Global| Sep 19 2012

Global| Sep 19 2012Japan Indicators Show Softness

Summary

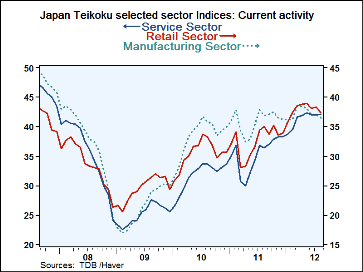

Japan's economic indices show faltering economic momentum. The economy-watcher gauge and its forward-looking measure are both easing. The NTC/Markit manufacturing sector gauge is weaker. The Teikoku manufacturing gauge echoes that [...]

Japan's economic indices show faltering economic momentum. The economy-watcher gauge and its forward-looking measure are both easing. The NTC/Markit manufacturing sector gauge is weaker. The Teikoku manufacturing gauge echoes that signal with weakness in retailing and wholesaling. Teikoku shows a tiny uptick in the weak services sector and some rebound in construction.

Japan's economic indices show faltering economic momentum. The economy-watcher gauge and its forward-looking measure are both easing. The NTC/Markit manufacturing sector gauge is weaker. The Teikoku manufacturing gauge echoes that signal with weakness in retailing and wholesaling. Teikoku shows a tiny uptick in the weak services sector and some rebound in construction.

To restore confidence and prop up the economy the Bank of Japan has followed the Fed’s lead. The Bank of Japan announced a new round of stimulus to revive the economy by expanding asset purchases by another 10 trillion yen. The central bank also cut its assessment of the economy, saying the recovery is pausing. The total size of the stimulus program was lifted to 80 trillion yen following an additional 5 trillion yen to purchase Japanese government bonds and another 5 trillion to purchase treasury discount bills. The remaining asset purchase target now stands at JPY 55 trillion.

Whether this program will have a material effect on the economy is hard to say. Central banks around the world have faith that these programs have impact yet the in the US where the Fed’s balance sheet has been greatly expanded the impact on the economy has been small and has not made the critical difference to launch it into a normal recovery. All estimates of the impact of these programs find that there is some positive impact but those estimates vary in their findings of the amount of that impact.

Japan is still digging out from its triple disasters that followed on the heels of the global recession, fighting off the impact of a strong yen, dealing with the adversity of a shrinking population and with political partisan instability. Japan is currently making huge adjustments in its power grid in order to wean itself off nuclear power. It is not surprising that Japan is still reeling.

The recent events in the Pacific, however, seem to be making things worse. Japan’s move to purchase what it calls the Senkaku Islands has inflamed tensions with China and disrupted the operations of Japanese firms operating in China. Other sorts of retaliatory measures have been discussed. Both countries claim the islands and neither shows any sign of backing down. The spread of this political tension to economic enterprises will not be good for either Japan’s or China’s economies; each is struggling in its own way.

The conflict with China is simply the latest in a series of events that seem to pop up every time Japan’s economy tries to get itself on solid footing to expand. It is still soon to gauge the seriousness of the expanding snit with China.

| Tankan Results | |||||||

|---|---|---|---|---|---|---|---|

| Readings | Averages | ||||||

| Aug 12 |

Jul 12 |

Jun 12 |

May 12 |

Aug 12 |

Jul 12 |

Jun 12 |

|

| Diffusion | |||||||

| Economy Watchers | 43.6 | 44.2 | 43.8 | 47.2 | 66.9% | 68.4% | 67.4% |

| Employment | 52.5 | 52.1 | 53.9 | 55.2 | 76.9% | 76.2% | 79.4% |

| Future | 43.6 | 44.9 | 45.7 | 48.1 | 66.7% | 70.0% | 72.1% |

| NTC MFG | 47.7 | 47.9 | 49.9 | 50.7 | 72.0% | 73.0% | 80.7% |

| Econ Trends (Teikoku'/50 neutral/weighted diffusion) | |||||||

| MFG | 36.5 | 37.0 | 37.0 | 38.0 | 59.0% | 60.6% | 60.7% |

| Retail | 37.3 | 38.3 | 38.1 | 39.0 | 66.6% | 70.4% | 69.6% |

| Wholesale | 36.4 | 36.8 | 36.7 | 37.4 | 62.2% | 63.5% | 63.1% |

| Services | 42.1 | 42.0 | 41.9 | 42.4 | 67.1% | 66.7% | 66.5% |

| Construction | 38.0 | 37.2 | 36.2 | 35.5 | 90.2% | 86.7% | 81.9% |

| percentiles: 100 is high; zero is low | |||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates