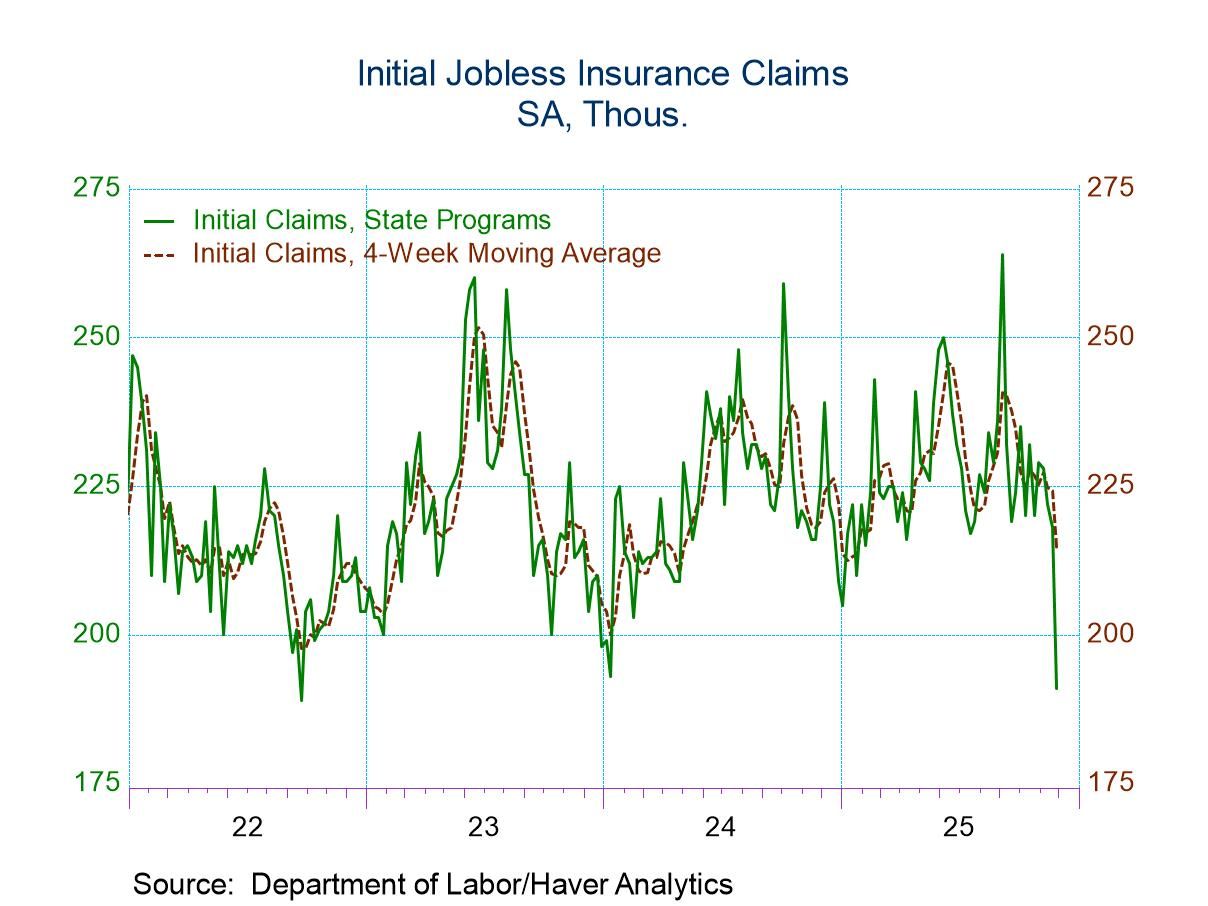

- Decline in initial claims at lowest level since January.

- Continuing claims edge lower; jobless rate steadies.

- State unemployment rates vary.

Introducing

Tom Moeller

in:Our Authors

Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

Publications by Tom Moeller

by:Tom Moeller

|in:Economy in Brief

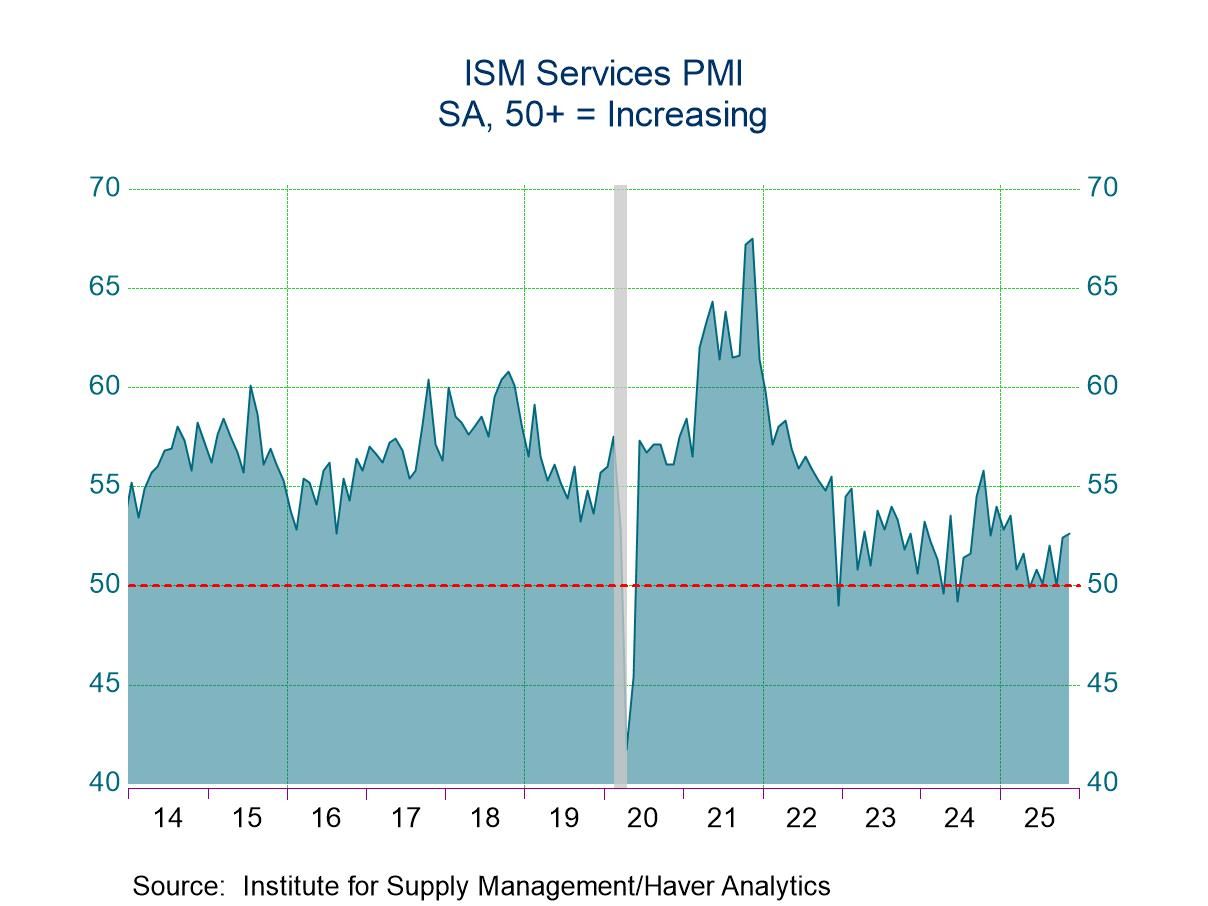

- Total services index is highest in nine months.

- Business activity, employment & supplier deliveries increase.

- Prices index declines sharply.

by:Tom Moeller

|in:Economy in Brief

- USA| Dec 03 2025

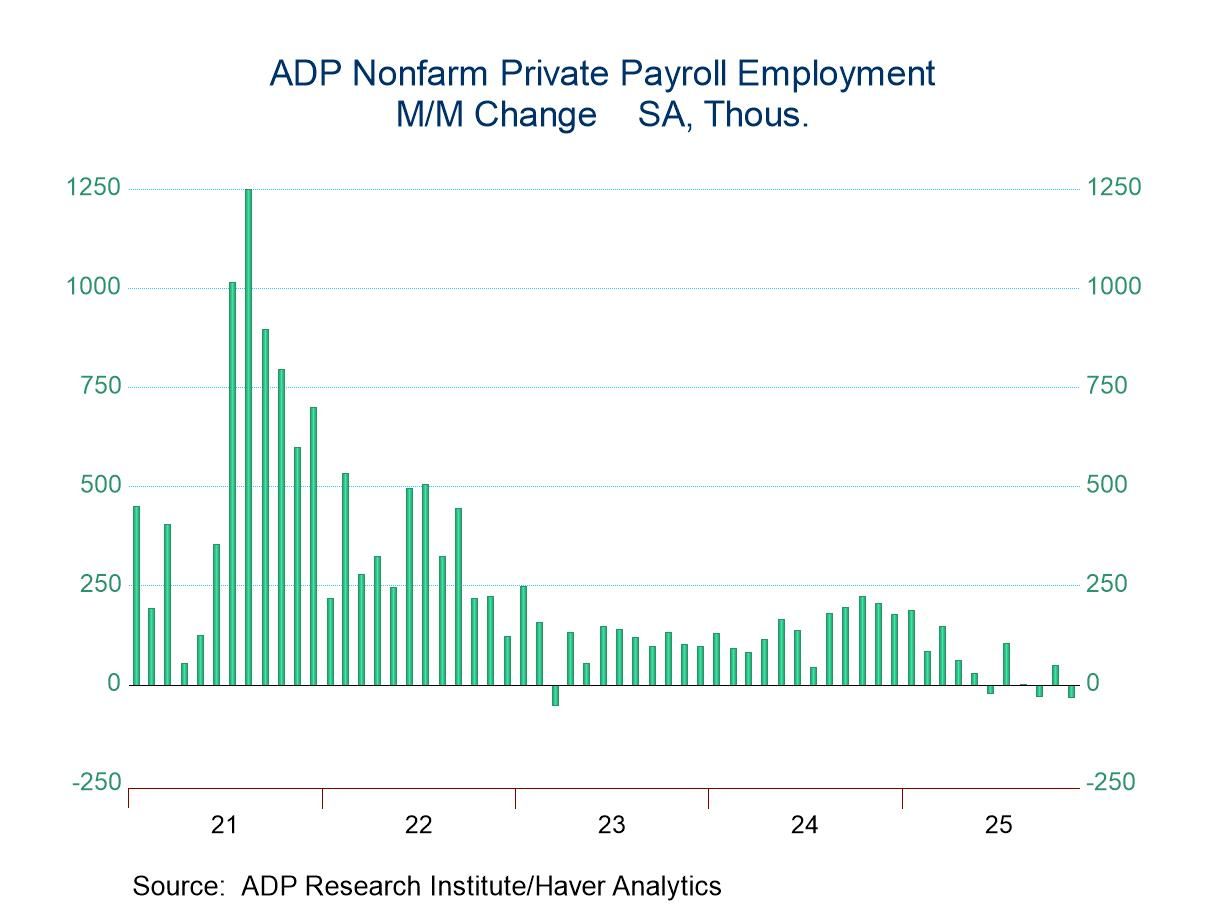

U.S. ADP Employment Declines in November

- Drop in private payrolls is third in four months.

- Hiring shortfall is led by small business.

- Both service-sector & factory jobs decline.

- Wage growth decelerates.

by:Tom Moeller

|in:Economy in Brief

- USA| Dec 02 2025

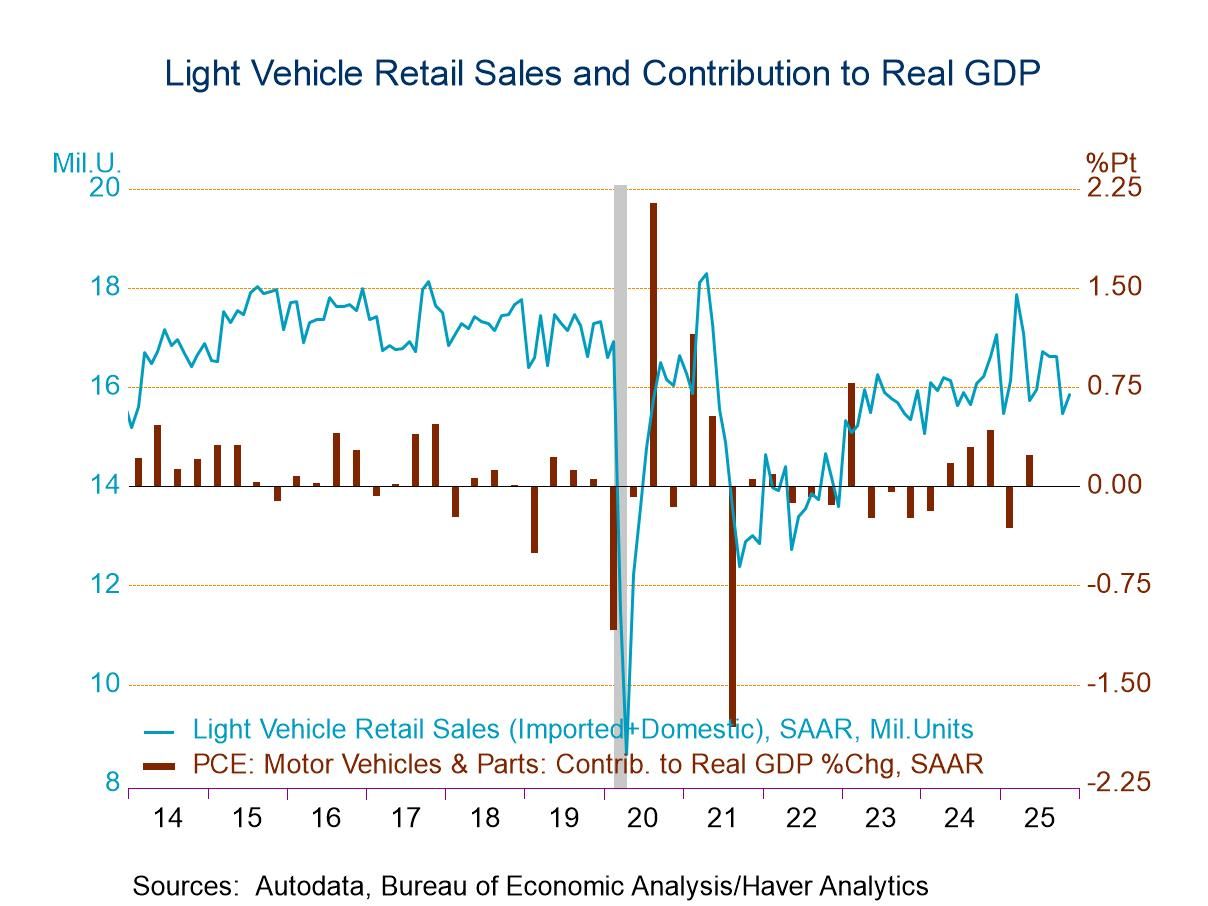

U.S. Light Vehicle Sales Edge Higher in November

- Light truck and auto purchases increase m/m.

- Passenger car sales continue to decline sharply y/y.

- Imports' market share increases.

by:Tom Moeller

|in:Economy in Brief

- USA| Dec 02 2025

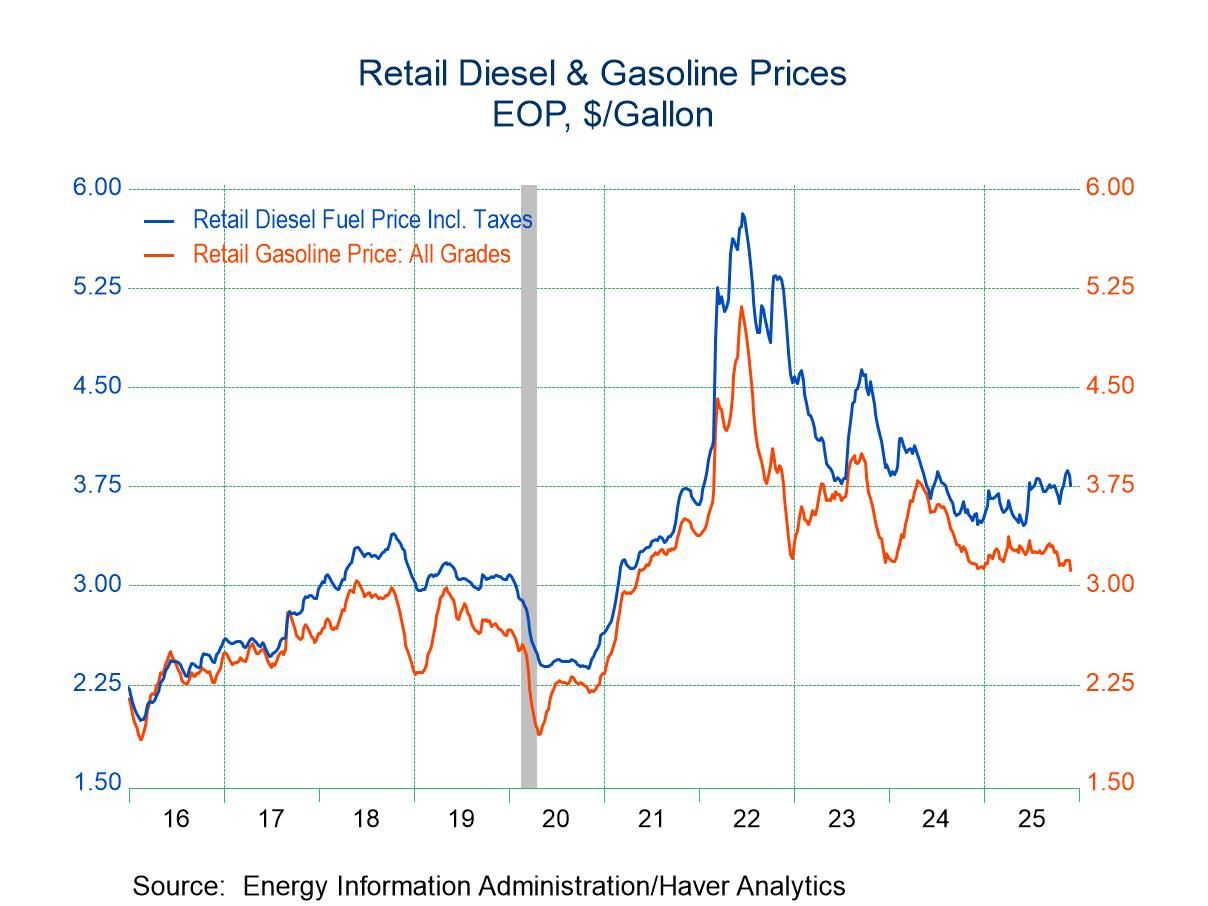

U.S. Energy Prices Are Mixed in Latest Week

- Gasoline prices fall week-to-week.

- Crude oil prices decline for fourth straight week.

- Natural gas prices move to highest level since February.

- Demand for gasoline & all petroleum products is little changed y/y.

by:Tom Moeller

|in:Economy in Brief

- Decline is to lowest level since July.

- New orders, employment & supplier deliveries drop.

- Despite a small gain, price index remains near ten-month low.

by:Tom Moeller

|in:Economy in Brief

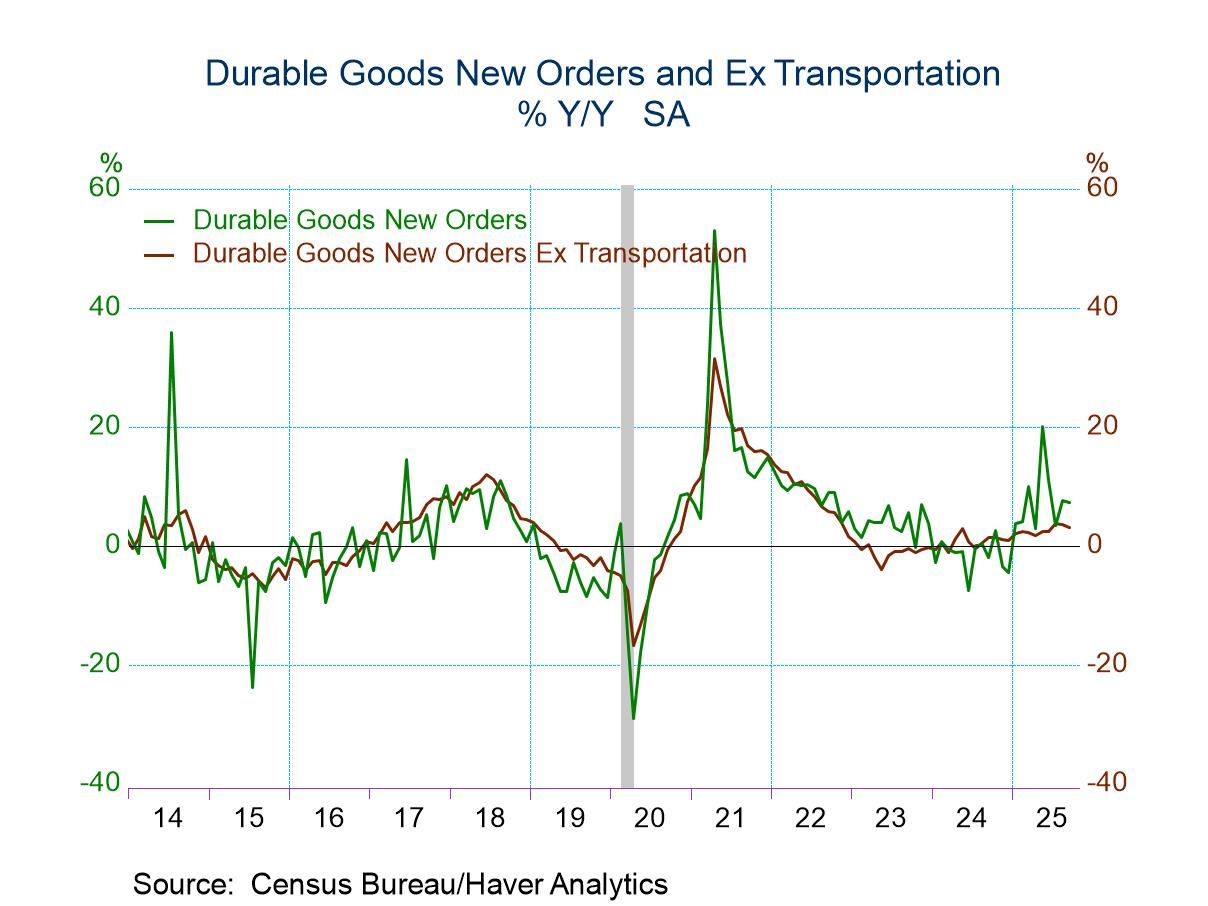

- Broad-based orders improvement follows August jump.

- Durable shipments gain reverses prior month’s dip.

- Order backlogs grow for second month; inventories ease.

by:Tom Moeller

|in:Economy in Brief

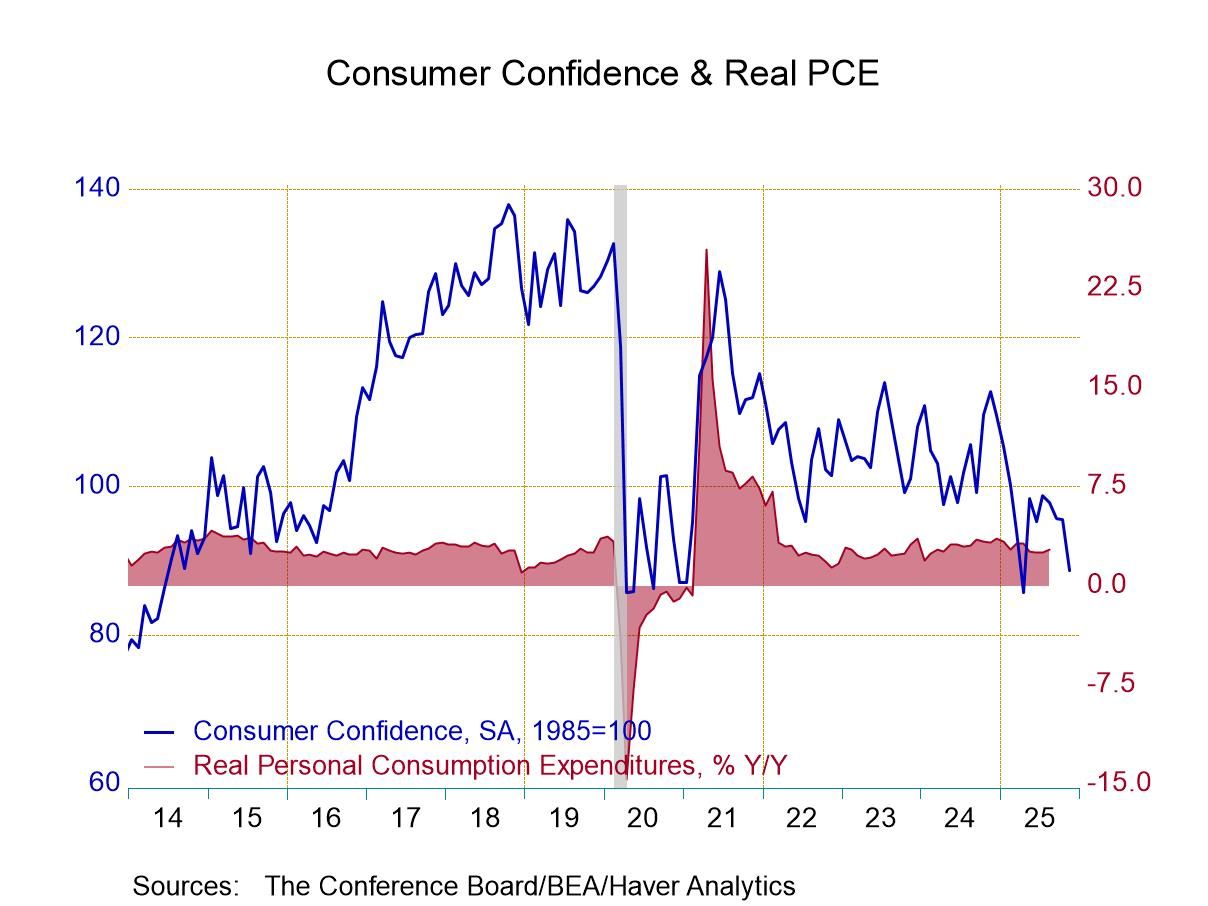

- Confidence level moves to lowest since April.

- Present situation index and expectations decline.

- Inflation expectations are contained.

by:Tom Moeller

|in:Economy in Brief

- USA| Nov 25 2025

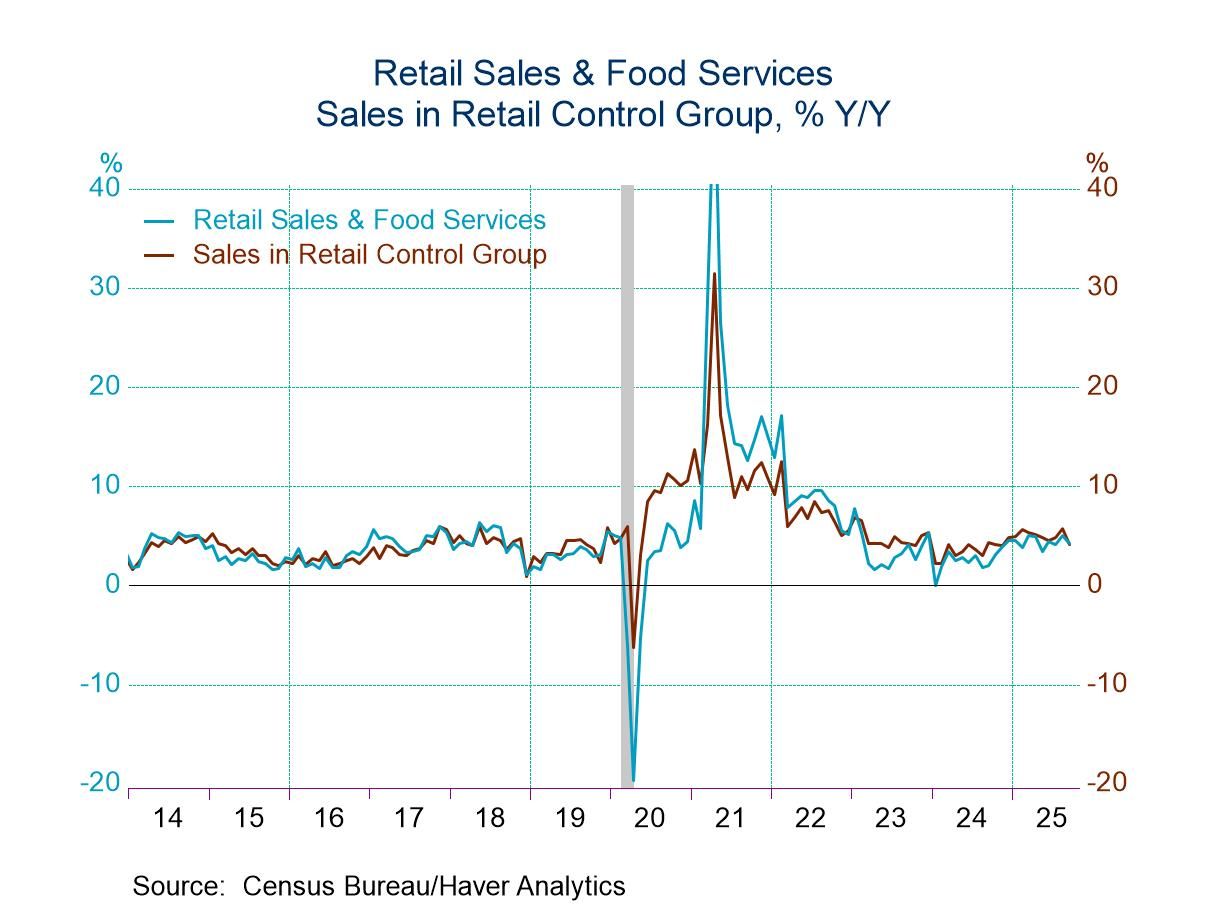

U.S. Retail Sales Post Limited Rise in September

- Auto sales decline; rise in nonauto sales is restrained.

- Sales ease in retail control group.

- Clothing & nonstore sales decline.

by:Tom Moeller

|in:Economy in Brief

- USA| Nov 24 2025

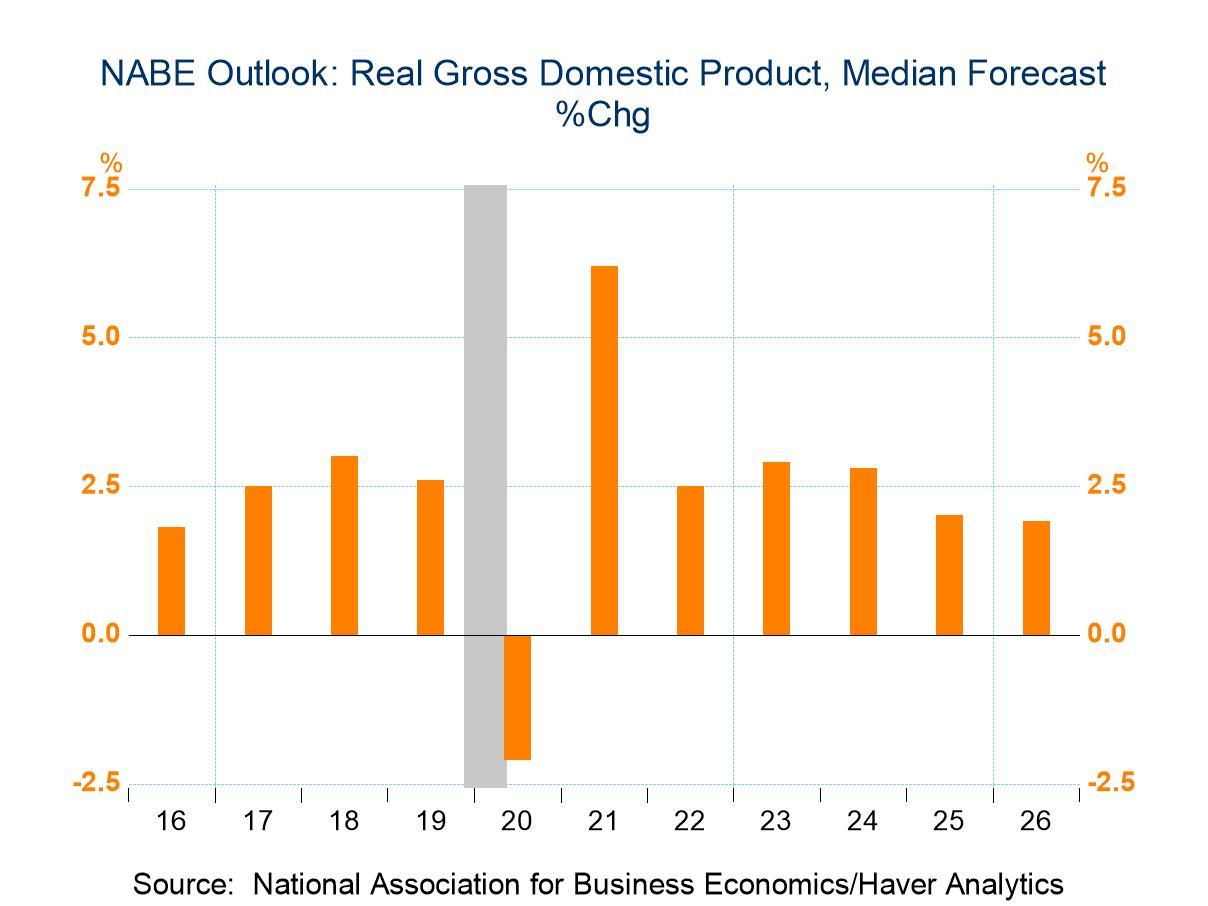

NABE GDP Growth Forecasts for 2025 & 2026 Edge Higher

- Consumer spending estimate is increased.

- Business & residential investment estimates are raised.

- Moderating inflation expectations are little-changed.

by:Tom Moeller

|in:Economy in Brief

- Textile and metals prices continue to strengthen.

- Crude oil prices rise.

- Framing lumber costs decline again.

by:Tom Moeller

|in:Economy in Brief

- USA| Nov 20 2025

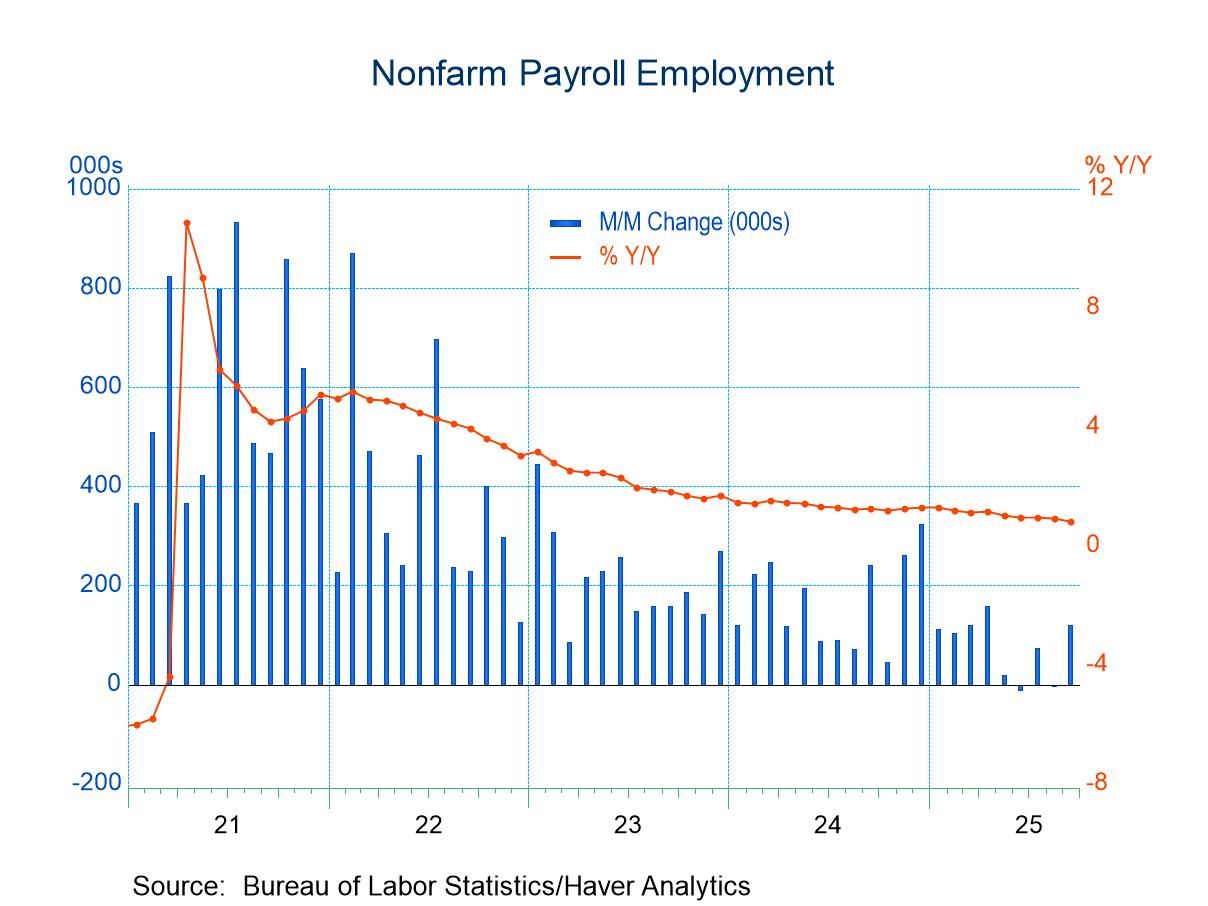

U.S. Payroll Employment is Unexpectedly Firm in September; Earnings Rise Steadily, but Jobless Rate Edges Up

- Hiring improves broadly.

- Construction, private services & government jobs rise, but factory employment declines.

- Earnings improvement is steady y/y, but slows m/m.

- Unemployment rate moves higher as job growth lags labor force gain.

by:Tom Moeller

|in:Economy in Brief

- of1081Go to 2 page