Global| Feb 28 2017

Global| Feb 28 2017GDP Growth and Policy Complacency

Summary

GDP growth and the theory of relativity GDP growth in the EMU, the U.K. and the U.S. is hardly knocking anyone's socks off. But what has been happening is that GDP has become remarkably free of worryingly weak results. Of course, in [...]

GDP growth and the theory of relativity

GDP growth and the theory of relativity

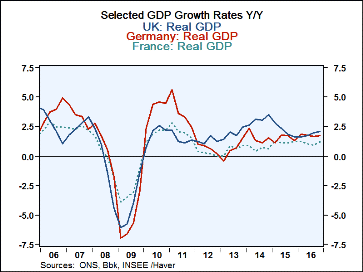

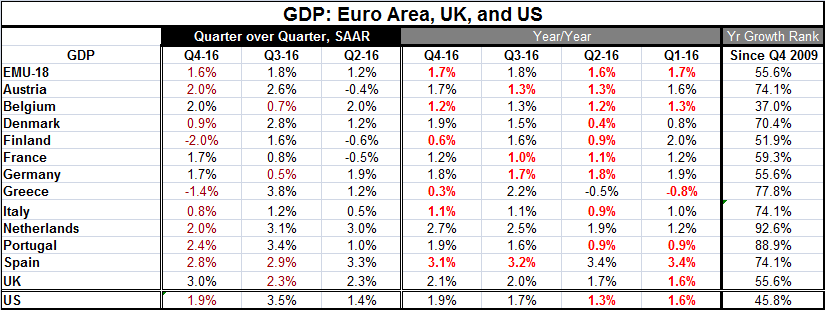

GDP growth in the EMU, the U.K. and the U.S. is hardly knocking anyone's socks off. But what has been happening is that GDP has become remarkably free of worryingly weak results. Of course, in the wake of the Brexit vote, the BOE took substantial precautionary measures to cut rates and provide stimulus to the U.K. Those actions resulted in a substantial weakening of the pound sterling and the U.K. economy has held steady. In the U.S., a series of disappointingly weak growth rates gave way to a 3.5% surge in Q3 2016, but the economy has only followed that up with a 1.9% gain in Q4. GDP 'Nowcasts' put Q1 growth in a range of 2.5% to 3.1% although as we have seen 'Nowcasts' can and do change a lot before GDP is actually posted. Interestingly, the EMU GDP growth standing is much weaker than the results for most of its members. But no EMU member is logging worrisome GDP growth. Only two EMU member in the table logged GDP drops quarter-to-quarter in Q4 and both still have solid year-on-year GDP gains and rankings. In sum, growth might not be great, but it is not worrisome (hold that thought).

Quandary at the central banks

So central banks no longer have a fire lit under them to take action to spur growth. And with OPEC boosting oil prices, headline inflation rates look pretty grim. But core inflation has not taken hold yet in either the U.S. or in the EMU. The U.K. has a bit more of an inflation problem since it has seen a sharp drop in the pound; it has inflation pouring through the exchange rate channel and through the oil channel. These circumstances are putting all central banks in a quandary. Is growth now truly 'stable?' Can policy rely on growth instead of having to nurture it? Has inflation replaced growth as the 'thing to worry about?'

Some GDP growth rates in context

GDP growth in the U.S., the EMU and the U.K. has not picked up noticeably. The U.S. and U.K. rates of growth are slightly higher for year-over-year growth in Q4 compared to Q3 while EMU growth is slightly weaker on that basis. Quarter-to-quarter U.S. and EMU growth rates are weaker, but the U.K. growth rate is stronger. In the EMU of the 11 original members reporting growth rates, eight have lower growth rates on a quarter-to-quarter comparison; five of 11 have growth lower on a year-over-year growth rate comparison.

Evaluating year-on-year growth

But if we evaluate all growth rates from Q4 2009 onward, only Belgium has a year-on-year rate of growth below its median on that timeline (below its 50th queue percentile). Germany, France and Finland have growth rate queue-standings in their respective 50th percentile decile. Spain, Italy, Greece, Denmark and Austria have growth rate standings in their 70th percentile deciles. Portugal is in its 80th percentile decile and the Netherlands is in its 90th percentile decile. The U.K., an EU member (for now), has a 50th percentile standing and the U.S. joins Belgium as the only other country with a percentile standing below its 50th queue-percentile standing.

How sturdy is growth?

I have presented the growth data from the table above in a relatively favorable light in some ways. There are always a variety of ways to assess economic data. But noting the queue standing is a reasonable way to put growth in context. Yet, the EMU and the U.S. each have growth rates below 2%. The U.K. has a rate barely above 2%. These may be rates that rank reasonably well when measured against recent experience, but they are still not very impressive. Viewed another way, they are impressive. The Fed has the U.S. economy's long-term potential pegged close to 2% so the Fed view is that this is about the best the U.S. economy can do on a sustained basis. And there is some evidence of economic tightness. Of course, in the EMU, the German unemployment rate is very low, but most other countries still have considerable labor market slack with unemployment rates above their medians since the EMU was formed. The U.S. is a bit more like Germany with an unemployment rate that is low. The position of the unemployment rate has been important to central banks making money policy decisions. Yet, Philips Curves (that map lower unemployment rates into higher inflation) have not been working very well largely because of the increased importance of the global economy, global competition and technology displacement. Yet, central banks still feel comfortable leaning on that stick to make policy. As result, central banks are being pressured to change policy to help growth less and to fight inflation and inflation risk more.

Policy in a tangle

Policy is in a tangle wherever you look. The BOJ has negative rates in place and a program of QE and still can't get inflation or growth higher and the government still sees a long-term need to address its fiscal situation and hike the VAT tax (at some point). The BOE took special effort to cut rates in the wake of the Brexit vote, but Brexit weakness did not follow. Now there is more inflation pressure and the BOE maybe compelled to hike rates even though the real growth risk from Brexit lies ahead of it. In Europe, Germany has a reunification low in its unemployment rate and is looking at high headline inflation in the EMU. It wants the ECB to dismantle its stimulus programs, but ECB head Mario Draghi is looking at the core HICP and sees no inflation there. In the U.S., the Fed worries about the low unemployment rate, seeing it through the eyes of the Phillips Curve despite the flaw in that. It also sees surging headline inflation and like the ECB sees no core inflation to speak of in the PCE it targets. Yet, it is also worried about fiscal stimulus that is coming with the unemployment rate already near what it regards as full employment. In this environment, the Fed's concerns have shifted to worrying about inflation; yet, it's not clear which of the new President's programs can be instituted or even what effect they might have. But that uncertainty seems to make the Fed worry even more.

Transitioning! Transitioning to plan B Danger! Danger! Lost in space!

Virtually all the major monetary center countries are in some sort of a mess. Japan is holding firm but not seeing progress. In the U.S. and the EMU, there are palpable pressures to turn monetary policy by about 180 degrees. The ECB is still resisting those pressures, but in the U.S. the Fed seems to have drunk the Kool Aid of the inflation worriers and will engage in policies to blunt the impact of the President's anticipated fiscal extravaganza of stimulus and tax cutting. That could create tensions between the central bank and the administration and do so at a time when the President still has a number of appointments to make at the Fed. I do not see any of this transitioning as easy or as riskless as the monetary policymakers seem to think it is. The bare bones growth we have gotten has been achieved with the help of all this special stimulus. Growth is not over the top; it is barely adequate and has been achieved with the wind at its back. Trying to return monetary policy to a more neutral posture with growth not firmly in engaged of its own accord carries real risks. Remember (in paragraph#1) I asked you to hold that thought about growth being not great but not worrisome? Well, here is where we want to challenge even that assertion. What happens to those mild growth rates when we pull the stimulus out from under them?

Smooth sailing...until it isn't

For now it is smooth sailing for markets and the Dow in the U.S. has logged its best winning streak in 30 years. Financial markets are getting a Trump bump from the expected stimulus from the U.S. But these are all moves based on Alt-facts, not that they are 'wrong facts' but they are facts different from the ones that currently are driving growth and they are based on policies markets assume will be implemented and will also be effective. Clearly, we are looking at a lot of enthusiasm in markets based on unrequited dreams. Not even Donald Trump can expect to get everything he dreams for. So what we need to ask ourselves is where will the disappointments crop up and how will that play out for global monetary policy? Also how strong is growth if we take way the special monetary stimulus? The answers to those questions are far from obvious.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.