Global| Oct 24 2007

Global| Oct 24 2007Italy's Biz Index in a Small, Unconvincing Rebound

Summary

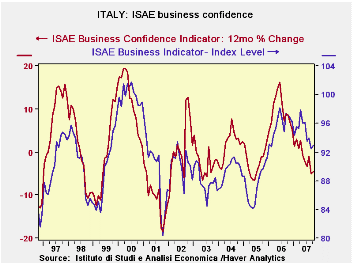

The ISAE business index did improve slightly in October from September. But the index, as well as its momentum, remain solidly in a down trend The ISAE business survey components tell a tale of a sector that is fading. For overall [...]

The ISAE business index did improve slightly in October from September. But the index, as well as its momentum, remain solidly in a down trend… The ISAE business survey components tell a tale of a sector that is fading. For overall industry the total order books and demand responses are at the 50% mark market and are dead neutral. Domestic and foreign demand are each rated a tick or so above neutral. Inventories are soaring and high. Production, as result, is below neutral at a reading of 49. The detail shows a story that has become old hat for the Euro area. The weakness is in intermediate goods and in consumer goods. Intermediate goods readings are below the 50% mark for the most part while consumer goods ratings cluster in the BOTTOM THIRD of their respective ranges. The sense of firmness that the overall measure retains is a function totally of capital goods where readings remains elevated at about the top third of their respective ranges with the notable exception of foreign orders for capital goods that are now little better that neutral. Cleary Italy is flashing some warning signals. The Euro area PMI for MFG was doing much the same today.

07

Aug

Jul

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.