Global| Jun 04 2014

Global| Jun 04 2014Euro Area Private Sector Weakens in May

Summary

The total PMI for the European Monetary Union slipped to 53.5 in May from 54.0 in April. However, the 12-month, six-month and three-month moving averages continue to show steadily stronger readings on the shorter horizons. At the [...]

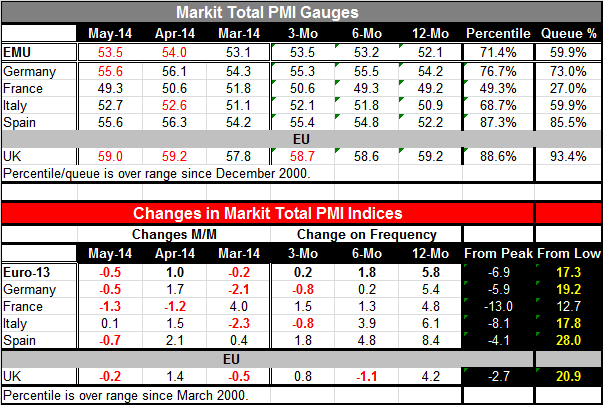

The total PMI for the European Monetary Union slipped to 53.5 in May from 54.0 in April. However, the 12-month, six-month and three-month moving averages continue to show steadily stronger readings on the shorter horizons. At the reduced level of 53.5, the EMU gauge for May stands in the 59.9th percentile of its historic queue, still a moderately firm reading.

The total PMI for the European Monetary Union slipped to 53.5 in May from 54.0 in April. However, the 12-month, six-month and three-month moving averages continue to show steadily stronger readings on the shorter horizons. At the reduced level of 53.5, the EMU gauge for May stands in the 59.9th percentile of its historic queue, still a moderately firm reading.

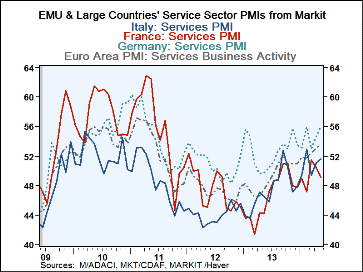

Among the few countries reporting separate services indices, Germany slipped to 55.6 in May from 56.1 in April. France slipped to 49.3 from 50.6. Spain slipped to 55.6 from 56.3, while Italy eked out a small gain, rising to 52.7 from 52.6. Of these countries, only France is showing a contracting services sector.

France continues to be the weak man of the EMU. Its service sector queue standing is only in the 27th percentile, marking it as weaker only 27% of the time. Italy's reading is in the 59.9th percentile. Germany's is in the 73rd percentile and Spain's reading is in the 85.5th percentile.

The UK which is not a member of the single currency area saw its services reading, while still strong, slipped to 59.0 from 59.2. Its 59.0 standing is in the 93rd percentile standing of its historic queue, quite strong.

Looking at the three-month, six-month and 12-month moving averages of the reporting EMU members, we see a steady progression of higher averages as we move from 12 months, to six months, to three months. All of the members except for Germany - even France with its withering 49.3 reading in May - have a progression of higher values. However, even Germany has its three-month average standing above its 12-month average.

The bottom panel of the table shows changes in the gauges as well as showing the current level in perspective. In the far two right hand columns, the current gauge is expressed as a point spread relative to its cycle peak and its cycle low. For each country, again with the exception of France, the current index level is substantially up from its cycle low and relatively closer to its cycle peak (by a factor of two or in some cases much more). However, in the case of France, it's index is closer to its cycle low than to its cycle peak, underlining the difficulty that France has had in trying to get its house in order.

While we don't show the table for the services values, the total PMI indices are available today because the service sector indicators were finalized. The service sector indicators show an improvement for the euro area as a whole which edged up to 53.2 from 53.1. Germany's services sector improved very sharply, moving to 56.0 from 54.7. Italy's services sector improved to 51.6 from 51.1. Spain saw some backtracking to 55.7 from 56.5. France's services sector slipped to 49.1 from 50.4. In terms of service sector rankings, the euro area stands in the 57th percentile of its historic queue. After that, Spain stands in its 85th percentile, Germany in its 79th percentile, Italy in the 51st percentile, and France in its 21st percentile.

Euro area has lost some momentum and that is made quite clear by looking at the total PMI indices. The current levels of the PMI indicators are for the most part still firm to strong. But momentum has been sharply reduced. Although we mentioned that the euro area moving averages continue to move higher, the three-month average at 53.5 is not really that much higher than the 12-month average at 52.1. The euro area index is rising over the past year on average by little more than one-tenth of one point per month. Progress in the euro area has seen recent backtracking and has seen its momentum shaved to a snail's pace. Couple that with still-weak inflation, and the European Central Bank is clearly on the hot seat.

Right now all eyes are focused on what the ECB is going to do at its upcoming meeting. The central bank is expected to take another step toward easing, but there still is no consensus about what it will do. The economic statistics are a clear call to some kind of action.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates