Global| Dec 07 2018

Global| Dec 07 2018German IP Takes Surprising October Slip

Summary

Germany's industrial production slowed to a gain of only 0.1% in September then dropped by 0.5% in October. The string of growth rates from 12-months to six-months to three-months also trace a legacy of losing as the 12-month gain is [...]

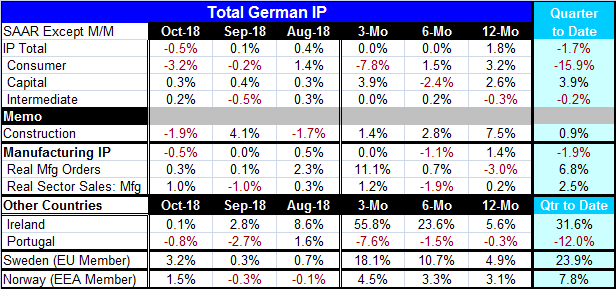

Germany's industrial production slowed to a gain of only 0.1% in September then dropped by 0.5% in October. The string of growth rates from 12-months to six-months to three-months also trace a legacy of losing as the 12-month gain is at a respectable 1.8%, but the six-month and three-month growth rates both are zero.

Germany's industrial production slowed to a gain of only 0.1% in September then dropped by 0.5% in October. The string of growth rates from 12-months to six-months to three-months also trace a legacy of losing as the 12-month gain is at a respectable 1.8%, but the six-month and three-month growth rates both are zero.

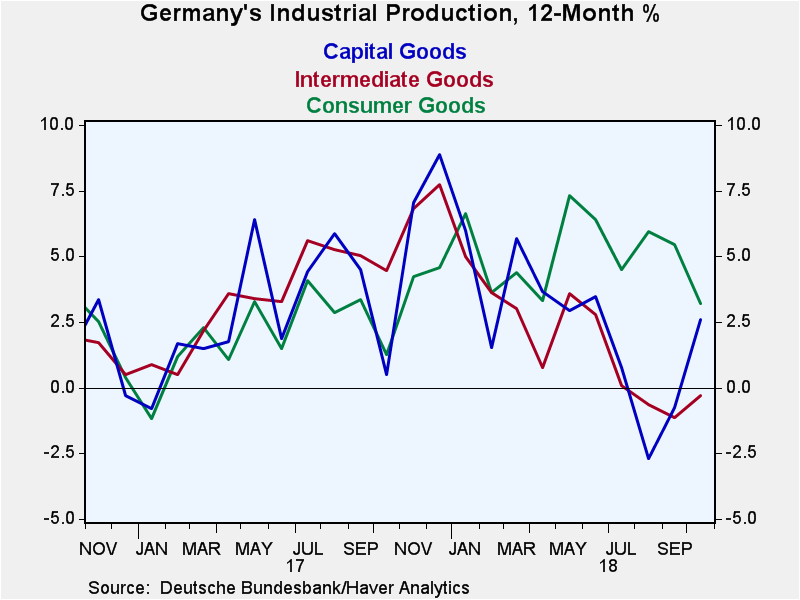

IP components show a smattering of negative growth rates, not some great syncopated wave of deceleration. Growth is uneven and the underpinning of deceleration is still unclear. Consumer goods output shows a steady deceleration, culminating in the three-month annualized growth rate of -7.8%. Capital goods output is surprisingly erratic, showing a 2.6% gain over 12 months and a 2.4% decline at an annual rate over six months then a rebound with a 3.9% gain annualized over three months. Intermediate goods output has been flying at a very low trajectory over all horizons; it has zero growth over three months with output lower by -0.3% year-over-year.

Year-to-date, IP is falling at a 1.7% annual rate in Q4, led by a 15.9% annual rate drop for the consumer sector, a 3.9% gain in capital goods output and a 0.2% drop in intermediate goods output. Construction output is up at a 0.9% pace in the quarter but shows decelerating gains over 12 months.

Manufacturing output is persistently weak and is flat over three months and lower over six months with a modest 1.4% rise over 12 months. In contrast, real manufacturing orders are moving steadily higher, logging an 11.1% annualized gain over three months. Real sales in manufacturing are also persistently weak. Sales and output trends are weaker than orders. Perhaps this lull in output is temporary and a ramp of order growth is yet to hit the bottom line for output. But even in the quarter-to-date, manufacturing IP is falling at a 1.9% annual rate as real orders rise at a 6.8% pace and real sales gain at a 2.5% pace. Moreover, the much more topical Markit PMI data show ongoing manufacturing weakness. There is no hint that order strength will shine through in the end.

Only a few countries have reported IP for October this early. Among those four, Ireland shows powerful growth although Ireland tends to run from hot to cold. Sweden and Norway both show growth that is solid to strong, but Portugal shows declining IP on all horizons with weakness gathering momentum.

The IP picture has good deal of dissonance present in the dataset. For Germany, the various sectors show that output is out of phase and IP as a whole is running counter to the strength in orders. For the few reporting European countries, their results are wholly idiocentric and seemingly ruled by their own internal circumstances with little reference to outside forces or implications for European growth.

Quite apart from this IP report, even more topical data from Markit globally increasingly show slowing is in progress. Data in the U.S. add to all dissonance as housing and interest-sensitive sectors are slowing while the ISM data show a strengthening in manufacturing and in nonmanufacturing. Yet, job growth did slow in November and there is no consistent picture yet to be assembled from the current fragments of U.S. economic data that are available. Asia has clearly been slowing and the trade is a worry. CEOs are losing come of their past confidence too.

While some want to focus on the declines in markets as an issue, I would prefer to point out that markets do not unravel on their own. They are not manipulated by traders with an ‘agenda'. These are not markets trying to force the Fed or some central bank to do something. These are markets reacting to the news of the economic environment and with concerns about the present and fears of the future. These things are real and more real than a simple decline in stock prices. If central banks change policy or pace, it will be because of the same fundamentals that markets are reacting to not because of markets themselves. So now all eyes are on the Fed and on its ‘planned' December rate hike. Has that been put to question? The Fed's future path is thought to be much less of a gradient.

Book-makers in the U.K. have putting up the odds of there being no Brexit at all. This means not only that there will be no approval of Theresa May's deal but that the book-makers see a strong possibility of a change in the decision to leave- a new referendum with a new outcome. So stay tuned as the world churns. It's not a soap opera; it's real life. And things change. It's the Bob Dylan economy!

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.