

Are the easing campaigns still in force? Meanwhile, central banks have been on easing campaigns but have backed off or slowed the progress of these campaigns as the progress on inflation has slowed as the table above suggests. In the U.S., at least, job growth has come back strongly after a period of some weakness and some downward revisions to past growth rates. In Europe, unemployment rates are still broadly low and for the EMU as a unit, the rate is at an all-time low. Right now, central bankers in the U.S. aren't quite sure what to do with the most recent strong U.S. job growth report and the recent inflation report that has shown more strength than what the Fed had been expecting. Globally the move to less inflation progress is clear in this table and the notion that progress may stay slow, or stop is embedded in the trends for money growth and credit growth in the monetary union.

Is the inflation turn decisive; will central bank policy change soon? All of this raises questions about what happens next and whether this period of inflation deceleration has been brought to an end as money growth turns positive, accelerates, and as real money balances and real credit balances begin to advance. A simple tracking of the inflation data is enough to give inflation-fearing central banker pause. Policy needs are rarely clear cut with unanimous support. U.S. leadership in monetary policy could become more important going forward since the Federal Reserve has just embarked on an easing campaign and launched it with a large rate reduction and - not exactly promises - but with very strong hints of many more cuts to come soon. However, economic data seem to be painting a different picture of the future than the one the Fed expected. Could the Fed easing program start and finish at the same time? That is unlikely but the exuberant expectation for rate cuts will be trimmed. One thing to be aware of is the massive increase in expectations for 5-year ahead and the rise in the expectations for one-year ahead inflation in the U. of Michigan inflation survey. The median rate in that survey (that the Fed prefers) is steady at 3% but the survey mean has shot up over 7% for five-year ahead inflation in the wake of the large Fed rate cut- something I do not think the Fed can continue to ignore.

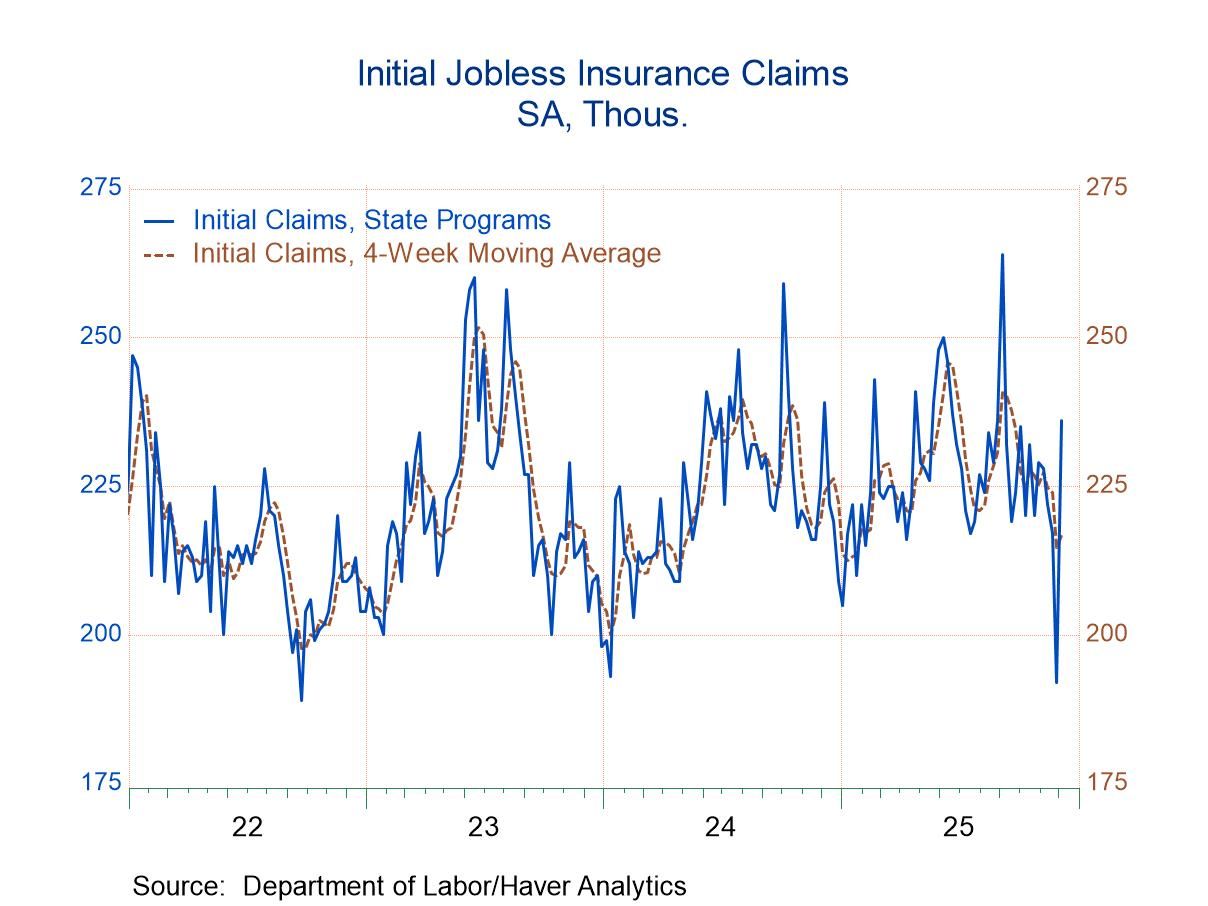

A very muddled outlook It may be that some of the weaknesses that the Fed thought it saw in economic and job growth was created by hurricane Beryl that hit Houston, Texas. This is significant because the U.S. is currently being blasted by or is cleaning up after two hurricanes: Hurricane Helene and Hurricane Milton. Helene, swept through North Carolina and has done terrible damage and raised a significant death toll. Milton is currently sweeping through Florida; it ripped the roof off the football stadium in Tampa, Florida and it is creating havoc on its own. These hurricanes are going to affect economic data; they're going to affect jobless claims data (already have), job growth data, and they may affect wage and price data as well. This will leave the Federal Reserve with some quandary about what to do with policy. I think it's fair to say in this environment where the Fed has had a bias to cut rates, it gives the Fed a freer hand to ignore economic data that might be strong or on the other hand to embrace weak economic data that are weak even if the reports come out of the distortion of a hurricane. U.S. data may be stepping into a data Twilight Zone; be on guard!

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

Global

Global