Global| Oct 24 2019

Global| Oct 24 2019European Growth Stands on the Brink of Extinction As EMU Area PMIs Show Fading Momentum

Summary

The EMU PMI preliminary reading ticked up in October from the actual PMI level in September. But at 50.2, the space between the actual level of activity on the PMI and the 'no growth' line of demarcation (50.0) is exceptionally thin. [...]

The EMU PMI preliminary reading ticked up in October from the actual PMI level in September. But at 50.2, the space between the actual level of activity on the PMI and the 'no growth' line of demarcation (50.0) is exceptionally thin. It is so thin that it could easily be breached by a normal revision on the way to posting the final values for October. Of course, the same was true last month.

The EMU PMI preliminary reading ticked up in October from the actual PMI level in September. But at 50.2, the space between the actual level of activity on the PMI and the 'no growth' line of demarcation (50.0) is exceptionally thin. It is so thin that it could easily be breached by a normal revision on the way to posting the final values for October. Of course, the same was true last month.

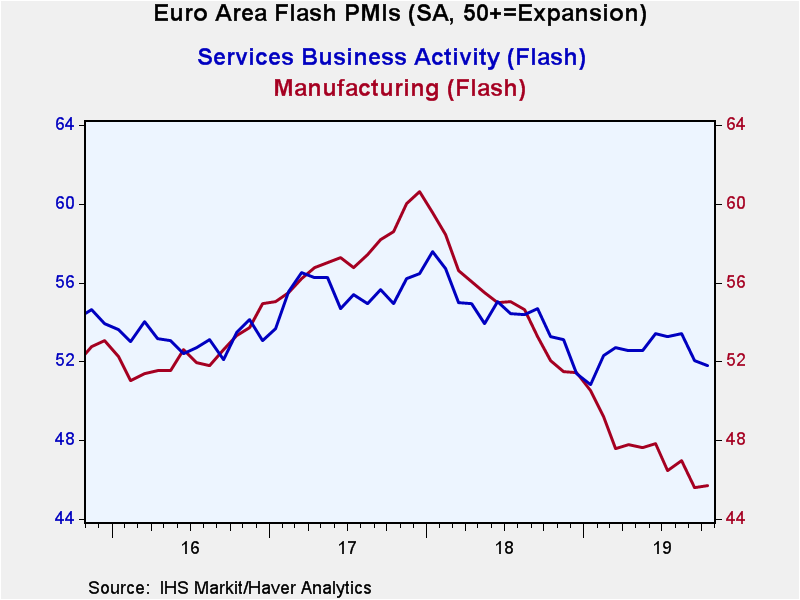

The PMI gauge for the EMU is gradually, very gradually, slipping toward contraction. The EMU manufacturing reading is showing contraction and all its moving averages from three-month to six-month to 12-month show contraction as well (values below 50). The services sector, however, has been steady with a very little variation at a weak reading just below the level of 53.0. However, the service sector reading has worked to below the 52.0 level in the last two months.

EMUThe percentile standings for the EMU show the overall reading at its lowest reading when ranked among ALL PRELIMINARY EMU readings (flash readings). The manufacturing index has been this low or lower only 1.7% of the time. The service sector reading, while substantially stronger in its diffusion appearance, compared to the manufacturing reading, is in fact nearly as weak in standing. The percentile standing assesses the weakness of the PMI components using a metric that positions the current value among its historic values back to January 2015. The services sector has been this week or weaker only 3.4% of the time.

Germany

In PMI terms, the German composite PMI slipped below '50' in October, signaling contraction of the private sector. The German contraction is built on a very weak 41.9 diffusion value for manufacturing and a 51.2 diffusion reading for services. While German manufacturing weakness is severe and steadily losing momentum sequentially, the German services sector has been stable until the weakening of the last two months. This pattern raises unpleasant questions about services sector staying power.

France

France is a different case in many respects. Its composite reading stands at its median since January 2015. Its manufacturing gauge has been persistently skimming over the surface of the boom-bust diffusion value at 50. And while its services gauge is stronger than Germany's in October, over three months six months and 12 months the French services sector is weaker than the German sector in diffusion terms. But the French services sector has been strengthening; it has a 50th percentile overall standing in October. France has also gotten a warning from the EU Commission about not flaunting the EU fiscal rules specifically the budget deficit as a percent of GDP; France has promised to be inline on its next budget.

Japan

Japan's showing suggests private sector contraction after a long progression of contraction in its manufacturing readings. Japan's services sector lost 2.5 points of diffusion value in October alone. This is as much as the EMU composite reading as lost in 12 months. And even though Japan's services sector does not at this time signal contraction, the weakening coupled with more manufacturing weakening puts Japan's composite reading into contraction. Japan's services sector has a 13.8 percentile standing. Manufacturing has a 5.2 percentile standing and the composite index has a 10.3 percentile standing.

The United States

The Markit gauges for the U.S. are less closely watched than the ISM (which uses a manufacturing vs. nonmanufacturing framework instead of manufacturing vs. services). The U.S. Markit flash PMI shows a weakening in the U.S. composite to 51.2 in October from 52.1 in September with a 13.8 percentile standing. U.S. manufacturing that has been below 50 only for the three-month average (not for six-month or 12-month) sees a relatively sharp move up in that reading in October to 51.5 to end the contraction from 47.8 in September. The services reading in the Markit framework is still steadily working its way lower, however. The 12-month average of 56.8 gives way 55.0 over six months and to 54.2 over three months and then drops to 51.0 in October. The U.S. PMI composite has a 13.8 percentile standing compared to a 20.7 percentile standing for manufacturing and a lower 12.1 percentile standing for services. The U.S. is the only response in this table with a weaker services sector standing in October than its manufacturing sector standings (in Germany the standings are tied).

Summing up

On balance, the PMI readings show continued weakness. France seems largely to have been more resilient, but it too has lost some footing this month. Germany is in (private sector) contraction in October. The EMU region is on a razor's edge for maintaining growth against a legacy of bad momentum. Japan is contracting with a weakening manufacturing and a near-term services sector step down. The U.S. has trended to a weakening in manufacturing and in services. The U.S. PMI step back in October is on the back of a sizeable services sector step back in October that is opposed by a spurting 3.7 diffusion point jump to show growth in manufacturing. All in all, it is not a reassuring set of readings for the global economy. No countries' trends are left unscathed.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.