Global| Jun 02 2014

Global| Jun 02 2014EMU PMI Is Revised Lower in May

Summary

The EMU PMI turned lower in May, falling to 52.2 from April's 53.4. The May reading is the lowest since November, when index stood at 51.6. There's been a definite cooling in the European Monetary Union. For the first time in a while, [...]

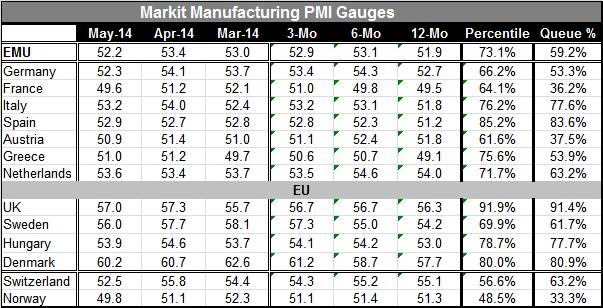

The EMU PMI turned lower in May, falling to 52.2 from April's 53.4. The May reading is the lowest since November, when index stood at 51.6.

The EMU PMI turned lower in May, falling to 52.2 from April's 53.4. The May reading is the lowest since November, when index stood at 51.6.

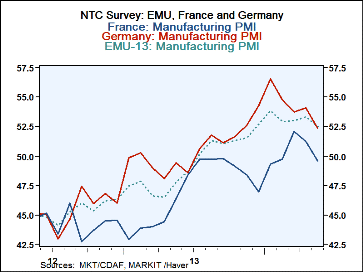

There's been a definite cooling in the European Monetary Union. For the first time in a while, the upward trend has abated. Germany's manufacturing index fell to 52.3 in May from 54.1 in April; the index is the lowest since October 2013, seven months ago when it stood at 51.7.

France's PMI was lower on the month as well, falling to 49.6 in May from 51.2 in April. The French index is the weakest since January 2014. Its drop breaks the two-month streak of being above 50 indicating expansion.

Spain, the fourth largest EMU country, saw its manufacturing index move up slightly in May. The 52.9 level for Spain's May index is slightly higher than its 52.7 level in April.

Among the other three countries reporting monthly manufacturing PMIs in May, Austria and Greece weakened while the Netherlands strengthened slightly.

Of these key reporting countries, only France reported a number below 50 signaling contraction, while the other reporting member countries in the table showed expansion. But the level of the PMI indices for the EMU as a whole is now well off its trend and the sense of acceleration is in question.

At its current level, the EMU index stands in the 59th percentile of its historic queue, a reasonably firm level. Germany stands only in the 53rd percentile of its queue. France is extremely weak, standing in the 36th percentile of its historic queue, barely out of the lower third of its range. Italy is relatively stronger in the 77th percentile and Spain is stronger yet at the 83rd percentile. Austria is weak, like France, and sits in its 37th percentile, while Greece stands in the 53rd percentile, above its historic median. The Netherlands stands at the 63rd percentile, another reasonably firm reading.

On balance, what we see this month from the EMU is that the momentum that had been demonstrated has substantially dissipated. While growth is still in order with the manufacturing PMI indices by large above 50, acceleration has slipped. The level of the three-month average for the monetary union at 52.9 is below its six-month average at 53.1. This clearly indicates a substantial loss in momentum. Germany, Austria, Greece and the Netherlands have lost momentum in this three-month/six-month comparison. Improving on this comparison are France, Italy and Spain (the second, third and fourth largest EMU countries).

The countries from the European Union that are not EMU members and other European reporters are presented in the bottom segment of the table. Each of these countries reports lower PMI readings in May than it did in April. Three-month moving averages are generally still showing improvement for the economic union members but for others, namely Switzerland and Norway. There is a downshift in the three-month average compared the six-month average.

The non-EMU members in the bottom of the table generally show stronger readings than for the EMU counterparts in the top of the table. The United Kingdom sees its manufacturing sector in the 91st percentile of its historic queue. Denmark is in the 80th percentile. Italy is in the 77th percentile. Switzerland is in its 63rd percentile. Sweden stands in the 61st percentile. All these readings are above the EMU-wide average of the 59th percentile. Norway, however, sits in the bottom third of its historic queue and is still struggling and losing momentum.

By large, the revisions to the PMI data for Europe this month were disappointing. It may be that the strong euro exchange rate has started to take some toll on the manufacturing sector in the Monetary Union. Whatever the case, this change in momentum will bear watching. The manufacturing PMI indices are well off their peaks and have lost upward momentum. Meanwhile, economic development and progress still have a long way to go. All this would seem to push the European Central Bank even harder to take some addition steps toward stimulus.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates