Global| Apr 18 2019

Global| Apr 18 2019Philadelphia Fed Manufacturing Index Slips in April

by:Sandy Batten

|in:Economy in Brief

Summary

The Federal Reserve Bank of Philadelphia reported manufacturing conditions weakened in April with its General Factory Sector Business Conditions Index falling to 8.5 from 13.7 in March. The Action Economics Forecast Survey median [...]

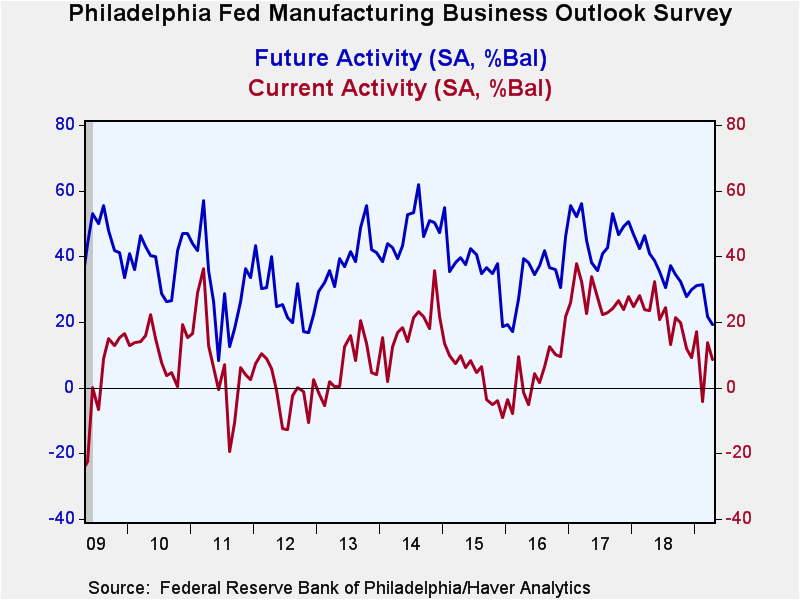

The Federal Reserve Bank of Philadelphia reported manufacturing conditions weakened in April with its General Factory Sector Business Conditions Index falling to 8.5 from 13.7 in March. The Action Economics Forecast Survey median estimate was for a modest decline to 11.0. The index reflecting expectations of business conditions in six months recorded a smaller decrease to 19.1 in April from 21.8 in March, but the April reading was the lowest since February 2016. These figures are diffusion indexes where readings above zero indicate expansion. The percentage of firms reporting an improvement in business activity slipped to 31.9% in April from 32.2% in March. The percentage reporting weaker conditions rose to 23.4% from 18.5%.

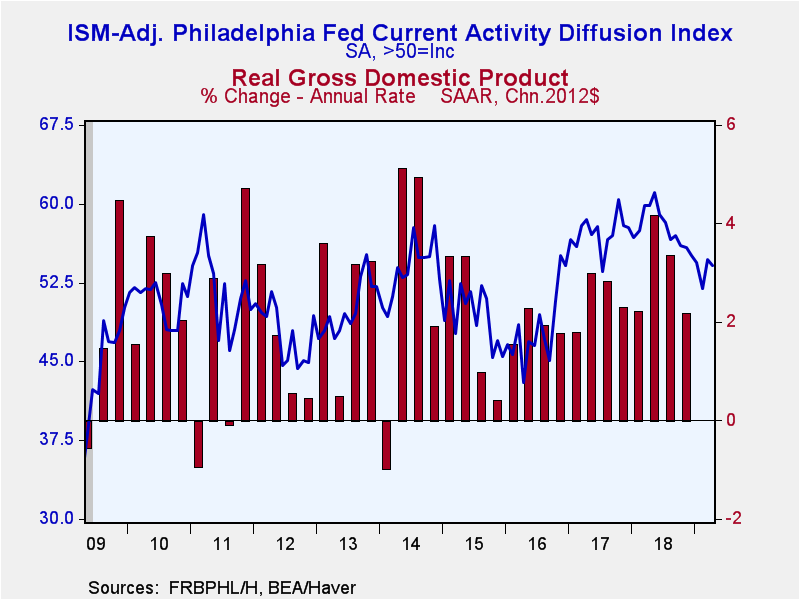

In contrast to the ISM indexes, the headline index in this release is not calculated from components, but rather reflects the answer to a single question on business conditions. Consequently, Haver Analytics constructs an ISM-Adjusted General Business Conditions Index in an attempt to provide a broader measure of activity. It also slipped in April, but only modestly and remains relatively elevated, falling only 0.6 point to 54.1 from 54.7 in March. Over the past eleven years, there has been a 65% correlation between the quarterly ISM-adjusted Philadelphia Fed Index and quarterly real GDP growth.

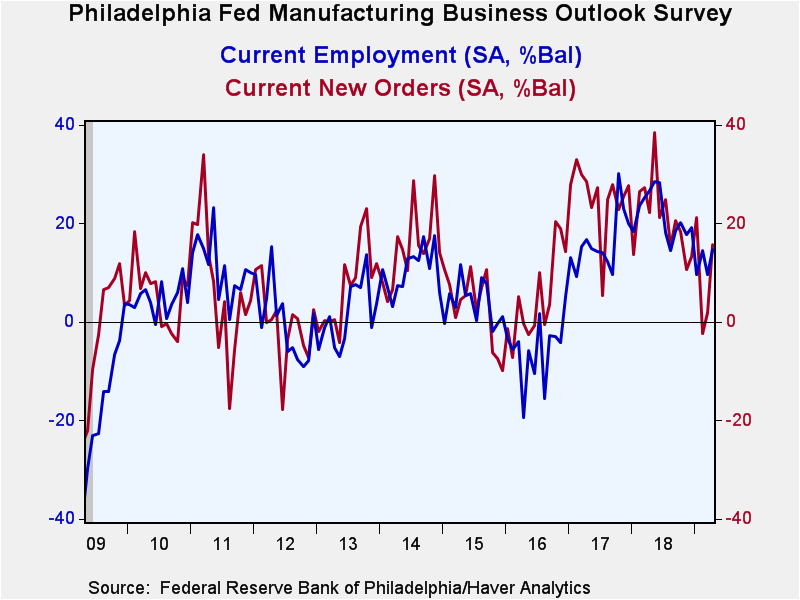

Contrary to the decline in the headline index, the key orders subindex rose sharply in April to 15.7 from 1.9 in March. And the shipments subindex slipped only to 18.4 from 20.0. Other activity-related subindexes fell more meaningfully in April, led by a marked decline in the inventories subindex to 2.6 from 17.2.

Labor-use related subindexes rose in April. The number of employments index increased to 14.7 from 9.6. The percentage of firms reporting an increase in hiring rose to 26.8% from 19.9% with the percentage reporting a decline in hiring also rising but more modestly to 12.1% from 10.3%. The average workweek subindex edged up to 11.2 from 10.6.

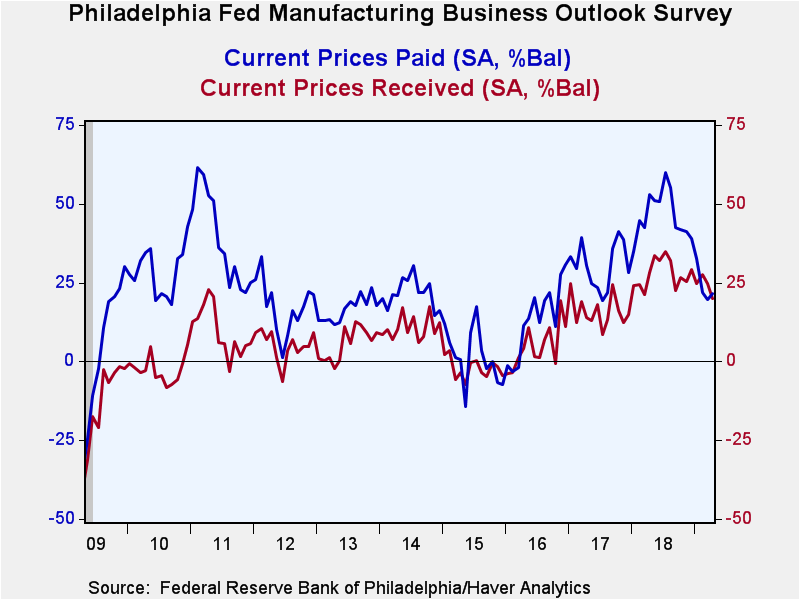

With energy prices generally rising, the prices paid index rose modestly in April to 21.6 from 19.7. By contrast, the prices received index fell for the second consecutive month, to 20.0 from 24.7 with the percentage of firms reporting receiving higher prices falling to 22.9% from 26.2%. The April figure was the lowest since March 2018.

The survey panel consists of 150 manufacturing companies in the third Federal Reserve District (which consists of southeastern Pennsylvania, southern New Jersey and Delaware). The diffusion indexes represent the percentage of respondents indicating an increase minus the percentage indicating a decrease in activity. The ISM-adjusted figure, calculated by Haver Analytics, is the average of five diffusion indexes: new orders, shipments, employment, delivery times and inventories with equal weights (20% each). Each ISM-adjusted index is the sum of the percent responding "higher" and one-half of the percent responding "no change."

The figures from the Philadelphia Federal Reserve dating back to 1968 can be found in Haver's SURVEYS database. The expectation from the Action Economics Forecast Survey is available in AS1REPNA.

| Philadelphia Fed - Manufacturing Business Outlook Survey (%, SA) | Apr | Mar | Feb | Apr'18 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| General Factory Sector Business Conditions | 8.5 | 13.7 | -4.1 | 23.4 | 21.1 | 27.3 | 4.9 |

| ISM-Adjusted Business Conditions | 54.1 | 54.7 | 51.9 | 59.8 | 57.7 | 57.3 | 48.2 |

| New Orders | 15.7 | 1.9 | -2.4 | 22.2 | 21.0 | 25.3 | 5.0 |

| Shipments | 18.4 | 20.0 | -5.3 | 25.1 | 22.8 | 26.8 | 6.9 |

| Unfilled Orders | 0.4 | 3.1 | 6.9 | 8.7 | 7.1 | 11.9 | -5.6 |

| Delivery Time | -5.1 | 8.8 | 13.6 | 18.0 | 9.5 | 10.6 | -4.6 |

| Inventories | 2.6 | 17.2 | 3.3 | 10.1 | 7.4 | 2.9 | -9.6 |

| Number of Employees | 14.7 | 9.6 | 14.5 | 26.6 | 21.6 | 16.1 | -5.6 |

| Average Workweek | 11.2 | 10.6 | 4.7 | 21.2 | 15.9 | 14.9 | -5.4 |

| Prices Paid | 21.6 | 19.7 | 21.8 | 53.1 | 46.4 | 30.4 | 13.5 |

| Expectations - General Business Conditions; Six Months Ahead | 19.1 | 21.8 | 31.3 | 40.9 | 36.9 | 47.1 | 33.7 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.