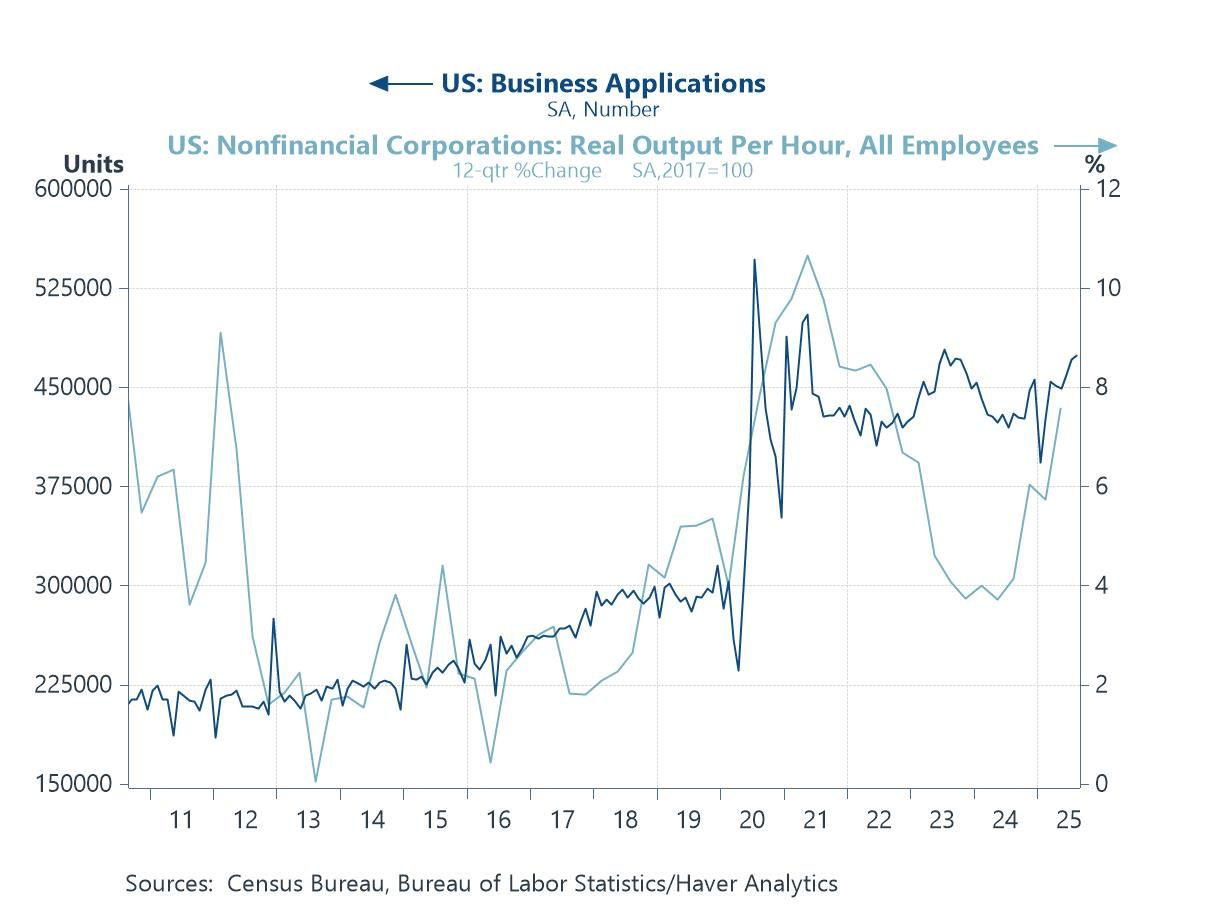

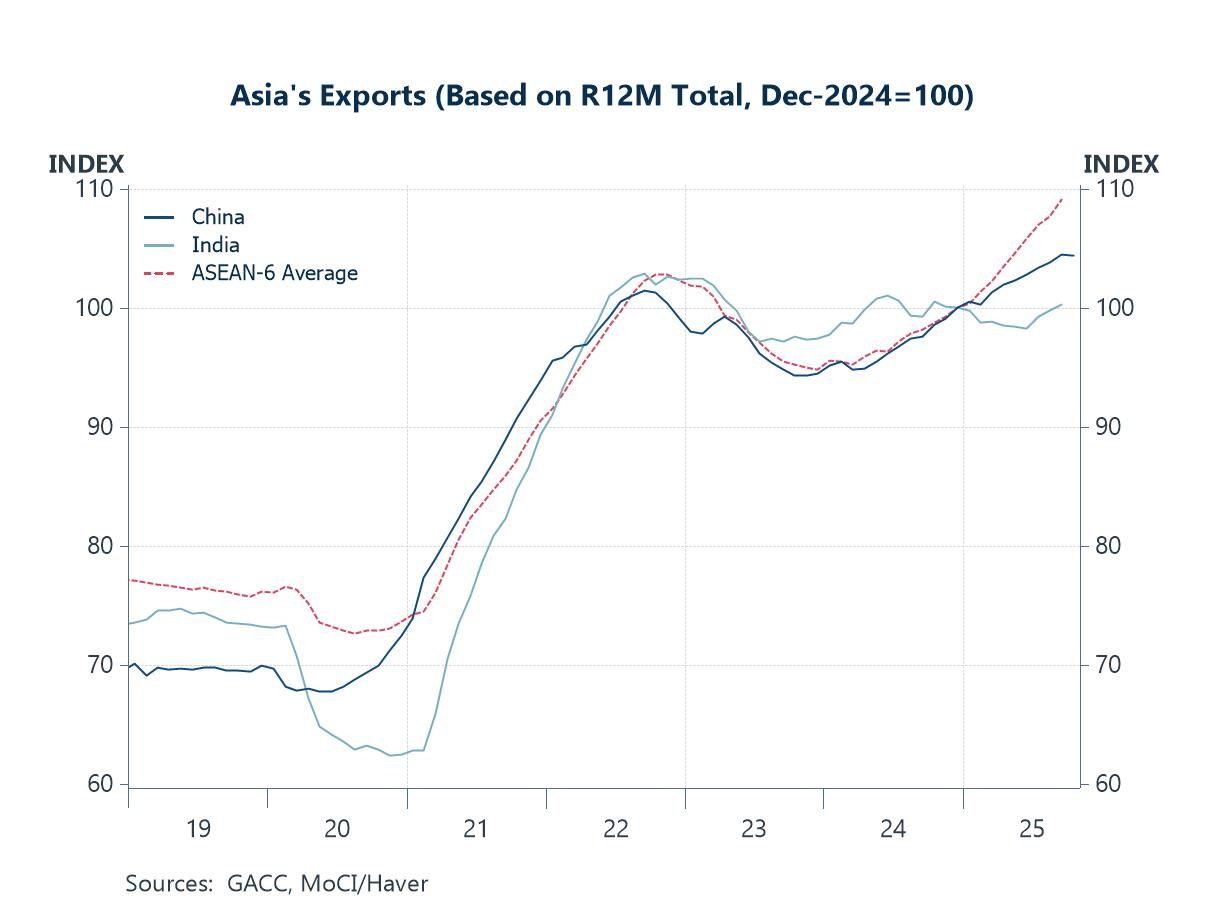

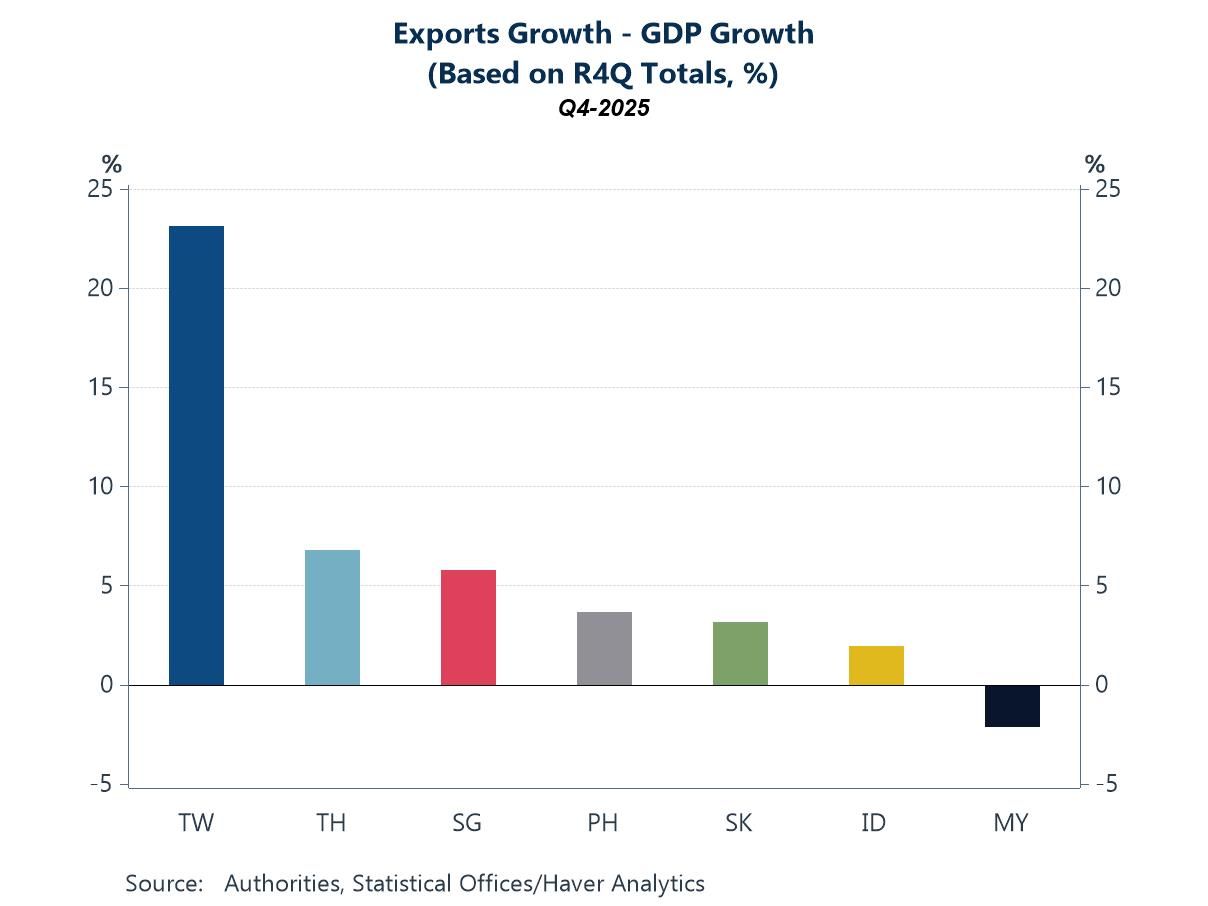

In our Letter this week, we delve deeper into AI, with a focus on Asia and, where relevant, comparisons with the US. The global economy remains firmly in the buildout phase of AI, where much of the near-term economic benefit is derived from investment in hardware and enabling infrastructure—such as AI chips, memory, and data centres. At the same time, though still at a relatively early stage, firms are beginning to adopt advanced AI capabilities and integrate them into workflows in pursuit of productivity gains. So far, labour productivity improvements have been evident in parts of Asia (chart 1), largely driven by stronger exports (chart 2) and capital deepening—similar to trends observed in the US (chart 3) and, within Asia, in economies such as Malaysia (chart 4). However, these gains have yet to translate into a clear and sustained acceleration in total factor productivity (TFP), which accounts for the combined use of labour, capital, and other inputs—though TFP is admittedly a challenging metric to estimate, as illustrated by the US case (chart 5). This raises an important question: what happens when the AI buildout phase begins to moderate, and the associated investment-led tailwinds fade? At that point, further AI-related gains will depend more heavily on the successful embedding and diffusion of AI across sectors. On this front, Asian economies remain at very different stages of readiness to adopt AI (chart 6), suggesting that the next phase of productivity gains may be uneven across the region.

The productivity story Several Asian economies have already recorded substantial productivity gains in recent years, even before the narrative around AI-driven productivity boosts gained traction last year. As shown in chart 1, measured by labour productivity—simply defined as output per employed person—economies such as Taiwan and several in Southeast Asia stand out for their strong performance. However, these gains cannot be attributed solely to the promise of AI. By definition, labour productivity rises whenever output (the numerator) grows faster than employment (the denominator). Such an outcome can stem from a range of factors—cyclical recoveries, capital deepening, sectoral shifts, or efficiency improvements—and does not necessarily reflect widespread AI adoption.

Asia

Asia