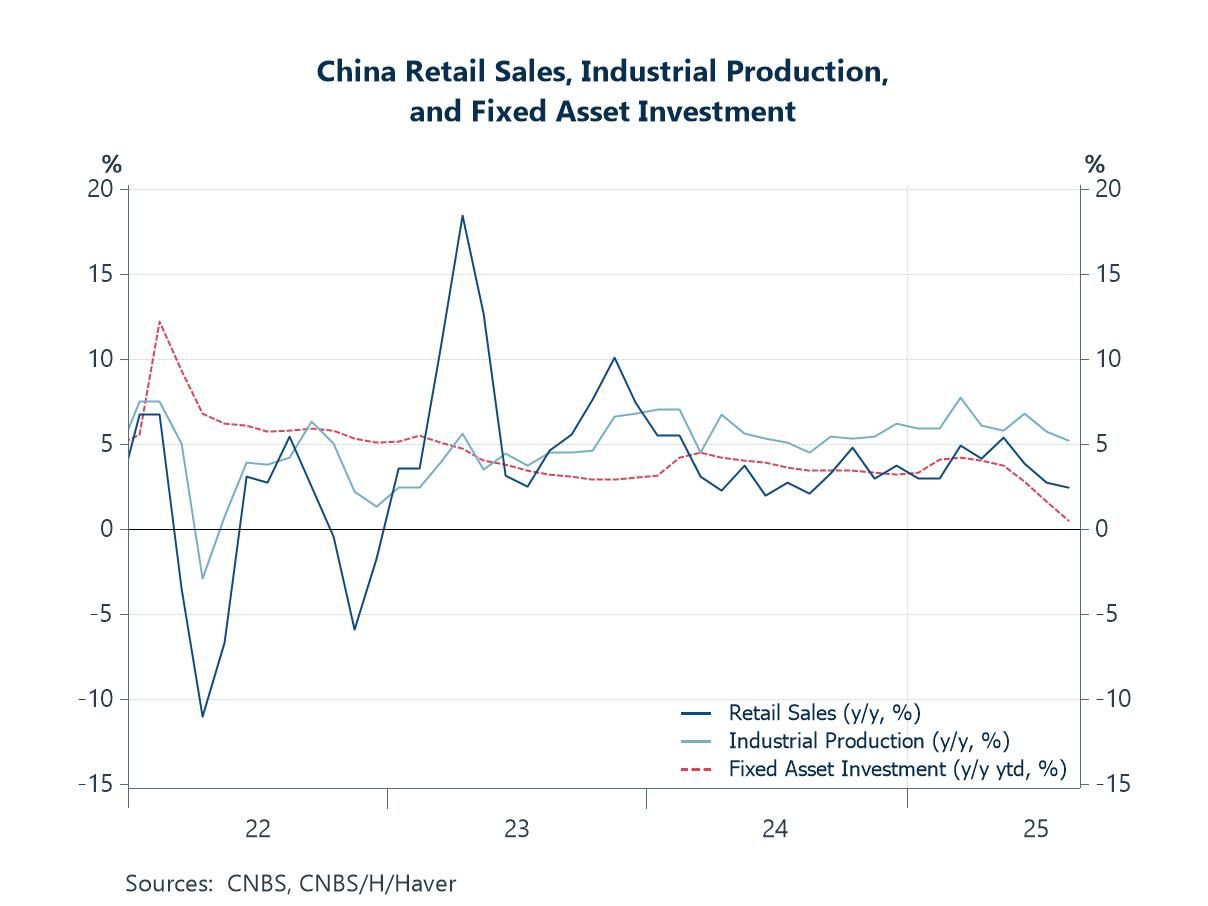

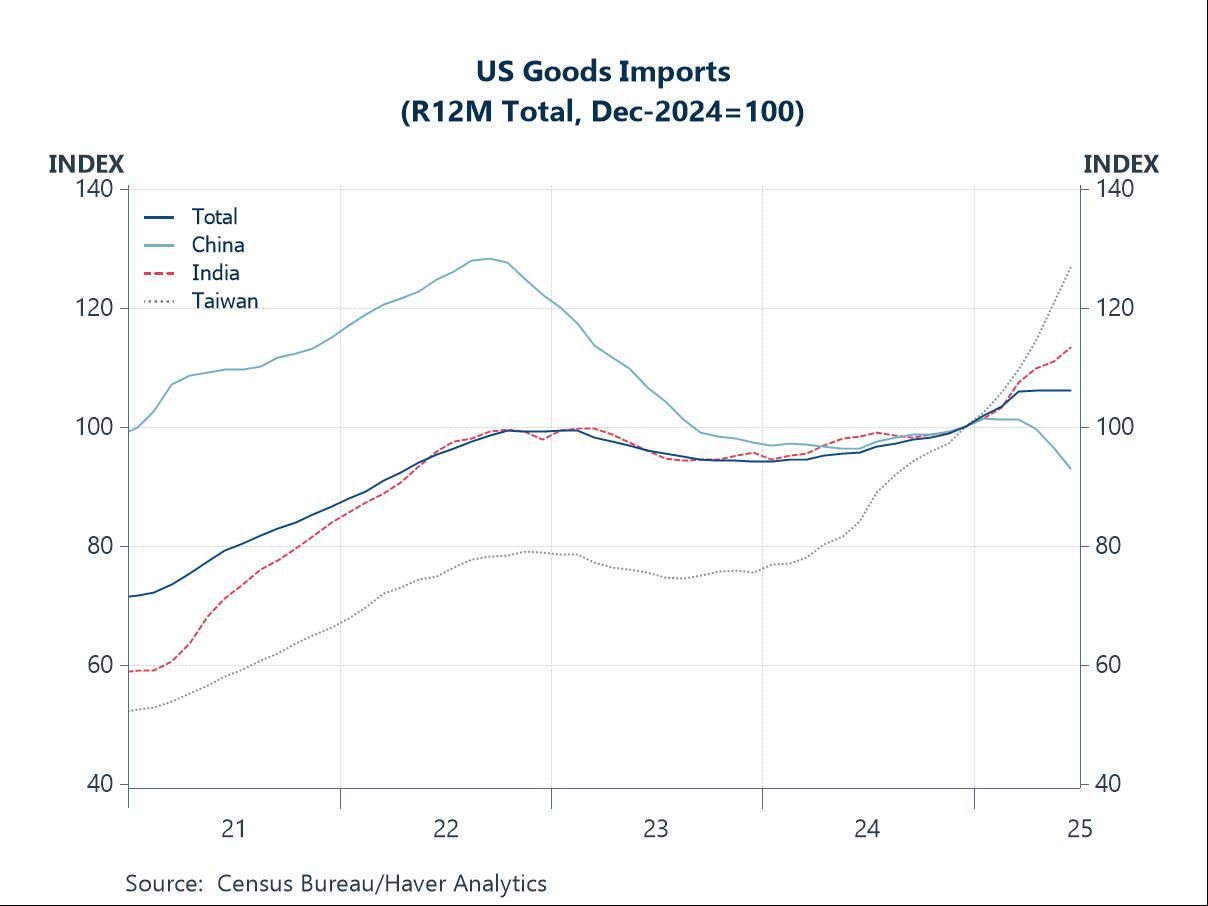

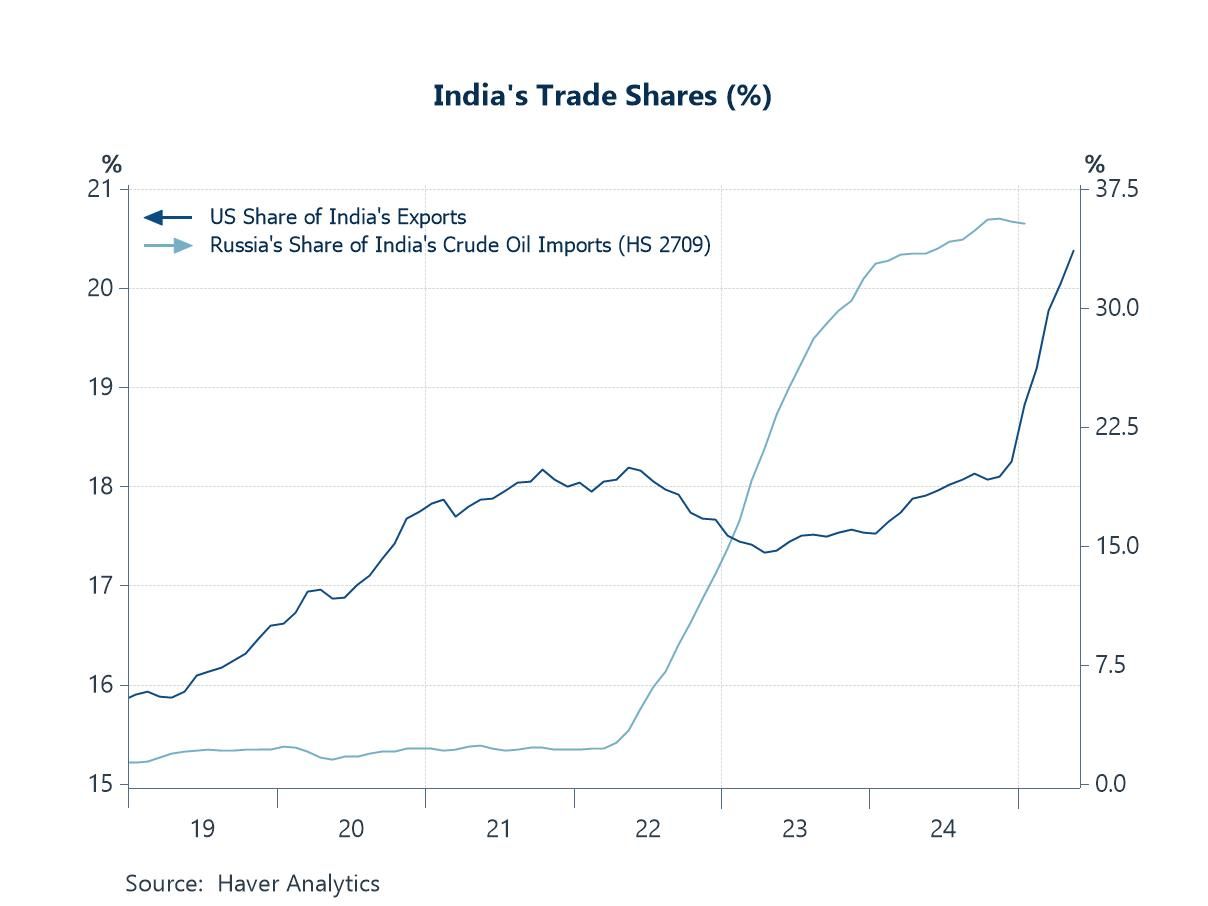

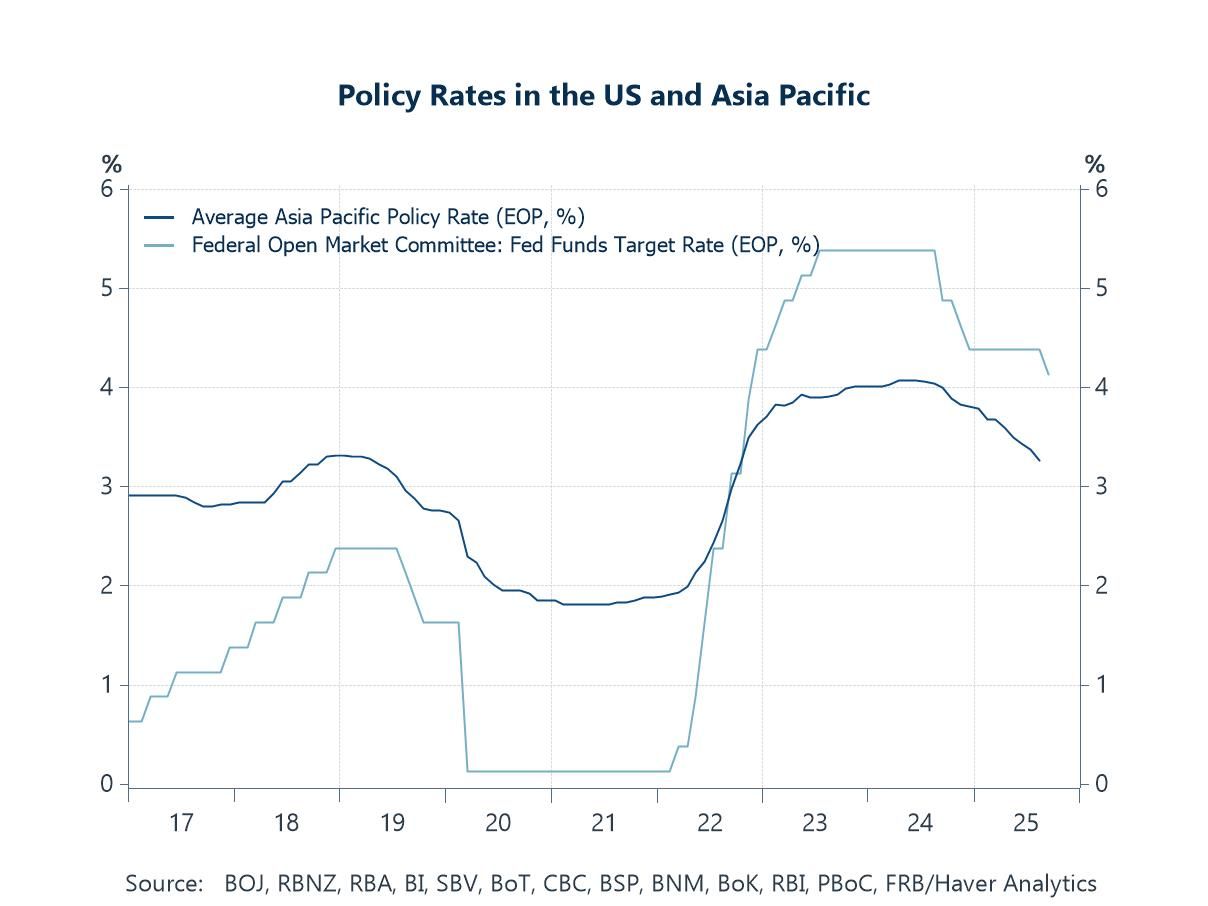

Following last week’s decision by the Fed to lower US interest rates, we examine Asia’s economic outlook, with particular focus on Japan, Indonesia, and Thailand. The Fed’s first rate cut of the year—while signalling more to come—has cleared the path for further easing from Asia’s central banks. Still, many regional central banks had already loosened policy despite wider yield differentials, responding to sluggish domestic demand, the growth drag from new US tariffs, and muted inflation pressures (chart 1). Across Asia, moreover, political turbulence risks distracting governments from tackling deeper structural challenges.

In Japan, the BoJ kept its policy rate unchanged as expected last week but announced the gradual unwinding of its large ETF and J-REIT holdings, a move likely to tighten liquidity (chart 2). On the political front, investors are watching the LDP’s two-week leadership contest, which culminates in an October 4th vote, with elevated food costs and broader inflation still pressing concerns (chart 3). Indonesia remains in focus as well, with investor concerns over fiscal discipline heightened by the recent removal of its long-serving Finance Minister. Long-standing issues, such as persistently high youth unemployment, continue to weigh as well (chart 4).

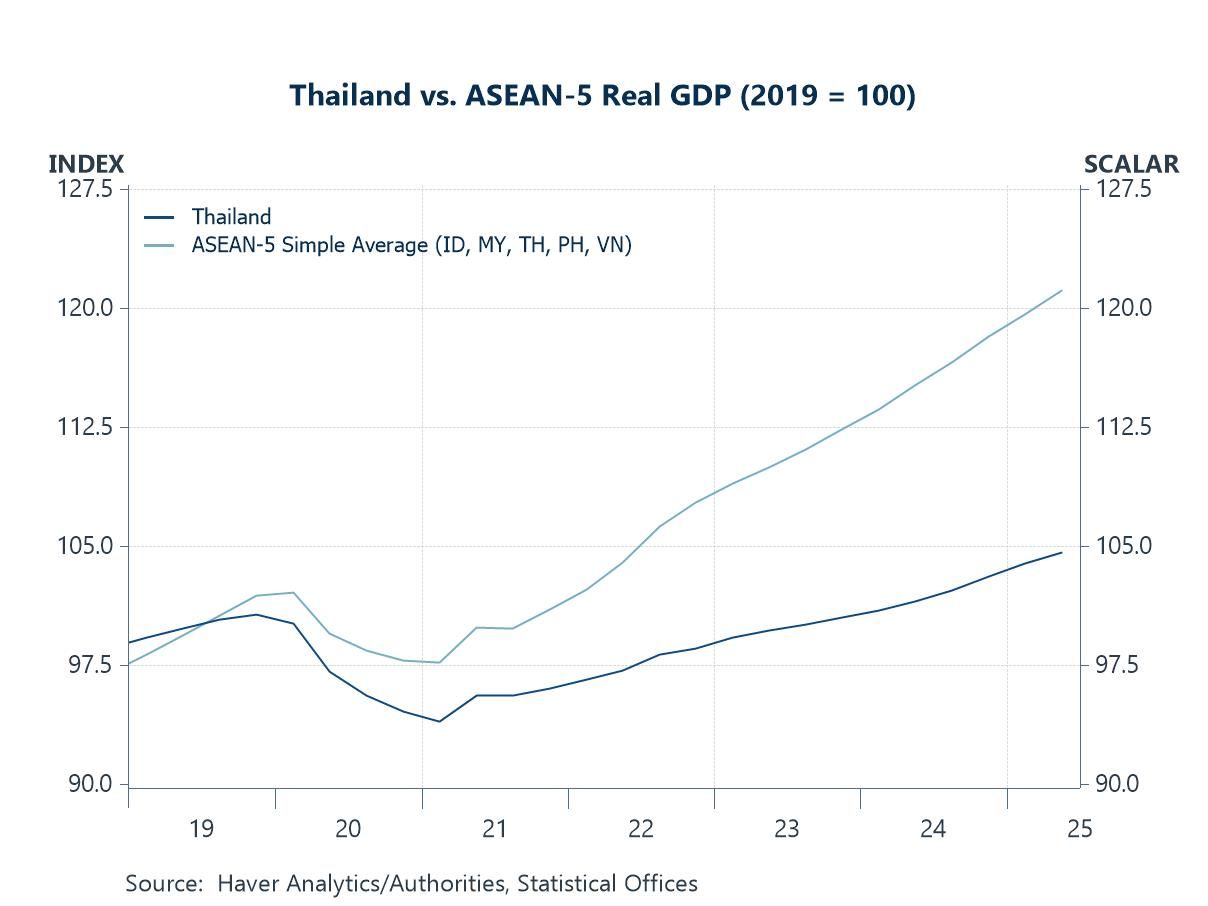

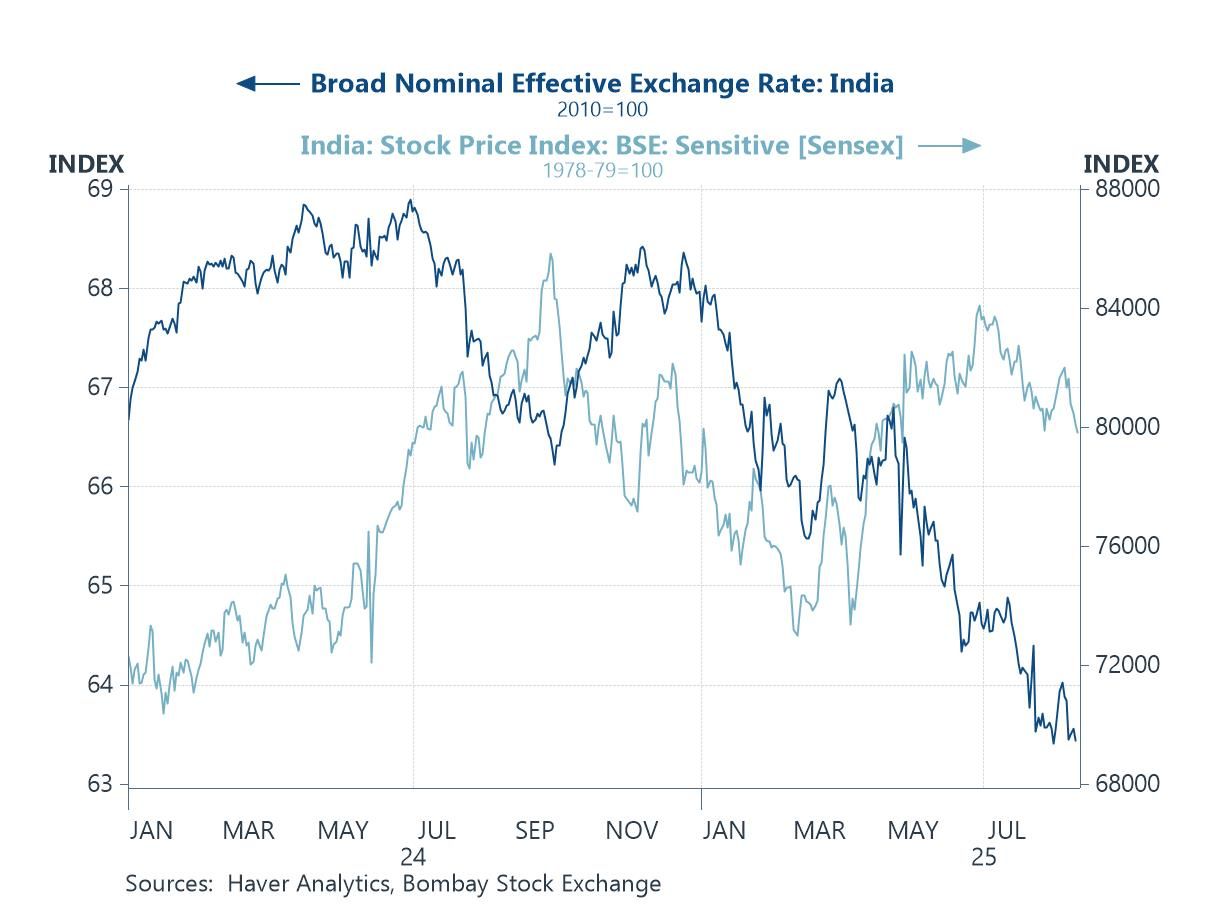

Thailand faces its own political uncertainty, with elections expected within four months after Prime Minister Anutin’s appointment. The interim push for near-term policy wins risks delaying structural reforms on household and public debt (chart 5). Meanwhile, the baht’s recent sharp appreciation—driven partly by surging gold prices (chart 6)—is straining exports and tourism, prompting the Bank of Thailand to explore measures to ease the currency’s gains, including taxing gold and encouraging US dollar-denominated trades.

Post-Fed reactions, implications As expected, the Fed cut its policy rate by 25 bps at its September meeting, marking its first reduction of the year after months of anticipation. The updated “dot plot” suggests two additional cuts may be on the horizon, though these projections remain data-dependent. The Fed’s move follows several rounds of easing by Asian central banks (chart 1), which cut rates despite wider US differentials to shore up weak domestic demand or offset risks from US tariffs. Contained headline CPI, driven by softer demand and the absence of broad supply shocks, has given the Asian policymakers room to ease. Looking ahead, further rate cuts across Asia—except in economies such as Japan, which maintain a tightening bias—remain possible. This is especially likely as the growth effects of the latest US tariff hikes, effective August 7th, have yet to be fully felt. If the Fed delivers additional easing later this year, it could further strengthen the case for Asian central banks to loosen policy again.

Asia

Asia