Global| Nov 13 2007

Global| Nov 13 2007Inflation Trends Turn Bleak in the Euro Area…

Summary

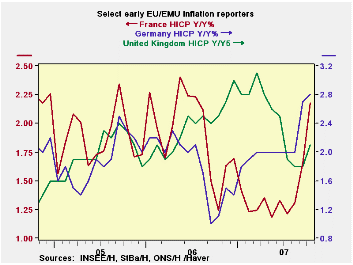

In October, as energy prices have surged again, the Euro area is suffering inflation bulging beyond the limits of its ceiling. We know that the ECB is not happy with this development even though most of it is due to oil prices and [...]

In October, as energy prices have surged again, the Euro area is suffering inflation bulging beyond the limits of its ceiling. We know that the ECB is not happy with this development even though most of it is due to oil prices and core inflation seems less of a problem. Still the ECB makes policy without an explicit reference to core prices unlike the Federal Reserve in the US.

Despite a surging Euro that should help to combat any true inflation forces in the Euro area economy, the ECB remains wary of this over top inflation partly because of the ongoing strong money and credit growth in the EMU. So Europeans find themselves in the sticky position of seeing inflation flare, the central bank remain wary, ready to act, even as their currency value remains quite strong and the competitiveness pressures from that strength are squelching growth and killing Europe’s export orders. The European policy dilemma has become an economic oxymoron: the ECB’s own threat to hike rates is further bolstering the euro and further exacerbating the economic problems within the zone as the ECB does nothing and worries about inflation pressure which worsen.

| Euro area & Friends: Headline Inflation Yr/Yr | |||||||

|---|---|---|---|---|---|---|---|

| Year/year | Mo/Mo | 3Mo: AR | 6Mo:Ar | ||||

| Core HICP | Oct-07 | Sep-07 | Aug-07 | Oct-07 | Sep-07 | May-07 | Apr-07 |

| Belgium | 2.2% | 1.5% | 1.2% | 0.8% | 0.1% | 3.5% | 2.1% |

| France | 2.1% | 1.6% | 1.3% | 0.2% | 0.1% | 2.6% | 2.3% |

| Germany | 2.7% | 2.6% | 2.0% | 0.2% | 0.7% | 3.1% | 2.7% |

| Greece | 3.1% | 2.9% | 2.7% | 0.4% | 0.3% | 1.1% | 4.0% |

| Ireland | 3.0% | 2.9% | 2.3% | 0.2% | 0.3% | 2.3% | 2.5% |

| Italy | 2.3% | 1.8% | 1.7% | 0.7% | 0.3% | 4.7% | 3.3% |

| Luxembourg | 3.6% | 2.5% | 1.8% | 0.6% | 0.0% | 2.8% | 2.7% |

| The Netherlands | 1.6% | 1.3% | 1.0% | 0.4% | 0.0% | 1.5% | 0.6% |

| EU: Other HICP/CPI | |||||||

| UK(HICP) | 2.0% | 1.7% | 1.8% | 0.5% | 0.1% | 2.7% | 1.5% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.