In January, we see an uptick in the EU Commission indexes that chronicle conditions in the European Monetary Union. The overall index is up smartly to 99.4 in January from 97.2 in December with improvement in four of the five subindexes with construction being unchanged month-to-month and for three months in a row; construction is also the strongest sector among the five by a long shot. The top line EMU reading was last this strong in January 2023, two years ago, on an isolated reading. It was last stronger for a string of period March 2021 through February 2022, in the heat of the post-Covid revival, averaging 111.6 on that span and reaching a monthly value as high as 119.9.

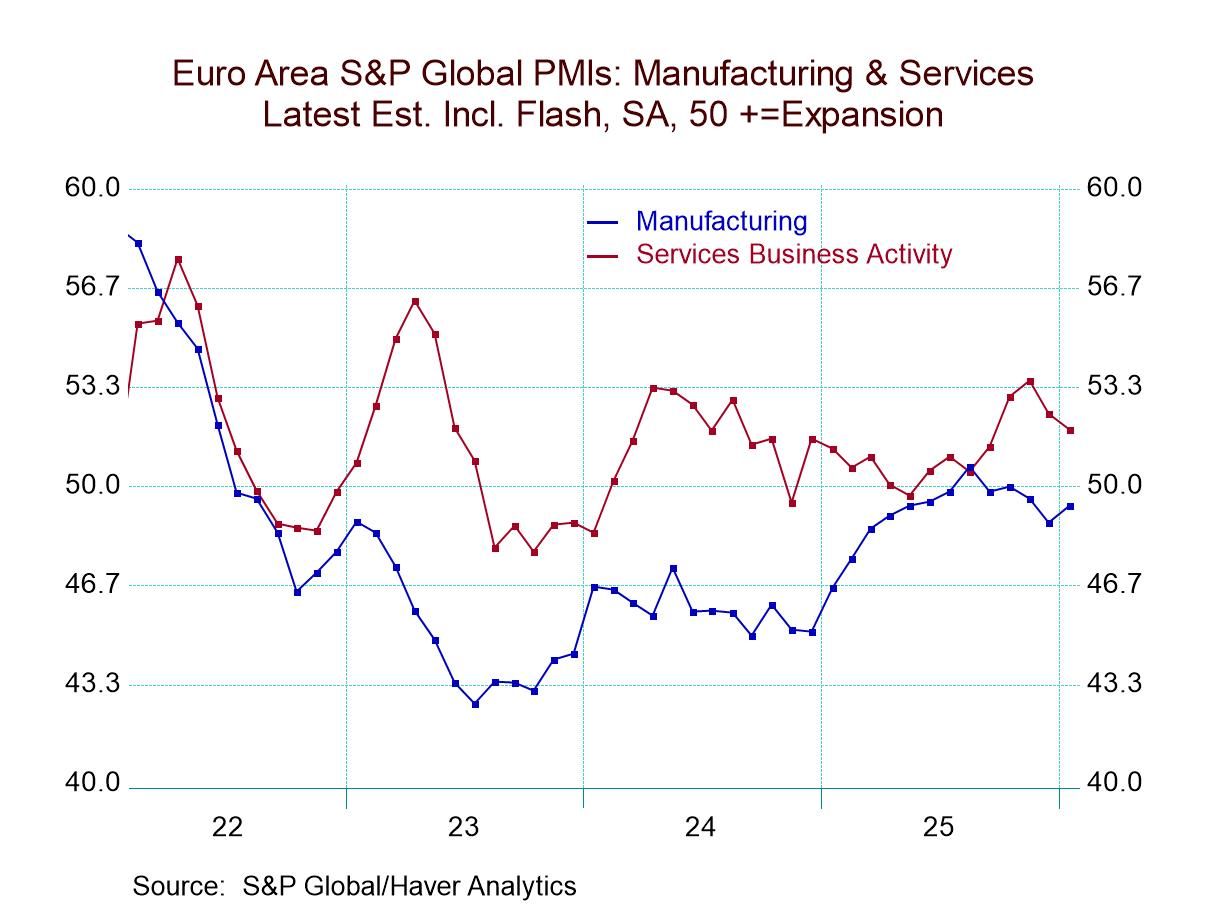

Rank standings rise and firm The overall EU Commission index has the queue percentile standing at its 46.7 percentile, very close to the 50% mark that establishes the median for the series among the five components. Retailing and construction are both above their respective 50% marks, with retailing at a 56-percentile standing and construction at an 81.9 percentile standing. The weakest reading is on consumer confidence at a 26.6 percentile standing, while services have a 43.5 percentile standing with the industrial sector at a 43.4 percentile standing. Both the services and industrial readings are climbing up closer to their respective medians but not quite there yet.

Largest economies show the clearest turns All four of the largest economies showed monthly increases in January with the largest increase a 6.1% month-to-month increase by France; the smallest was a 1.3% increase by Italy. While that's good news, it's also true that all four of those readings had declined in December compared to November. For the rest of the countries of the Monetary Union, eight of those 14 countries experienced month-to-month setbacks to their overall confidence readings in January, but only 3 of those 14 countries had experienced contractions in December and only 3 of them had experienced contractions in November; and, in November, only one of the four largest economies had experienced contraction.

Generally, positive developments are afoot Generally speaking, the trends are moving in a positive direction despite monthly volatility across the 18 early reporting countries; 9 of them show queue percentile standings above the 50th percentile, 2 of those are among the four largest economies, Italy and Spain. Quite clearly conditions within the monetary union remain mixed but the upward momentum and recent improvement is unmistakable.

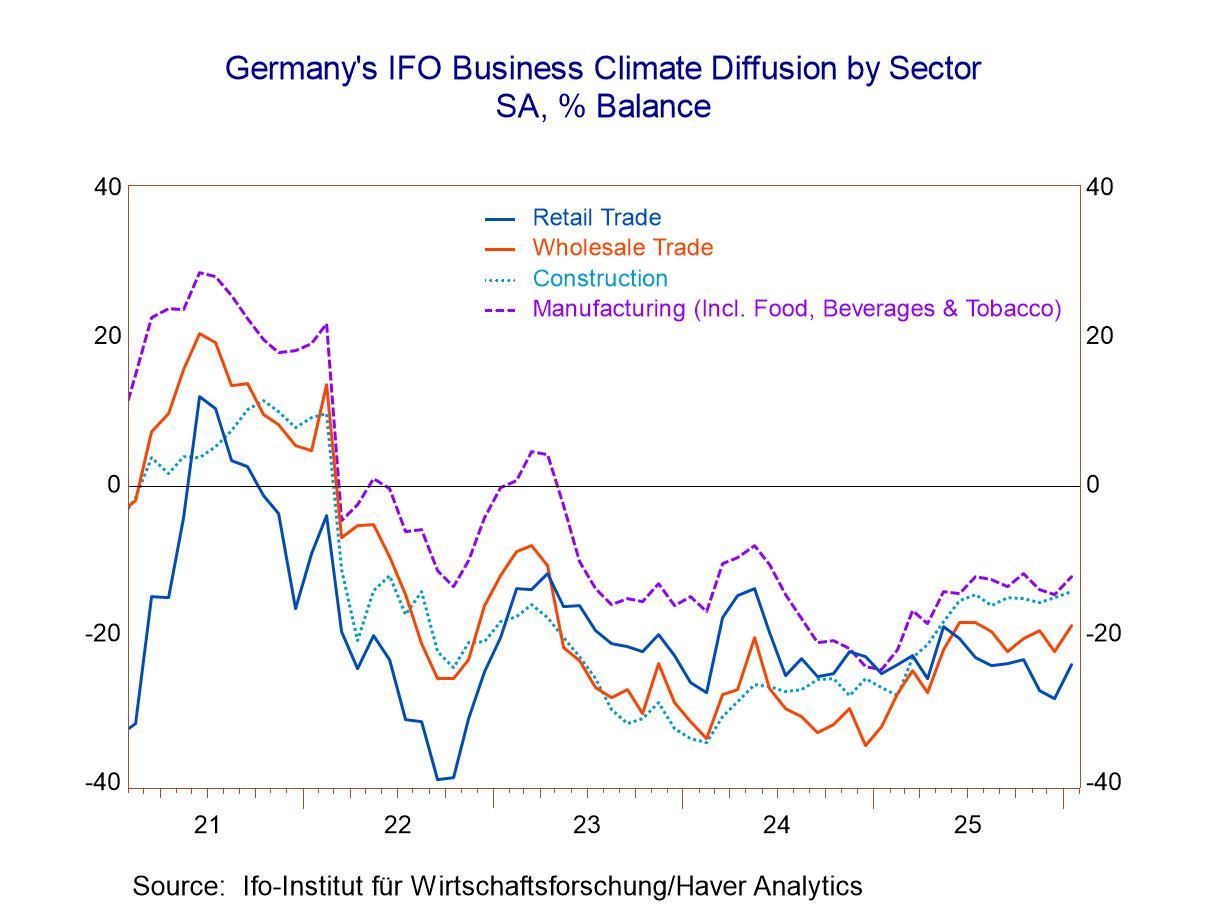

Sector performance in largest EMU economies Among the four largest economies, the industrial sector has an above 50 percentile ranking in France and in Spain. Germany, and Italy are lagging behind. Construction has above 50-percentile standing in each of the four largest economies except France where its percentile standing is in its 42nd percentile. Spain does not report consumer confidence, retailing, and services numbers separately. Among the remaining big three countries, only Italy has readings above its 50-percentile mark and those are only in retailing and services. Consumer confidence continues to lag everywhere with the highest assessment among the BIG-4 economies in Germany with the 45.8 percentile standing and the lowest in France at a 20.4 percentile standing.

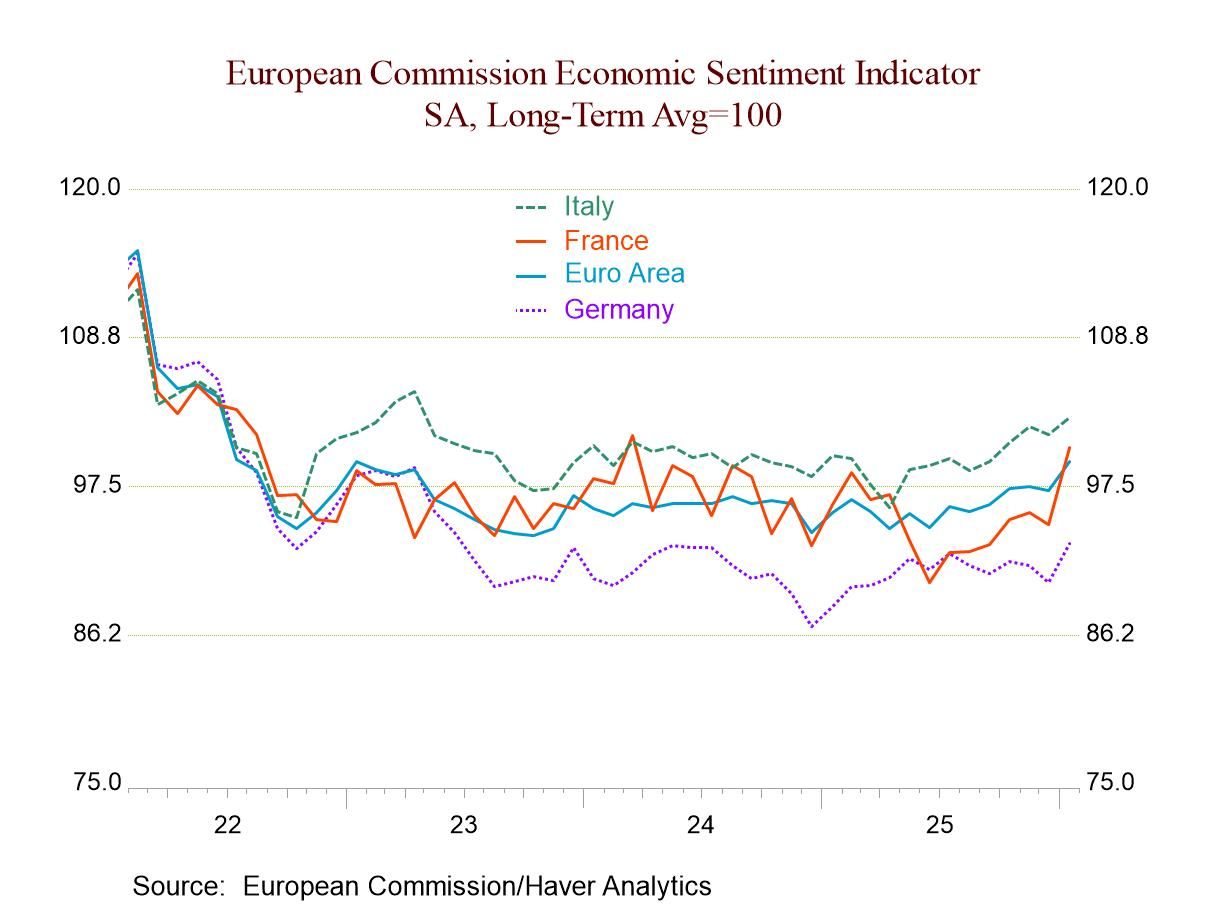

Tracking improvement The chart at the top shows that in broad terms we can see the improvement is relatively long lived for the BIG-3 economies and in EMU. We can be hopeful that there really is a trend of improvement that is taking hold. From mid-2025 or so onward, there are steady improvements in gear. Two of the BIG-3 economies are improving along with the EMU aggregate; only Germany tends to flatline on that timeline. The recent improvement in Germany is a relatively new feature in what otherwise looks like German stability. These trends now have some length, making the momentum seem more durable.

Global

Global