Global| May 12 2017

Global| May 12 2017Business Sales Unchanged While Inventories Rise in March

by:Sandy Batten

|in:Economy in Brief

Summary

Business sales were unchanged (6.5% y/y) in March from February versus an unrevised 0.2% monthly gain in February. For the major sectors, retail sales edged up 0.1% m/m (4.9% y/y) in March (posting a more solid 0.3% m/m gain when [...]

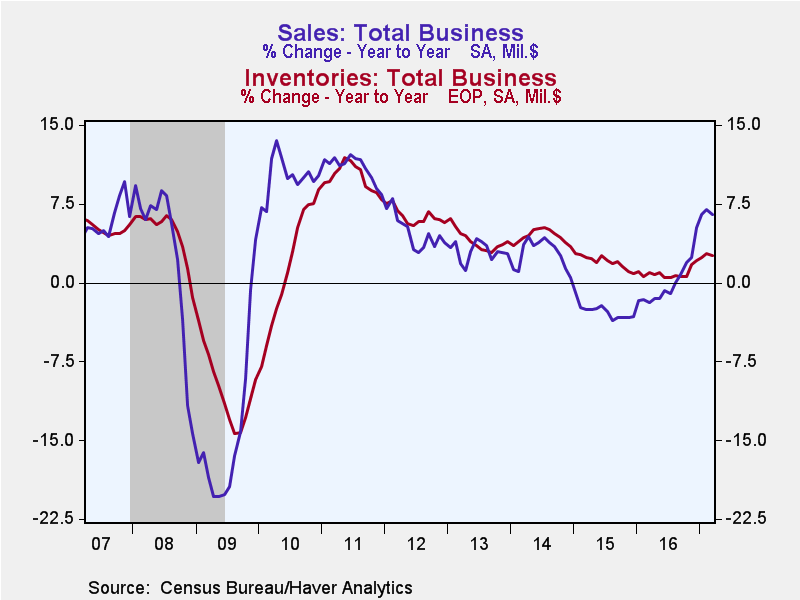

Business sales were unchanged (6.5% y/y) in March from February versus an unrevised 0.2% monthly gain in February. For the major sectors, retail sales edged up 0.1% m/m (4.9% y/y) in March (posting a more solid 0.3% m/m gain when motor vehicle sales are excluded). In contrast, wholesale sales were unchanged in March (9.1% y/y) after having jumped 0.7% m/m in February. Manufacturing shipments slipped 0.1% m/m (+5.3% y/y) in March.

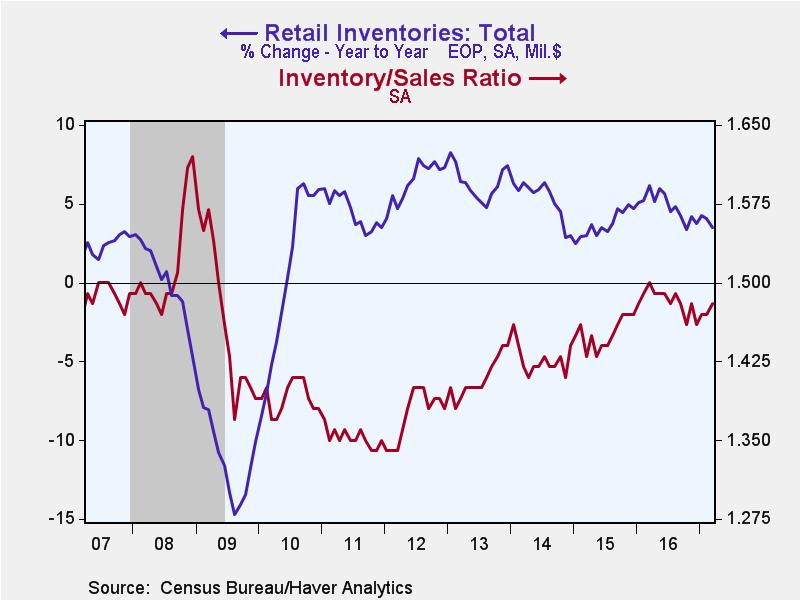

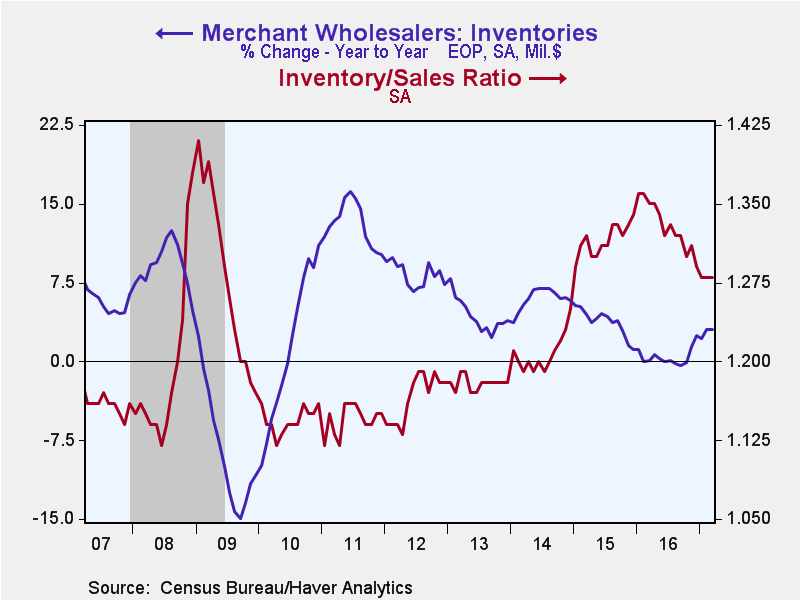

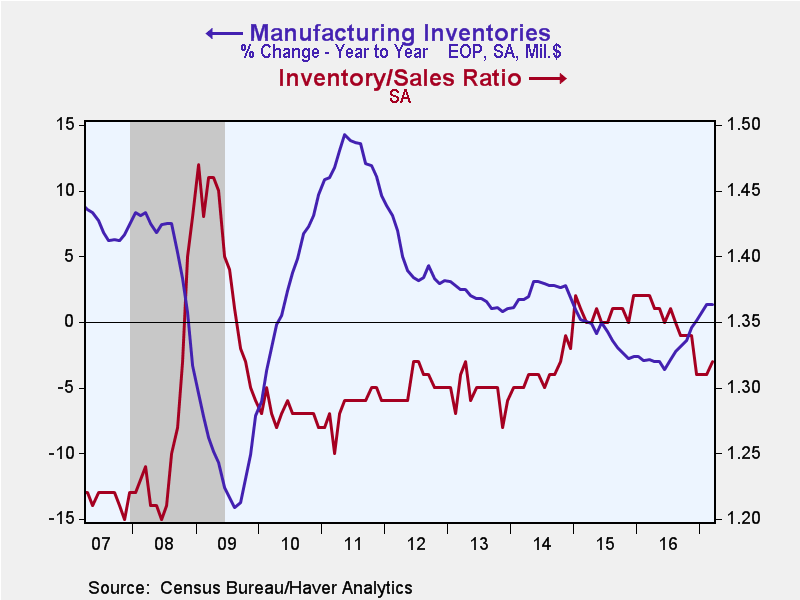

Total business inventories rose again in March. They increased 0.2% m/m, the same monthly gain as in February to stand 2.6% higher than a year ago. The February increase was slightly stronger than market expectations. Retail inventories jumped 0.5% m/m (3.5% y/y) in March, led by a 0.9% m/m surge in inventories of motor vehicles and parts. Retail inventories excluding motor vehicles rose a more modest 0.3% m/m in March. Wholesale inventories were up 0.2% m/m (3.0% y/y), while manufacturing inventories were unchanged in March (+1.4% y/y).

Even though sales have slowed over the past couple months, the real story for the outlook for production continues to be the longer-term acceleration of both sales and inventories, and particularly the more rapid acceleration of sales. Sales have risen at a 7.2% annual rate over the past six months and 6.5% over the past year. Inventories have also accelerated, but more modestly. They are up at a 3.5% annual rate over the past six months and 2.6% over the past year.

Faster growth in sales relative to inventories reduces the inventory-to-sales ratio. Indeed the total business I/S ratio has fallen consistently over the past year and the latest reading (1.35) is the lowest since December 2014. The wholesale and manufacturing I/S ratios have exhibited behavior similar to the total while the retail I/S ratio has edged up over the past three months, but remains below levels of a year ago.

This outpacing of sales relative to inventories depletes merchandise on sellers' shelves and eventually leads to new orders which then lead to increased production. This is a virtuous spiral that is occurring at across the economy and augurs increased industrial activity in the near future.

The manufacturing and trade data are in Haver's USECON database.

| Manufacturing & Trade | Mar | Feb | Jan | Mar Y/Y | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Business Inventories (% chg) | 0.2 | 0.2 | 0.3 | 2.6 | 2.1 | 0.9 | 3.5 |

| Retail | 0.5 | 0.3 | 0.8 | 3.5 | 3.8 | 4.7 | 3.0 |

| Retail excl. Motor Vehicles | 0.3 | -0.1 | 0.0 | 1.3 | 1.8 | 3.8 | 2.6 |

| Merchant Wholesalers | 0.2 | 0.3 | -0.2 | 3.0 | 2.5 | 1.2 | 5.8 |

| Manufacturing | 0.0 | 0.2 | 0.3 | 1.4 | 0.1 | -2.6 | 1.8 |

| Business Sales (% chg) | |||||||

| Total | 0.0 | 0.2 | 0.3 | 6.5 | 0.0 | -2.8 | 2.8 |

| Retail | 0.1 | -0.2 | 0.4 | 4.9 | 2.7 | 1.9 | 4.0 |

| Retail excl. Motor Vehicles | 0.3 | 0.2 | 1.0 | 5.0 | 2.3 | 0.4 | 3.3 |

| Merchant Wholesalers | 0.0 | 0.7 | 0.3 | 9.1 | -0.5 | -4.9 | 3.6 |

| Manufacturing | -0.1 | 0.2 | 0.3 | 5.3 | -1.8 | -4.4 | 1.2 |

| I/S Ratio | |||||||

| Total | 1.35 | 1.35 | 1.35 | 1.40 | 1.38 | 1.37 | 1.31 |

| Retail | 1.48 | 1.47 | 1.47 | 1.50 | 1.48 | 1.45 | 1.43 |

| Retail excl. Motor Vehicles | 1.24 | 1.24 | 1.24 | 1.29 | 1.27 | 1.26 | 1.23 |

| Merchant Wholesalers | 1.28 | 1.28 | 1.28 | 1.35 | 1.33 | 1.32 | 1.21 |

| Manufacturing | 1.32 | 1.31 | 1.31 | 1.37 | 1.35 | 1.36 | 1.31 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates