Global| Apr 15 2020

Global| Apr 15 2020Coronavirus Closings Plunge Empire State Manufacturing Index to Record Low

by:Sandy Batten

|in:Economy in Brief

Summary

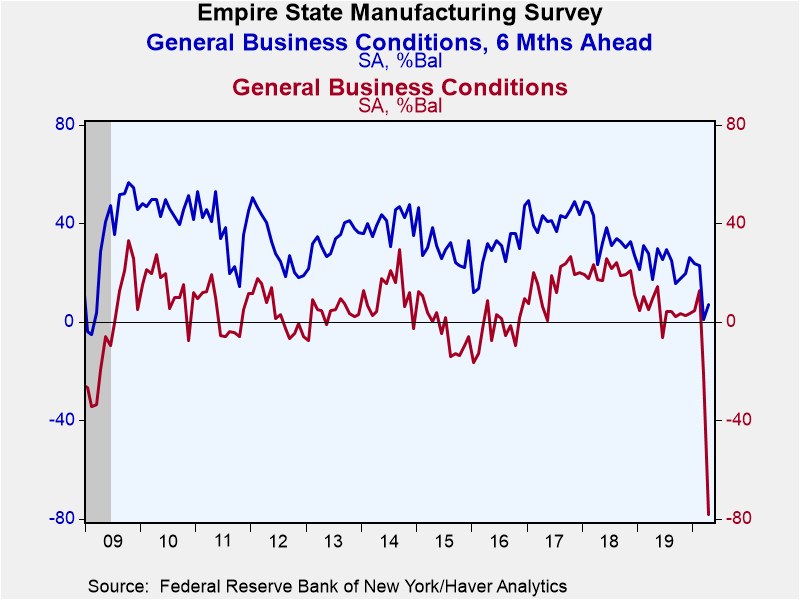

The Empire State Manufacturing Index of General Business Conditions collapsed to -78.2 in April from -21.5 in March. The April reading was the lowest on record, by far surpassing the previous low of -34.3 reached during the Great [...]

The Empire State Manufacturing Index of General Business Conditions collapsed to -78.2 in April from -21.5 in March. The April reading was the lowest on record, by far surpassing the previous low of -34.3 reached during the Great Recession in 2009. The Action Economics Forecast panel had expected a fall to -30. A record 85.2% of respondents reported weaker business conditions in April while only 7.0% report stronger conditions. This is a diffusion index, which measures how widely dispersed a change is across an area. With nonessential businesses in the New York area having been closed in late March, it is not surprising that a wide swath of respondents reported that conditions had weakened.

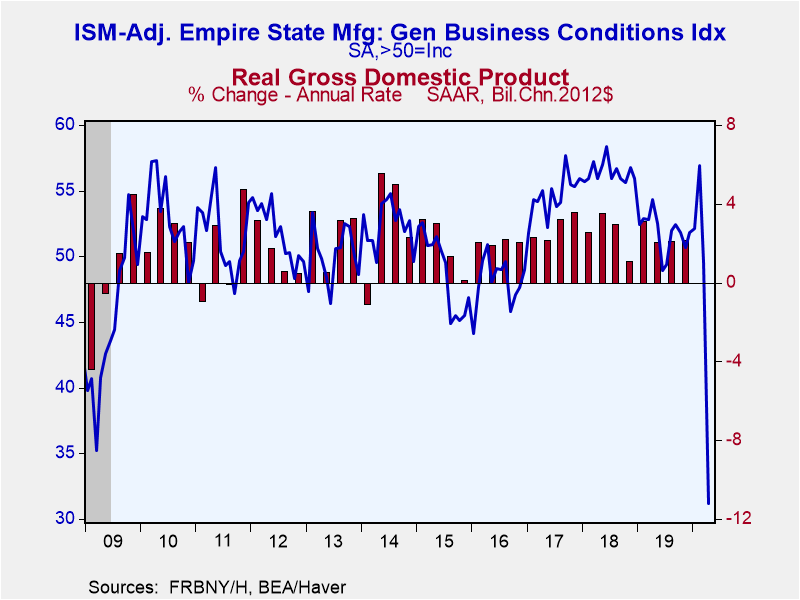

The ISM-Adjusted Index, constructed by Haver Analytics, also deteriorated markedly in April, to 31.2 from 49.5 in March. This was again a record low, but only slightly below the previous record low of 35.2 reached during the Great Recession.

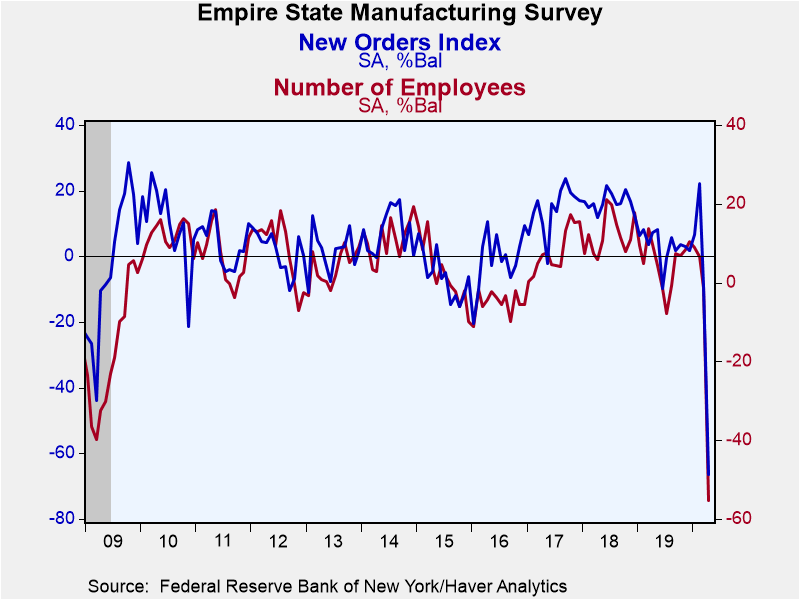

As would be expected given the collapse in the headline figure, the subindexes also posted substantial declines in April with new orders and shipments each falling to a record low. New orders plummeted to -66.3 in April from -9.3 in March. Shipments plunged to -68.1 in April from -1.7 in March. These calamitous drops greatly surpassed the previous record lows which were both reached during the Great Recession: -43.8 for new orders and -25.2 for shipments. The delivery time index actually rose in April, signaling longer delivery times. This would normally indicate a growing economy in which demand is stretching supply. However, in the current environment, it likely indicates that supply chains have been severely disrupted by the business closures that have been dictated by the coronavirus

Employment indicators also declined to record lows in April. The number of employees index plunged to -55.3 from -1.5 in March while the average workweek index plummeted to -61.6 in April from -10.6.

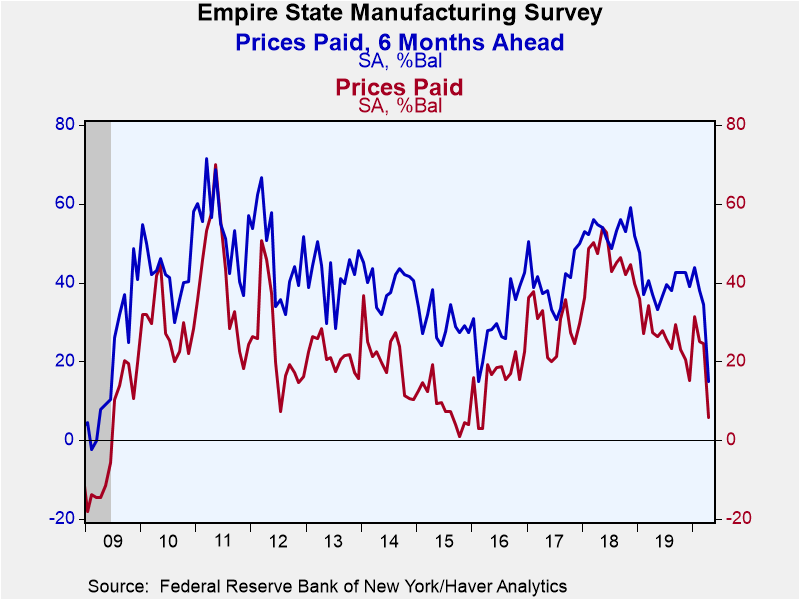

The prices paid index only eased to 5.8 from 24.5 while the prices received index fell more markedly to -8.4 from 10.1.

The behavior of the Expected General Business Conditions index indicated that on average the respondents thought the recent hit to business conditions would not linger very long. The expected conditions index rose to 7.0 in April from 1.2 in March. However, there was little consensus on what business conditions would look like in six months. Of the respondents, 48.6% thought conditions in six months would be improved while 41.6% thought they would be weaker.

The Empire State figures are diffusion indexes, which are calculated by subtracting the percentage of respondents reporting declines from the percentage reporting gains. Their values range from -100 to +100. The data are available in Haver's SURVEYS database. The ISM-adjusted headline index dates back to 2001. The Action Economics Forecasts can be found in Haver's AS1REPNA database.

| Empire State Manufacturing Survey | Apr | Mar | Feb | Apr'19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| General Business Conditions (Diffusion Index, %, SA) | -78.2 | -21.5 | 12.9 | 9.4 | 4.8 | 19.7 | 16.1 |

| General Business Conditions Index (ISM Adjusted, >50=Increasing Activity, SA) | 31.2 | 49.5 | 56.9 | 54.3 | 51.8 | 56.4 | 54.6 |

| New Orders | -66.3 | -9.3 | 22.1 | 7.4 | 3.3 | 16.4 | 14.4 |

| Shipments | -68.1 | -1.7 | 18.9 | 10.3 | 10.5 | 20.3 | 15.8 |

| Unfilled Orders | -16.8 | 1.4 | 4.5 | -0.7 | -6.0 | 3.5 | 1.9 |

| Delivery Time | 11.0 | 2.2 | 8.3 | 7.0 | -0.1 | 9.1 | 6.1 |

| Inventories | -9.7 | 5.8 | 12.9 | 8.4 | -0.9 | 5.9 | 1.5 |

| Number of Employees | -55.3 | -1.5 | 6.6 | 9.7 | 5.4 | 12.3 | 8.0 |

| Average Employee Workweek | -61.6 | -10.6 | -1.0 | 3.1 | 2.3 | 7.8 | 4.6 |

| Prices Paid | 5.8 | 24.5 | 25.0 | 27.3 | 26.3 | 45.8 | 29.0 |

| Prices Received | -8.4 | 10.1 | 16.7 | 14.0 | 10.3 | 19.3 | 11.0 |

| Expectations 6 Months Ahead | 7.0 | 1.2 | 22.9 | 17.4 | 23.9 | 35.2 | 42.6 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates