Global| Mar 18 2025

Global| Mar 18 2025ZEW Experts See German Outlook JUMP and U.S. Outlook TANK!

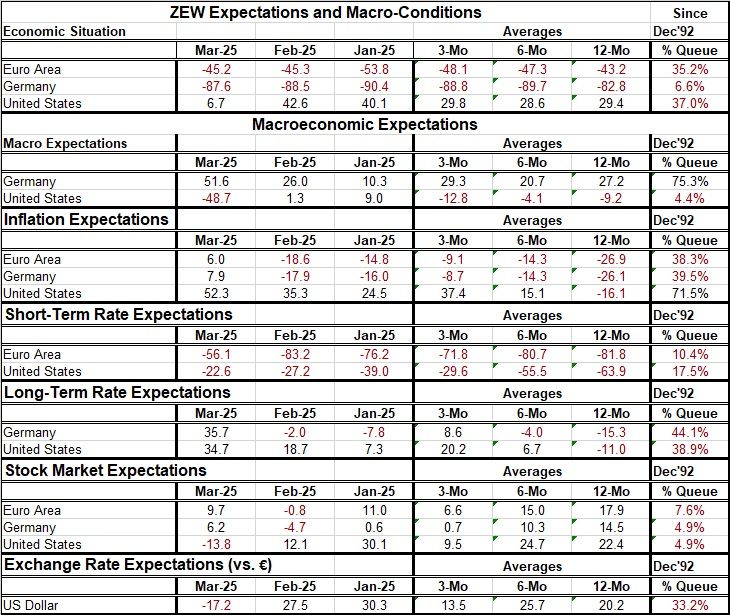

WOW! What a chart!! Enter the Post-War age of the rediscovery of geopolitics Press reports this morning are all over the new ZEW release that shows that macroeconomic expectations for Germany have jumped sharply to a level of 51.6 in March from 26.0 in February. This, of course, is being heralded as a result of the great German turnaround and Germany discovering that it really needs to provide for its own security rather than to spend its money paying down its debt and letting the U.S. provide its protective defense umbrella. A real epiphany… After years of turning down U.S. entreaties to be more careful with its security that started with Barack Obama and went on to Donald Trump, Germany refused to spend more money in NATO and brushed off Trump's concerns about being linked to Russia through a pipeline. It basically did just about whatever it could to cause Russia to think that the Germans no longer had any interest in NATO which played a part and fueling Russian boldness and its attack of Ukraine. Russia thought Germany would leave NATO to preserve its economic ties to Russia! Wrong. But a war’s start often is based on poor assumptions or hidden factors. Had Germany wanted to spend the least it could on the military, it should have listened to Barack and to Trump. However, it didn't, and so now we have this huge military buildup that is really pushing macroeconomic expectations ahead in Germany. While we can argue about military spending and whether it's good or bad, right now, it's providing the stimulus that Germany and Europe need to jumpstart their economy out of this long period of weakness that stemmed from COVID, its aftermath, and from of the Ukraine invasion by Russia.

Dramatic shifts However, the part of this new survey that is not getting as much attention is that U.S. macroeconomic expectations that were +1.3 in February have dropped to -48.7 in March, a massive drop in one month; the ranking or queue standing of the U.S. macro-expectations in March is at a 4.4 percentile mark which means that since the early 1990s that has been weaker than this only 4% of the time. In contrast, the jump in German expectations have boosted German expectations up to the 75th percentile of their ranking over the same period. The economic situation in March, which is less malleable because it's tethered to what's happening ‘on the ground’ says the euro area is roughly unchanged at a ratio of -45.2. Germany’s situation is also roughly unchanged, slightly improved, at a level of -87.6; but the U.S. current index drops sharply to +6.7 in March from +42.6 in February, down to a 37-percentile standing. I frankly wonder if it's possible for current conditions - actual current conditions - apart from expectations, to deteriorate that sharply in one month but that's the result we have here to report.

Stunning developments On dating back to early 1992, U.S. current conditions have fallen (experienced a deterioration) month-to-month more than they have in March 2025 on only four other occasions and those were generally in the middle of either COVID or a sharp stock market sell off or some clear precipitating event. In this case, I suppose we would say it's the fear of Donald Trump, his geopolitical stance, his government overhaul, and tariffs are driving these changes. Macroeconomic expectations in the United States have deteriorated month-to-month more than this only once, and in Germany macroeconomic expectations have improved more sharply than they have in March only five other occasions in the past. This report from ZEW is a watershed report; it's fair to say we've never seen anything like it in the past because not only are these statistically highly unusual moves, but it is unprecedented to see the U.S. and the German macroeconomic expectations move so sharply in one month in completely different directions. This result is simply stunning.

The nail in coffin of deflation In the wake of these findings, it's not surprising to see that inflation expectations have jumped in the euro area from -18.6 in February to +6 in March. In Germany, they've jumped from -17.9 in February to +7.9 in March while in the U.S. they have jumped from 35.3 to 52.3. The queue standings now for inflation expectations are in the 38.3 percentile for the euro area (since the early 1990s), in the 39.5 percentile for Germany, and in the 71.5 percentile for the U.S. Quite apparently the period where we will worry about deflation and the zero bound, and all of those things is over, and we are back to worrying about inflation...hello darkness my old friend...

"Reports of my death have been exaggerated" – Inflation

No more low rates, well… except for central banks? Short-term interest rate expectations continue to bear negative signs for some strange reason in the wake of all of these concerns that have inflation flaring but concerns about growth rising. And the euro area’s February's -83.2 reading becomes -56.1 in March; the U.S. February reading of -27.2 becomes -22.6 in March. Short-term rates are still seen as dropping but not with as much certainty as previously. The euro area figure has a 10.4 percentile queue standing; the U.S. figure has a 17.5 percentile standing. These are still low enough results that tell us that rate expectations are tilted toward rate cuts not toward rate increases. This tells us that there is still a lot more concern about macroeconomic growth than about the rise of inflation. We’ll see. Central banks have been locked into that view for a long time as they are still cutting rates with inflation above their targets.

Long-rate expectation are higher- Long-term rate expectations in Germany have moved from -2 in February to +35.7 in March; the U.S. February reading of +18.7 has moved up to +34.7 in March. The German figure has a ranking at its 44th percentile; in the U.S. the ranking is essentially at its 39th percentile. Those are relatively similar standings and even though they show a significant change compared to a month ago, long-term rate expectations are still below a ranking of ‘50’ which leaves them below their historic median.

Taking stock... The euro area stock market reading moved up to 9.7 in March from -0.8 in February. For Germany, the March reading moved up to 6.2 from -4.7 in February. The U.S. is the lone voice of deterioration where the February reading of 12.1 has turned into a March reading of -13.8. However, all of the stock market rankings remain relatively weak. The euro area ranking is at its 7.6 percentile, the German ranking at its 4.9 percentile, the same as in the U.S. While the ZEW experts are not willing to look for substantial decrements in stock market values from current levels, they're still keeping their assessments near the low end of what they have been historically.

The Dollar As for the dollar, the expectation for the dollar -which had been at 27.5 in February- has fallen to -17.2 in March. We'll see if that kind of decrement in dollar value is played out in the future.

Summing up It appears that we are living in interesting times. If Time magazine is true to its moniker in naming the person of the year the person who affects events the most, based on how this year is developing Donald Trump will be the man of the year in 2025…because I can't imagine anybody affecting economic or global events any more than Trump has in the early months of 2025. It’s only mid-March! Long ago the Time magazine dropped the requirement that ‘the person of the year’ had to do something good. They just had to do something that influenced events the most. That appears to be where Donald Trump is right now; global events have been turned upside down. Will things calm, will the world make peace with Trump (and vice-versa), or will this continue to be a year of tumult?

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.