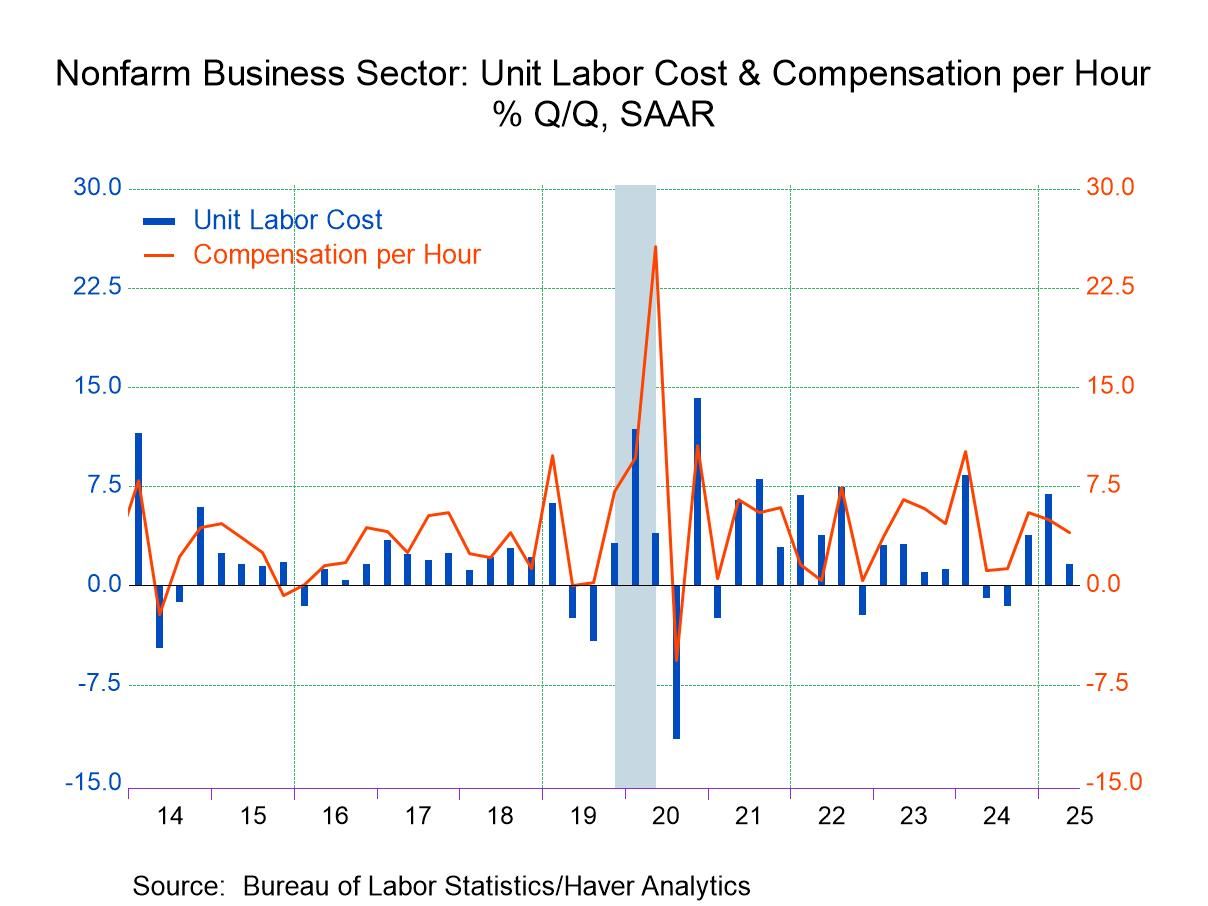

- Nonfarm business productivity increased 2.4% q/q annualized in Q2, more than reversing the 1.8% quarterly decline in Q1.

- Compensation growth slowed to 4.0% from 5.0% in Q1.

- Consequently, unit labor cost growth slowed markedly to 1.6% from 6.9% in Q1.

Introducing

Sandy Batten

in:Our Authors

Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

Publications by Sandy Batten

- USA| Aug 07 2025

U.S. Productivity Rebounded in Q2; Unit Labor Costs Slowed

by:Sandy Batten

|in:Economy in Brief

- USA| Jul 31 2025

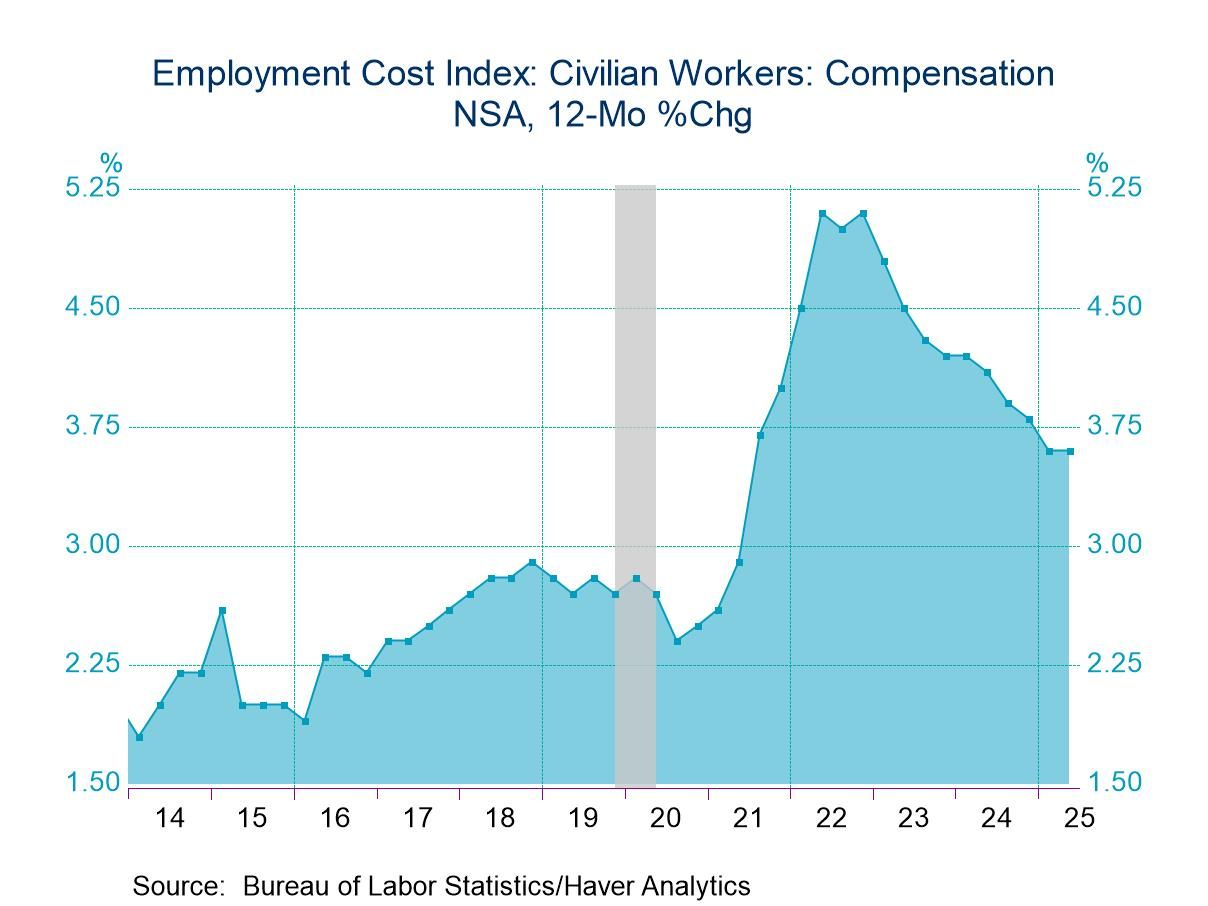

Growth of U.S. Employment Cost Index Unchanged in Q2

- Compensation grew 0.9 q/q in Q2, the same pace as in both Q1 and Q4 2024.

- Wage growth picked up to 1.0% q/q while benefits slowed to 0.7% q/q after Q1 surge.

by:Sandy Batten

|in:Economy in Brief

- USA| Jul 30 2025

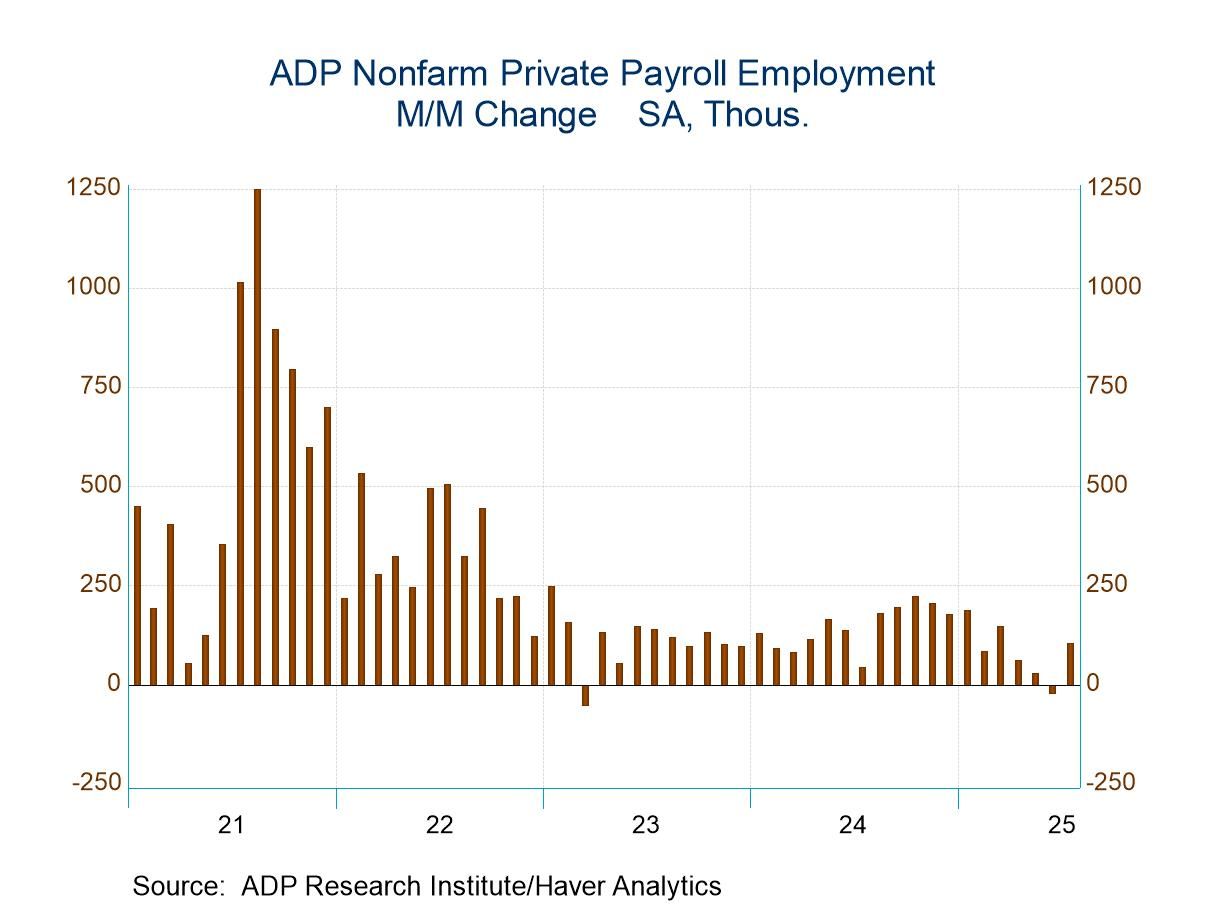

U.S. ADP Employment Rebounds in July

- Private payrolls increased 104,000 in July after a 23,000 decline in June.

- Goods-producing jobs rose 31,000, and service-producing jobs rose 74,000.

- Job stayer wage growth moderated further.

by:Sandy Batten

|in:Economy in Brief

- USA| Jul 29 2025

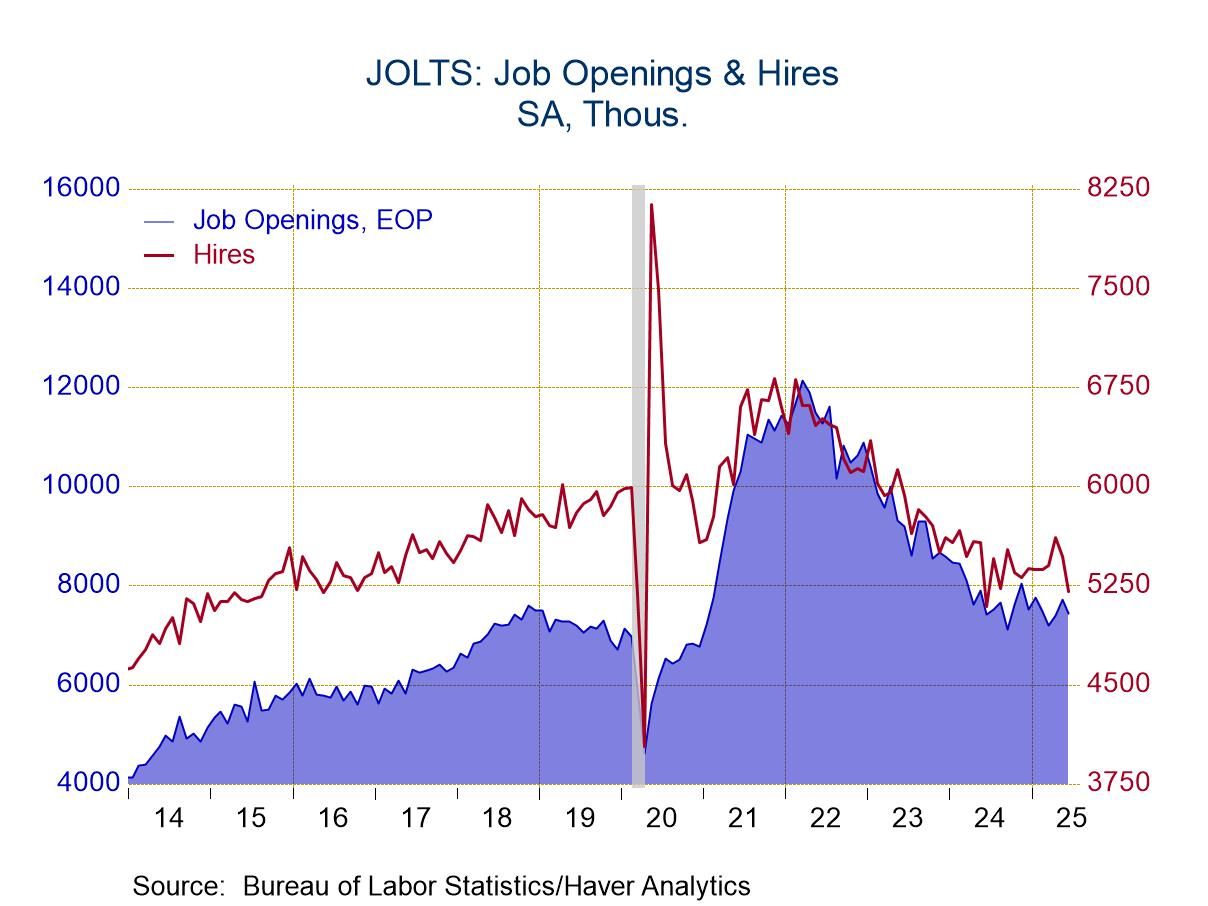

U.S. JOLTS—Openings and Hiring Slid in June

- Job openings fell 275,000 in June after having risen in each of the previous two months.

- Hiring fell 261,000, the largest monthly decline since June 2024.

- Separations fell 153,000, led by a 128,000 decline in quits.

- Layoffs edged down 7,000, the third monthly decline in the past four months.

by:Sandy Batten

|in:Economy in Brief

- USA| Jul 17 2025

U.S. Philly Fed Manufacturing Index Jumps in July

- The headline index jumped nearly 20 points, led by strong performances by both orders and shipments.

- However, ISM-adjusted composite slipped a bit, indicating that the jump in the headline index was not widely supported by the components.

- Delivery times shortened markedly while both prices paid and prices received indexes posted significant gains.

by:Sandy Batten

|in:Economy in Brief

- USA| Jul 17 2025

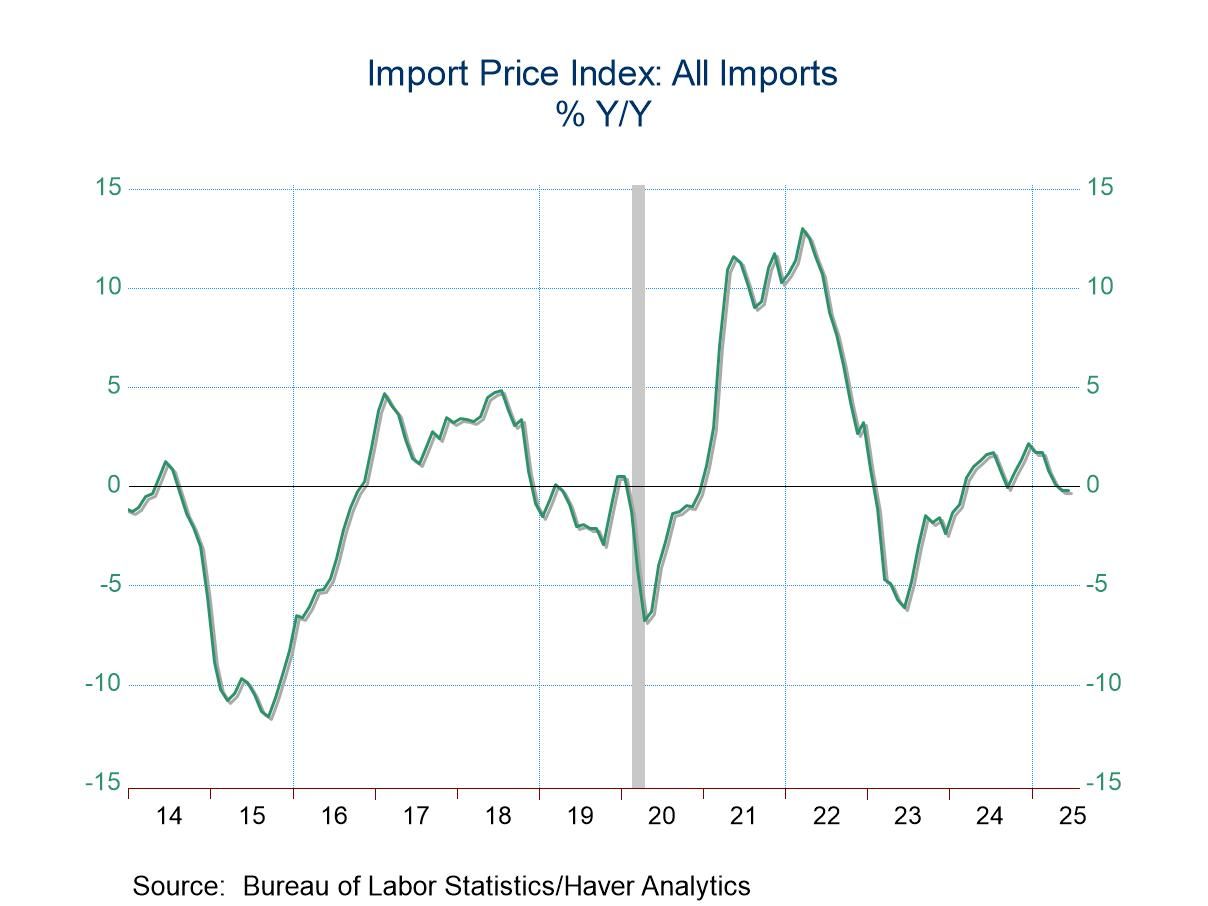

U.S. Import Prices Edged Up and Export Prices Rebounded in June

- Import prices edged up in June from May but fell from a year ago.

- Higher prices for nonfuel imports more than offset lower prices for fuel imports in June.

- Export prices jumped more than expected, nearly reversing May’s decline.

- Prices rose for both agricultural and nonagricultural exports.

by:Sandy Batten

|in:Economy in Brief

- USA| Jul 15 2025

FRBNY Empire State Manufacturing Index Jumped 22 points in July

- The first positive reading for the index since February.

- The July jump reflected widespread increases across components.

- Evidence of some nascent supply-chain problems.

- Outlook six months ahead continues to brighten.

by:Sandy Batten

|in:Economy in Brief

- USA| Jul 03 2025

U.S. Trade Deficit Widened in May

- Trade deficit widened in May on decline in goods exports.

- Still, the real deficit in April/May points to net exports making a meaningful positive contribution to Q2 GDP.

- Both exports and imports declined in May.

- Series low trade deficit with China.

by:Sandy Batten

|in:Economy in Brief

- USA| Jul 01 2025

JOLTS: Job Openings Jumped but Hiring Fell in May

- Job openings increased 374,000 in May, the largest monthly gain since last November.

- Hiring fell 112,000, the largest monthly decline since last October.

- Separations fell 71,000, led by a 202,000 decline in layoffs.

by:Sandy Batten

|in:Economy in Brief

- USA| Jun 26 2025

U.S. Q1 GDP Revised Weaker in Third Estimate

- The previously reported 0.2% q/q saar decline was revised to -0.5%.

- Consumer spending weakened markedly to a tepid 0.5% from 1.2% previously.

- Net exports were still the major drag while inventory investment still made a key contribution.

- GDP and PCE inflation were each revised up slightly.

by:Sandy Batten

|in:Economy in Brief

- USA| Jun 17 2025

U.S. Retail Sales Fell More than Expected in May 2025

- Sales fell a more-than-expected 0.9% m/m, led by a 3.5% decline in motor vehicle sales and a 2.0% drop in gasoline store sales.

- Sales excluding autos unexpectedly fell 0.3% m/m.

- In contrast, sales in the control group (used to estimate PCE) rebounded 0.4% m/m.

by:Sandy Batten

|in:Economy in Brief

- USA| Jun 17 2025

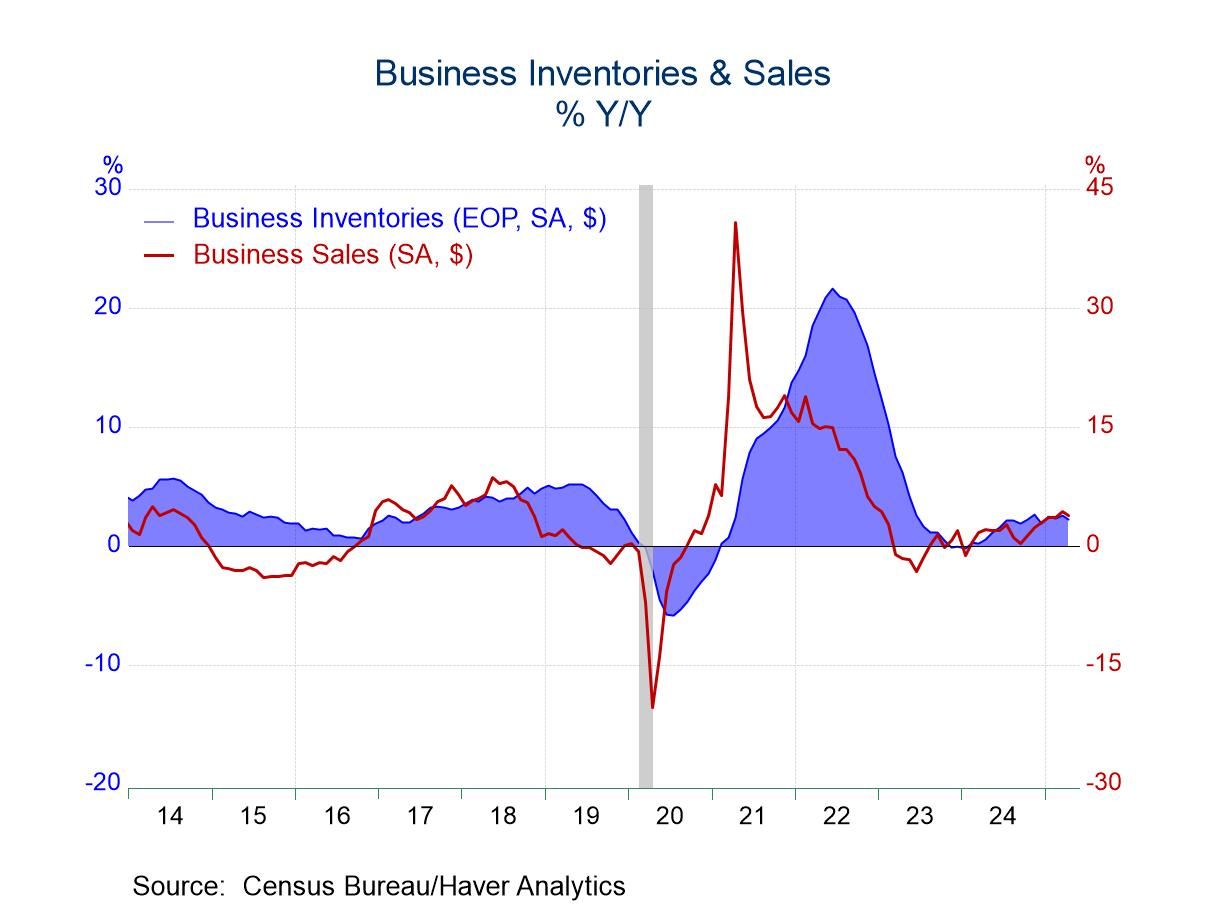

U.S. Business Inventories Unchanged in April as Sales Slipped

- Total inventories were unchanged in April from March.

- Wholesale inventories rose for the fourth consecutive month while retail and factory inventories slipped.

- Sales edged down 0.1% m/m, the first monthly decline in three months, with declines in both factory and retail sales.

- With little change in both sales and inventories, the inventories/sales ratio was unchanged in April following two consecutive monthly declines.

by:Sandy Batten

|in:Economy in Brief

- of57Go to 4 page