Global| Jan 22 2020

Global| Jan 22 2020Chicago Fed National Activity Index Points to Below Trend Growth in Q4

Summary

• Activity index declines to -0.35 in December. • Three-month average at -0.23 suggests below trend growth for Q4. • Production and income indicators led the decline. The Federal Reserve Bank of Chicago's National Activity Index [...]

• Activity index declines to -0.35 in December.

• Three-month average at -0.23 suggests below trend growth for Q4.

• Production and income indicators led the decline.

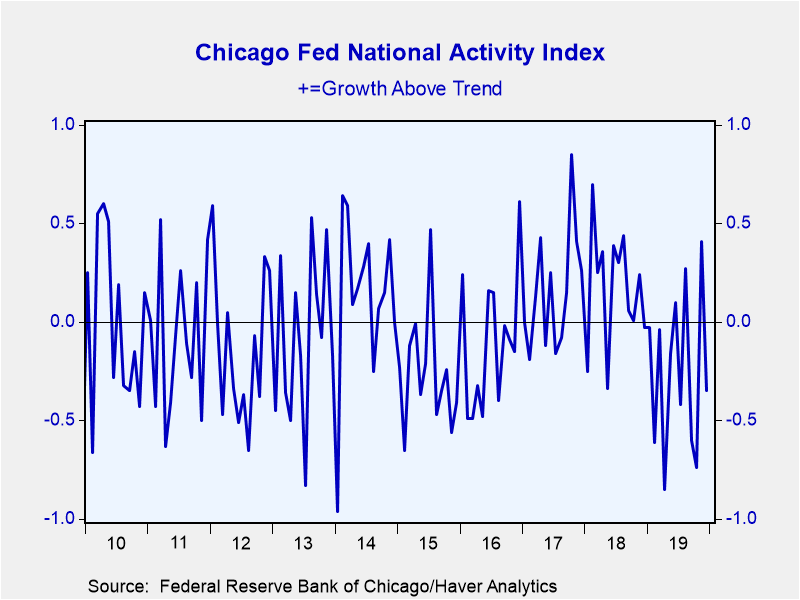

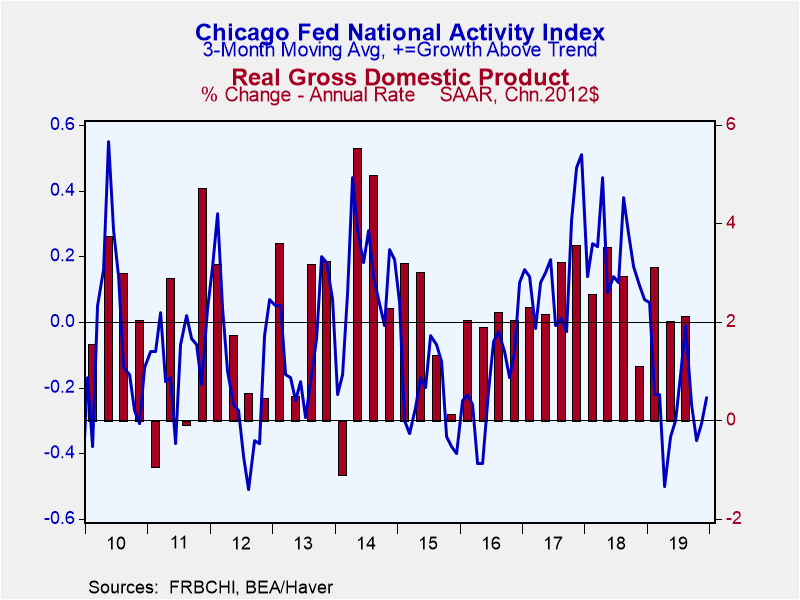

The Federal Reserve Bank of Chicago's National Activity Index decreased to -0.35 in December from a downwardly-revised 0.41 in November (was 0.56). The three-month moving average, which smooths out volatility in the monthly figures, improved to -0.23 from -0.31. The negative reading for the quarter suggests below-trend growth in the fourth quarter of 2019. During the last 20 years there has been a 70% correlation between the Chicago Fed Index and the quarter-on-quarter real GDP growth. However, during the last 10 years that correlation has dropped to just 25%.

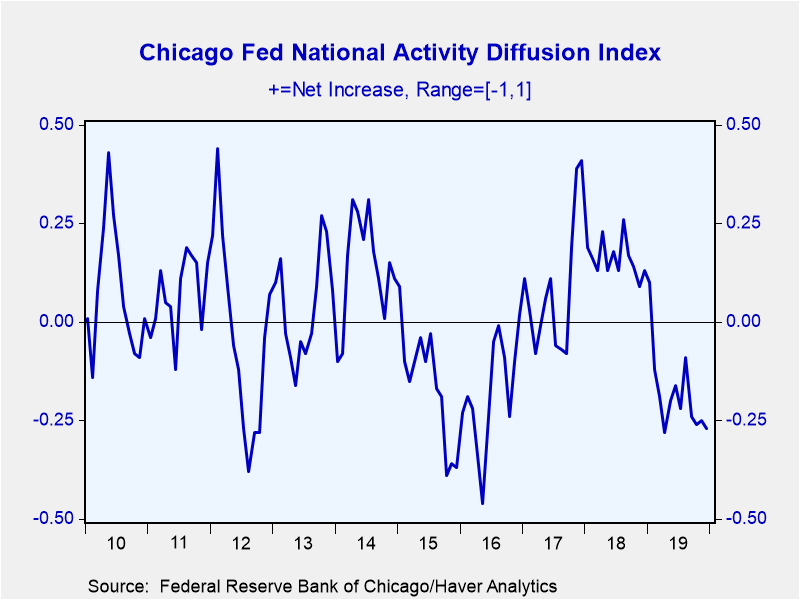

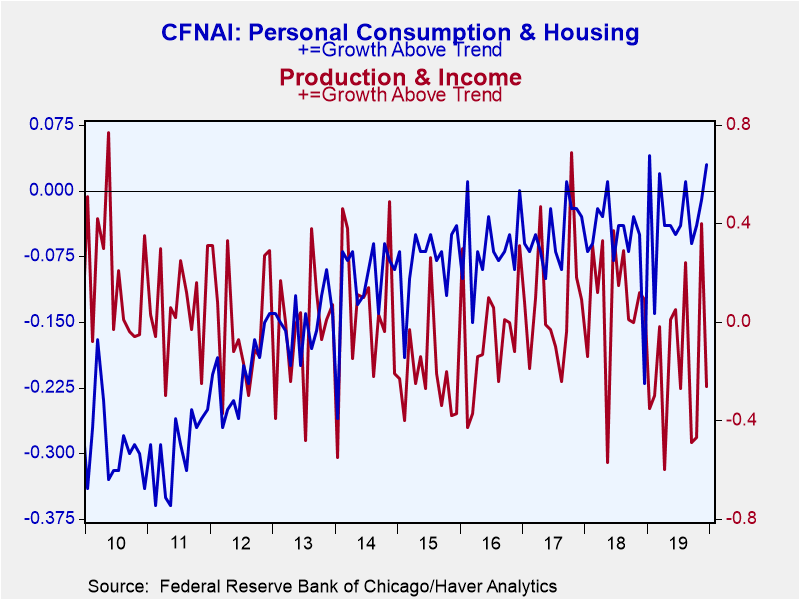

Three out of four of the contributing sectors decreased in December led by the production and income indicators, which contributed -0.26 points to the decline. The diffusion index, which measures the breadth of movement in the monthly series, edged down to -0.27 as 56 out of the 85 components deteriorated.

The CFNAI is a weighted average of 85 monthly indicators of national economic activity. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend and a negative index reading corresponds to growth below trend.

These figures are available in Haver's SURVEYS database.

| Federal Reserve Bank of Chicago | Dec | Nov | Oct | Dec '18 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| National Activity Index (+ = Growth Above Trend) | -0.35 | 0.41 | -0.74 | -0.03 | -0.25 | 0.18 | 0.16 |

| Production & Income | -0.26 | 0.40 | -0.47 | 0.09 | -0.17 | 0.09 | 0.08 |

| Employment, Unemployment & Hours | -0.06 | 0.04 | -0.06 | -0.01 | -0.01 | 0.12 | 0.08 |

| Personal Consumption & Housing | 0.03 | -0.01 | -0.04 | -0.22 | -0.03 | -0.06 | -0.05 |

| Sales, Orders & Inventories | -0.05 | -0.02 | -0.17 | 0.11 | -0.04 | 0.02 | 0.05 |

| 3-Month Moving Average | -0.23 | -0.31 | -0.36 | 0.07 | -- | -- | -- |

| Diffusion Index | -0.27 | -0.25 | -0.26 | 0.13 | -0.18 | 0.16 | 0.08 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.