Global| Feb 19 2008

Global| Feb 19 2008Japan Offers Up some Mixed Signals From Two LEI Concepts

Summary

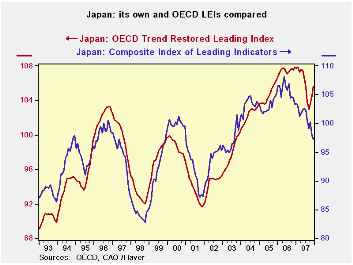

Japan’s own leading index composite is demonstrating ongoing weakness. The OECD’s take is that there is an improvement afoot. Japan’s own index peaked in the first half of 2006 and has since then been in a steady and rapid [...]

Japan’s own leading index composite is demonstrating ongoing weakness. The OECD’s take is that there is an improvement afoot. Japan’s own index peaked in the first half of 2006 and has since then been in a steady and rapid deteriorating phase. Not so for the OECD measure. It went flat from early 2006 to early 2007 then fell sharply but has since regained about half of its drop. These are two different views of Japan’s future to be sure – as well as different views of its present.

While the two indexes broadly tell the same story historically, currently their divergence has never been so great. The OECD index is a bit smoother back through time. There have been disagreements in the message of these two indexes before, but never one so stark with one index rising while the other is falling. In the past they were not directionally different as much as one simply lagged the other.

Recently it seems that the OECD index has performed a bit better. In 2000 it turned over to show weakness first. From 2001 to 2005 it expanded steadily while Japan’s own index moved up to dwell at two separate plateaus before expanding again. It is hard to argue with the OECD’s recent plateauing then dropping as being a superior signal to the Japan’s domestic LEI that has simply fallen so sharply that it would be reasonable to look for even more disruption in the economy. But then maybe that bad news is still in the pipeline?

On the other hand what rings false about the OECD index is

that,

apart from the recent episode of plateauing then dropping, it has the

index at its highest point in 15 years. The Japan’s domestic LEI has

the index level back below four past peaks going back to 1994. Those

are real differences, not just different assessments on the timing of

the economic rebound.

We are left in a quandary by these discrepancies. Still it is clear that both reports are saying that Japan has taken some hit and the uncertainty is about how soon or vigorous the recovery will be. But they are also saying that there is some difference of opinion on how hard Japan has been hit and that is an important element in assessing the depth of the expected drop as well as the timing of recovery. As a result we must be prepared to continue to watch Japan closely.

| Japan's LEI and its Trends | |||||||

|---|---|---|---|---|---|---|---|

| Levels | Growth (saar) | ||||||

| Dec-07 | Nov-07 | Oct-07 | 3M0 | 6M0 | 12Mo | 24MO | |

| LEI | 97.3 | 97.8 | 100.3 | -7.1% | -10.1% | -5.8% | -7.6% |

| LEI: OECD | 105.7 | 104.6 | 103.5 | 11.0% | -1.9% | -2.0% | -0.7% |

| OECD LEI Details | |||||||

| Share P | 1.2 | 1.2 | 1.3 | -12.7% | -27.0% | -8.2% | -6.1% |

| Int Spread (chngs) | -0.5 | -0.5 | -0.4 | -0.2 | -0.5 | -0.4 | -0.7 |

| Loan/Deposit | #N/A | 1.1 | 1.1 | -1.1% | 1.5% | 1.2% | 7.1% |

| Dwellings Started | 0.9 | 0.9 | 0.8 | 319.1% | -39.9% | -18.4% | -8.8% |

| OT-MFG | #N/A | 1.0 | 1.0 | 8.5% | 6.3% | 0.0% | -2.0% |

| Stocks/Deliv (M&M) | #N/A | 1.0 | 1.0 | 10.6% | 6.6% | 1.3% | 2.1% |

| Exp>Imp | -0.1 | -0.1 | -0.1 | -40.9% | 93.6% | -214.3% | -900.0% |

| SmallBiz | #N/A | #N/A | #N/A | 7.1% | -6.4% | -8.1% | -5.2% |

| Grey shaded rows are one month behind current; Small Biz lags by SIX months | |||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.